TABLE OF CONTENTS

Preparing for Medical Marijuana in Pennsylvania

Major Changes to FLSA Overtime Rules on Hold For Now

New Federal Law Provides Greater Trade Secret Protections

ACA’s Fate, Plus Other Big Employment Benefits Developments

Employment Discrimination Law Update

USCIS Expands Optional Practical Training Program for Foreign Students with STEM Degrees

Form I-9 Fines and Other Immigration-Related Penalties Significantly Increased in 2016

Workers’ Compensation Update

National Labor Relations Board Update

U.S. Supreme Court Year in Review: Significant Employment Cases Decided in 2015-2016 Term

Preparing for Medical Marijuana in Pennsylvania

By: Joshua L. Schwartz

Marijuana legalization reached Pennsylvania in 2016, bringing with it a host of new questions employers are going to have to answer. Signed into law on April 17, the Medical Marijuana Act adds the Commonwealth to the growing list of jurisdictions in which medical use is permitted. Though the Act is relatively limited in scope, its protections for covered individuals pose a number of challenges for employers.

The Current State Of The Medical Marijuana Act

The Act went into effect May 17, but it will likely be some time before employers are affected. The Act permits marijuana use only for those individuals who are certified and who obtain an identification card from the Pennsylvania Department of Health (DOH). No such certifications have been issued yet. Similarly, the DOH hasn’t yet issued any regulations or guidance implementing the Act’s employment provisions, which likely won’t be fully implemented until 2018. Nonetheless, employers may wish to take certain steps now to prepare for full implementation.

Who Is Authorized To Obtain Medical Marijuana In Pennsylvania?

Only someone diagnosed with one of the medical conditions identified in the Act is permitted to obtain marijuana. He or she must also be under the care of a physician registered with the DOH. That physician must sign a certification of the patient’s serious health condition, which is also submitted to the DOH. The patient must then apply for and receive an identification card from the DOH before he or she will be permitted to obtain medical marijuana. The Act doesn’t permit anyone in Pennsylvania to smoke marijuana. On the contrary, certified users may obtain the drug only from an authorized dispensary, and it can be dispensed only as a pill, cream, oil, liquid, tincture, or vapor. No authorized dispensaries exist to date.

Employment Protections

The Act provides that “no employer may discharge, threaten, refuse to hire or otherwise discriminate or retaliate against an employee regarding an employee’s compensation, terms, conditions, location or privileges solely on the basis of such employee’s status as an individual who is certified to use medical marijuana.”

The statute therefore doesn’t protect marijuana users generally—only certified users. In addition, the Act doesn’t require employers to “accommodate” marijuana use at work or prevent employers from disciplining employees for being “under the influence” at work if their conduct “falls below the standard of care normally accepted for that position.” Employers may also legally prevent any employee who is “under the influence” from (1) “performing any task which the employer deems life-threatening, to either the employee or any of the employees of the employer,” (2) performing any duty which could result in “public health or safety risk,” (3) working “at heights or in confined spaces,” or (4) operating or controlling certain chemicals, high-voltage electricity, or any other public utility.

Finally, the Act states that it doesn’t require an employer to take actions “in violation of federal law”—a provision apparently designed to protect businesses subject to federal drug-testing mandates, like trucking companies.

This leaves several questions unanswered, and hopefully the regulations will provide some clarification. First, the Act is vague regarding what qualifies as “a public health or safety risk” or working “at heights or in confined spaces.” Second, the statute offers little guidance on how employers can determine that an employee is “under the influence” or violating “the standard of care.” Regarding operating or being in control of chemicals, electricity, or a public utility, the Act specifies a threshold “of more than 10 nanograms of active tetrahydrocannabis per milliliter of blood in serum,” but there is no such limitation when it comes to the other tasks employers may lawfully prevent. Moreover, an employer cannot know in advance whether the employee has reached the 10 nanogram threshold, and certified user employees certainly aren’t expected to take a blood test before every shift.

It also remains questionable whether employers with zero-tolerance drug policies must make exceptions for certified users. Courts in other states have upheld an employer’s right to implement a zero-tolerance policy in the face of statutes permitting medical marijuana use. Some commentators have also suggested that a zero-tolerance policy protects employers from a discrimination or retaliation charge because the statute uses the word “solely” in its prohibition: in other words, if an employee is terminated because of a positive drug test in violation of a zero-tolerance policy, then an employer can argue that the employee wasn’t discriminated against “solely on the basis of such employee’s status as an individual who is certified” under the Act. That said, Pennsylvania is somewhat unique in providing explicit protections to certified users, so court decisions from other states might be irrelevant. And while the word “solely” in the statute theoretically provides a defense under the Act, certified users will also be protected from discrimination under the Americans with Disabilities Act and the Pennsylvania Human Relations Act by virtue of their qualifying health conditions. Accordingly, employers are well advised to make the same accommodations to certified users as they do to users of other prescribed medications, unless the employer is subject to a specific federal requirement prohibiting the employment of individuals who use marijuana (like employers in the transportation and higher education fields).

Policy And Practice Recommendations

Despite these uncertainties, employers may wish to take the following steps to prepare for the Act’s full implementation:

• Review and revise drug-testing and anti-discrimination policies. Because the Act created a new protected category under Pennsylvania law, equal employment and anti-discrimination policies should include a reference to “certified users of medical marijuana.” In addition, while the status of zero-tolerance policies remains uncertain, employers should at least account for medical marijuana in their drug policies—either specifying in a zero-tolerance policy that testing positive for medical marijuana could lead to termination or explicitly providing a carve-out for certified users.

• Train supervisors about signs of intoxication. In light of the uncertainties surrounding the “under the influence” language, employers should ensure that supervisors can articulate specific symptoms contributing to “reasonable suspicion” drug-testing. These symptoms will later form the basis for an “under the influence” determination should a drug test confirm it. By the same token, job descriptions and discipline policies should be clear about job duties and expectations so that supervisors can rely on them in determining whether an employee’s conduct “falls below the standard of care.”

• DON’T ask applicants whether they are certified users. Certified users suffer from qualifying medical conditions. So asking whether an applicant is a certified user is akin to soliciting medical information and inquiring about disability status. However, you can and should ensure that prospective employees are able to perform all essential functions of a position. And if you’re notified of an applicant’s status as a certified user, keep in mind the possible ADA implications and clearly communicate rules and procedures.

Conclusions

On Election Day 2016, eight more states voted to expand legal use of marijuana. Twenty-nine states now allow medical or recreational use of marijuana. Though medical marijuana is still illegal under federal law, it remains unclear what approach the new federal administration will take to these new state laws. The DOH, too, may change the landscape when it issues clarifying regulations. Stay tuned for more specifics regarding the Act, and don’t hesitate to contact legal counsel if you have specific questions or would like assistance with your policies and procedures.

About the Author

Joshua Schwartz is a partner in the firm’s Employment Law Group and the head of the firm’s Workers’ Compensation practice. In that capacity, Josh represents public and private employers in litigation matters, administrative agency investigations, and labor arbitrations. Josh also counsels employers on issues related to injured workers, employee discipline and termination, workplace harassment, wage and hour compliance, medical leaves of absence, and labor relations.

(717) 399-1535 l jschwartz@barley.com

Major Changes to FLSA Overtime Rules on Hold For Now

Related Practice Area: Employment Employee Benefits

The new federal overtime rule is officially on hold after a Texas judge granted a nationwide preliminary injunction blocking the rule from taking effect on December 1 and allowing employers to stick with the status quo until the courts rule otherwise.

The U.S. District Court for the Eastern District of Texas granted the injunction, preventing the Department of Labor from implementing revised regulations to the overtime provisions of the Fair Labor Standards Act (FLSA). The injunction temporarily delays the new federal overtime rule, which would have raised the FLSA’s salary threshold for exemption from overtime pay from $23,660 to $47,476. Multiple states filed suit to block the new rule, and with the injunction in effect, businesses and employees are now in a holding pattern. A preliminary injunction preserves the status quo while a lawsuit is pending.

Until a final decision is reached, employers are NOT required to implement the new changes to the overtime rules as planned on December 1. Employers may continue to follow the existing overtime regulations. Employers who have already implemented changes to employees’ salaries or job descriptions may leave those decisions in place if they wish to do so. But they aren’t legally required to do so as of now. Employers who haven’t yet implemented the proposed changes may wish to postpone those plans until a final decision has been issued.

At this point, it is unclear how this will play out. Congress could step in and provide a legislative alternative, such as requiring an increase over a period of years, rather than all at once, or by enacting a carve-out exempting smaller businesses from the requirement.

The Department of Labor has already filed an appeal challenging the injunction, and the United States Court of Appeals for the Fifth Circuit has indicated it will decide the issue on an expedited basis. But that decision almost certainly won’t be issued before President-elect Trump’s inauguration. Once in office, Trump could order the department to drop its defense in the case, leaving the nationwide injunction in place. Although he may abandon the current case, it seems unlikely that Trump will drop the subject entirely since he expressed support for revisions to the overtime system during his campaign.

Because the injunction occurred so late in the process, it does little to assist companies who have spent significant funds preparing for implementation of the new overtime rules. At this point, it is more of a business decision as to whether employers should move forward with previously contemplated changes to compensation or duties. However, if these changes have already been communicated to employees, it may cause a serious morale issue if a company now forgoes implementation. Employers who decide not to implement the changes should make clear to employees that a judge has frozen implementation of the rules and the company is awaiting further direction from the courts or Congress before moving forward with any changes.

If you have any questions about how your business should address FLSA compliance moving forward, please contact Barley Snyder’s Employment Law Group.

About the Author

Richard Hackman is vice-chair of the firm’s Employment Law Group. He represents management and employers in all aspects of traditional labor and employment law issues.

(717) 852-4978 l rhackman@barley.com

New Federal Law Provides Greater Trade Secret Protections

By: Jill Sebest Welch

A new federal law provides uniform protections for trade secrets nationwide and allows companies to sue for trade secret theft in federal court. However, to take advantage of all the benefits the law offers, employers must notify employees of new whistleblower protections.

President Obama signed into law the Defend Trade Secrets Act of 2016 on May 11 (“DTSA”), providing federal protection for trade secrets and confidential business information. The DTSA received bipartisan support in both the House and the Senate, with the goal of developing more predictable federal case law governing trade secrets. Prior to its enactment, trade secret protections varied from state to state. The DTSA adds a federal civil enforcement scheme to the existing criminal protections under the Economic Espionage Act. But the DTSA doesn’t preempt state trade secret laws, leaving companies the option to sue in state court.

The DTSA provides robust remedies to victims of trade secret theft. To take advantage of these remedies, though, a business must ensure it provides notice of the DTSA’s whistleblower protections to employees in any agreement or contract regarding trade secret information, or alternatively that any such agreement cross references a policy document that describes the employer’s policy for reporting a suspected violation of law. So businesses should make sure this language is included in every type of document that they use to protect their trade secrets. That includes employment agreements, confidentiality agreements, non-disclosure agreements, proprietary information and invention assignment agreements, company confidentiality policies, and any other agreement or policy that a business uses to protect against trade secret theft.

An employer’s failure to provide notice precludes the award of exemplary damages or attorney fees otherwise available under the DTSA.

Donald Trump has just become President-elect Trump, and the future employment law landscape is difficult to predict. However, given the bipartisan support for the DTSA and the protections it affords to trade secret assets, this is a measure that appears likely to remain intact through the presidential transition.

About the Author

Jill S. Welch is a partner in Barley Snyder’s Employment Law Group. She counsels companies in handling workplace challenges and helps clients resolve disputes, claims, cases, and litigation in all aspects of labor and employment law. As an employment law counselor, Jill assists in developing employment policies, employee handbook provisions, non-compete and restrictive covenants and severance agreements, and has assisted companies through difficult layoffs and reductions in force. In her employment litigation practice, Jill defends employment law claims for employers across all industries: large and small, public, private, family-owned, emerging companies, entrepreneurs, and others.

(717) 399-1521 l jwelch@barley.com

ACA’s Fate, Plus Other Big Employment Benefits Developments

By: David J. Ledermann

The most important development of 2016 affecting the world of employee benefits—the outcome of the November elections—is only just beginning to materialize. With their party in control of the White House and both chambers of Congress, the long-sought Republican goal of dismantling the Patient Protection and Affordable Care Act (ACA) may be within reach. Even so, it is anticipated that a number of ACA provisions could survive, and employers are advised to maintain existing compliance practices until any changes are finalized.

Though perhaps less dramatic than the ACA’s imminent transformation, more certainty surrounds other 2016 developments of importance for employers and their employee benefit plans. A variety of benefits-related developments will reverberate into 2017 and beyond, including decisions from the U.S. Supreme Court and guidance published by the Internal Revenue Service and the Department of Labor.

End Of Five-Year Cycle For Retirement Plan Determinations

A sponsor of an individually designed retirement plan has had the opportunity to apply to the IRS for a determination letter on the plan’s tax-qualified status once every five years. An IRS announcement in 2015 and subsequent guidance issued in 2016 eliminated the five-year remedial amendment cycle for individually designed plans and limited the scope of the determination letter program to initial plan qualification, qualification upon plan termination, and certain other limited circumstances. Sponsors of Cycle A plans—sponsors with employer identification numbers ending in one or six—will be the last employers eligible to submit determination letter applications under the five-year cycle, which effectively ends January 31, 2017.

Going forward, the IRS will publish an annual “Required Amendments List” to assist employers in maintaining the tax qualification of their individually designed plans without the assurance of favorable determination letters. The list will identify necessary amendments to plans and establish deadlines to comply with changes in qualification requirements. The deadline will be the end of the second calendar year following the year in which the Required Amendments List is issued. No change in plan qualification requirements will appear on a Required Amendments List until the IRS has issued regulations or other official guidance on the topic.

Beneficial New Rules For Defereed Comp Of Tax-Exempts

In June 2016 the IRS issued long-awaited guidance governing the taxation of nonqualified deferred compensation plans of tax-exempt and governmental employers. Unlike in the for-profit sector, where income taxation can be postponed beyond vesting until actual payment, tax-exempt organization employees must include in income the present value of their deferred compensation at the time the right to the compensation vests, whether or not it is paid at that time. Employees of tax-exempt and governmental employers can delay including deferred compensation in their taxable income only so long as the deferred compensation remains subject to a substantial risk of forfeiture.

In an unexpected but taxpayer-friendly turn, the proposed regulations expand the circumstances in which the IRS will recognize that a substantial risk of forfeiture exists, thus delaying when employees of tax-exempt employers must recognize deferred compensation as income. Under the proposed regulations, deferred compensation that is contingent on compliance with a covenant not to compete will be considered subject to a substantial risk of forfeiture, provided certain criteria are satisfied.

Additionally, the proposed regulations in some instances permit the postponement of the lapse of a forfeiture risk, which also postpones the time when deferred compensation must be included as taxable income. A lapse of a forfeiture risk may now be postponed pursuant to a “rolling risk of forfeiture” provision, which would extend the period of substantial risk of forfeiture by, for example, adding additional years of service to a vesting requirement shortly before the original vesting period is satisfied. The recognition of these circumstances as substantial risks of forfeiture will depend upon meeting a number of requirements not listed here.

The new regulations also clarify that an employee’s elective deferrals to a deferred compensation plan may be deemed subject to a substantial risk of forfeiture if specified criteria are met. Employees, therefore, may also delay paying taxes on their elective contributions until these amounts are distributed.

Taxpayers may rely on the proposed regulations until they are finalized or withdrawn.

Form 5500 Failures And Other Violations

On June 30, the Department of Labor complied with prior legislation by increasing the maximum civil penalty for failing to file Form 5500 (Annual Return/Report of Employee Benefit Plan) from $1,100 to $2,063 per day. Additional lesser penalties will apply for failing to file the following notices:

- Form M-1 for multiple employer welfare arrangements

- Timely “blackout notices” (informing self-directed retirement plan investors of a period during which trading in their accounts will be unavailable)

- Required notices to participants in a retirement plan with an automatic contribution feature

- The summary of benefits and coverage notice under a group health plan.

These (and other) increased penalty amounts will be assessed for post-August 1, 2016, violations, though certain penalties can be mitigated through a plan sponsor’s voluntary corrective action.

Supreme Court Limits Health Plan Subrogation Rights

A recent U.S. Supreme Court decision will restrict a health plan’s ability to recover funds from plan participants. In the case of Montanile v. Board of Trustees of the National Elevator Industry Health Benefit Plan, the health plan attempted to recover $121,000 in medical expenses it paid for treatment of injuries that Robert Montanile suffered during an automobile accident caused by a drunk driver. Montanile successfully sued the driver and netted $240,000, after paying his attorneys’ fees and litigation costs. Montanile then spent the $240,000 without paying back the health plan. The health plan then sued for an equitable lien to recover the $121,000 in medical expenses from Montanile’s other assets.

In its January 2016 ruling, the U.S. Supreme Court held that the health plan couldn’t obtain such an equitable lien. Although the language in the health plan required Montanile to repay funds he received from a third party for injuries that the plan paid to treat, the health plan could only require such a payment if Montanile were actually in possession of the funds he received from the third party. The health plan, however, didn’t have the right to recover these funds from Montanile’s other assets. Because Montanile spent the third party funds on non-traceable items (like services, travel, and food), that eliminated the plan’s ability to recover funds from Montanile.

The case holds some important lessons for health plan sponsors. A plan sponsor–particularly a self-insured group plan–must have appropriate subrogation language in the plan document allowing it to recover payments that a participant receives from third parties. But that language, alone, isn’t enough. The plan sponsor must also move swiftly to enforce those rights. In Montanile, the health plan failed to respond to a letter from Montanile’s attorney indicating the funds would be provided to Montanile unless the health plan objected within 14 days. The health plan then delayed another six months before filing suit to recover the funds provided for treatment of Montanile’s injuries.

Guidance On Fiduciary Rules For Retirement Plan Advice

The Department of Labor finalized its new fiduciary rules governing retirement plan advice, significantly revising the rules as originally proposed by the agency in 2015. The rules are intended to protect retirement plan investors by requiring advisors to place their clients’ best interests ahead of their own. A principal focus of the rules is to prevent financial advisors and institutions from receiving payments that create conflicts of interest with their retirement plan investors.

The rules, which become effective April 10, 2017—with full compliance required by January 1, 2018—include a number of limited exemptions intended to permit advisors to receive compensation under certain arrangements the rules would otherwise prohibit. These 34 complex exemptions are listed in the “frequently asked questions” section of a document that the Department of Labor published in October.

There is some doubt whether the Labor Department’s fiduciary rules will survive the new Republican majority in Congress. Short of repeal, the rules’ implementation could be delayed or the new presidential administration might revise the rules.

About the Author

David Ledermann concentrates his practice in employee benefits law and ERISA, encompassing qualified and nonqualified deferred compensation arrangements, and employer-sponsored group health and welfare benefit plans. He has broad experience counseling clients, including publicly traded corporations, closely held companies, tax-exempt organizations and governmental entities, in connection with their retirement and other employee benefit programs.

(717) 399-1570 l dledermann@barley.com

Employment Discrimination Law Update

By: Jennifer Craighead Carey

It has been a busy year in the arena of employment discrimination law. The Equal Employment Opportunity Commission (EEOC) has been especially active in terms of issuing guidelines, establishing final rules, and advancing novel theories of discrimination law in the courts. Below are some of the highlights from 2016:

Pay Data Required For EEO-1 Form:

On September 29, 2016, the EEOC published a revised EEO-1 form. The new form will require private employers and federal contractors with 100 or more employees to report pay data information for their workforce. According to the EEOC, access to pay data will help the EEOC and the Office of Federal Contract Compliance Programs (OFCCP) identify pay discrimination and focus their enforcement efforts on employers who are more likely out of compliance with federal laws.

The revised form will require employers to identify employees’ total W-2 earnings for a 12 month period, looking back from a pay period between July 1st and September 30th. The revised EEO-1 has 12 pay bands for each job category. Employers must report the number of employees whose total W-2 earnings the prior year fell within the pay band, such as “15 African American females in the laborer category work in the pay band of $19,400 to $24,439.”

Employers will be required to submit the pay data information on their 2017 EEO-1 form, but the September 30th deadline has been extended to March 31, 2018 to give employers additional time to collect the pay data. Employers should begin assessing their existing human resource information systems to ensure that they have ready access to the information needed to prepare the new report. In addition, it is recommended that employers review the job titles in each of the ten EEO-1 job categories to ensure that employees are appropriately classified and that their job descriptions are accurate. Employers should also consider a preliminary audit of their compensation practices within each EEO-1 category using the salary bands established in the new form to identify and correct any disparities in compensation that cannot be justified by a legitimate, nondiscriminatory reason.

National Origin Discrimination:

In November, the EEOC issued new guidelines on national origin discrimination. The guidelines define national origin discrimination under Title VII as “discrimination because an individual (or his or her ancestors) is from a certain place or has the physical, cultural, or linguistic characteristics of a particular national origin group.” The guidelines include extensive examples or what constitutes national origin discrimination and provides advice to employers on how to avoid such discrimination. The new guidelines—plus a Q&A section and a Fact Sheet—are available on the EEOC’s website. Employers can expect the EEOC to aggressively enforce Title VII’s prohibition against national origin discrimination.

Voluntary Wellness Programs:

On May 16, the EEOC issued two final rules addressing voluntary wellness programs and compliance with the Genetic Information Non-Discrimination Act (GINA) and the Americans with Disabilities Act (ADA). The rules attempt to provide clarity in light of the Affordable Care Act, which permits employers to offer an incentive of up to 30 percent of the cost of health plan coverage for participating in a wellness program. Under the rules, employers are permitted to offer up to 30 percent of the total cost of self-only health plan coverage to an employee as an incentive to participate in a wellness program. But if multiple plans are offered, the incentive applies to the lowest cost plan. Moreover, an employer may not receive information collected under a wellness program that identifies a specific individual; employers may only receive that information in the aggregate. The rules also mandate that employees receive notice of the information which will be collected under the wellness program, with whom it will be shared, limits on disclosure, and how the information will be kept confidential. The rules further permit an incentive of 50 percent for a smoking cessation program, with some restrictions. The rules become effective January 1, 2017.

EEOC Litigation of LGBT Discrimination Claims: In 2012, the EEOC adopted its Strategic Enforcement Plan (SEP), which made preventing LGBT employment discrimination a top enforcement priority. The SEP includes coverage of lesbian, gay, bisexual and transgender discrimination under Title VII’s sex discrimination prohibition. In keeping with its promise, 2016 has been an active enforcement year for the EEOC in this area.

The EEOC filed one LGBT discrimination lawsuit against a Pennsylvania employer in 2016. In that case, the EEOC alleged that Scott Medical Health Center, a pain management and weight loss center, had subjected a male employee to harassment because of his sexual orientation and because he didn’t conform to the employer’s gender-based stereotypes. The EEOC alleged that the male employee’s supervisor knew that he was gay and subjected him to offensive anti-gay epithets, which forced the employee to resign. The employer sought to dismiss the case, arguing that sexual orientation isn’t a protected classification under Title VII. The trial judge, however, refused to dismiss the case, ruling that discrimination based on sexual orientation and sexual stereotyping implicates sex and is therefore protected by Title VII.

The EEOC is also actively pursuing litigation on behalf of transgender individuals. On July 6, the EEOC filed suit under Title VII’s sex discrimination provisions against Bojangles Restaurant, a fast food chain, alleging that it discriminated against a transgender woman by subjecting her to a hostile work environment based on her gender identity.

The EEOC’s stepped up enforcement has resulted in some success. On June 28, the EEOC resolved a case with an employer for $202,200 in a suit alleging that the employer had fired a lesbian employee who complained of sexual orientation discrimination. Earlier in 2016, the EEOC settled another case against a financial services company for $115,000, alleging the company had created a sexually hostile work environment, in part, by prohibiting a transgender employee from using the women’s restroom.

In light of the EEOC’s aggressive enforcement of LGBT discrimination, employers should consider whether they should revise their employment practices and policies to ensure compliance with the EEOC’s views regarding what Title VII requires.

Retaliation:

On August 25, the EEOC issued new enforcement guidance on retaliation. Claims of retaliation made up 45 percent of all EEOC charges filed in fiscal year 2015. Retaliation occurs when an employer takes a materially adverse action against an employee because the employee engaged in protected activity, like complaining internally about sexual harassment or filing an employment discrimination charge with the EEOC. The guidance offers detailed definitions of the terms “materially adverse” and “protected activity,” as well as examples. The guidance further describes “promising practices” that employers may consider implementing to avoid retaliation claims. The guidance is available on the EEOC’s website along with a question and answer section and a Small Business Fact Sheet.

EEOC’s Select Task Force on the Study of Harassment in the Workplace:

In June, the EEOC’s Select Task Force on the Study of Harassment in the Workplace issued a four-part report on workplace harassment. The reports provides direct guidance to employers on workplace harassment training, including recommendations on tailoring training to the specific workforce, bystander intervention training, and workplace civility training. Employers should reconsider using canned training programs and consult the report for ways to tailor their anti-harassment training to their particular workforce.

Religious Discrimination And The Vaccine Controversy:

In 2010, the Department of Health and Human Services set a target requiring that 90 percent of healthcare workers receive the flu vaccination. In response, hospitals across the country have established mandatory flu vaccine programs. Such programs have caused an increase in religious discrimination claims under Title VII, which requires employers to provide reasonable accommodations for employees’ sincerely held religious beliefs.

The EEOC has started taking up these employees’ cause. For example, in April the EEOC filed suit against Mission Hospital in North Carolina. The hospital’s policy required all healthcare workers to obtain a flu vaccination and set a September 1 deadline for requesting an exemption on religious grounds. The hospital terminated at least one employee who requested an exemption after the September 1 deadline had passed. In the litigation, the EEOC took the position that such a filing deadline is arbitrary and that an employer must consider a religious accommodation at the time it receives the request.

In another case, the EEOC sued Baystate Medical Center in Massachusetts for failing to accommodate a human resources employee who was granted a religious exemption from the vaccine but was required to wear a surgical mask in lieu of the vaccine. The employee alleged that the mask muffled her voice on the telephone and prevented her from performing her job. She refused to wear the mask and was fired. Additionally, in September, the EEOC filed suit against Pennsylvania-based Saint Vincent Medical Center after it denied flu vaccine exemptions to six employees whom the employer claimed failed to provide proof of religious doctrine.

Very few cases have addressed the extent to which an employer must permit an employee to forgo the flu vaccination on religious grounds. But this was precisely the issue that the U.S. District Court for the Eastern District of Pennsylvania addressed in the recent case of Fallon v. Mercy Fitzgerald Hospital. In that case, the hospital mandated the flu vaccine unless a medical or religious exemption was granted, and those employees granted an exemption had to wear a mask. In 2012 and 2013, Fallon sought an exemption “on the basis of a strong moral or ethical conviction similar to a religious belief.” He provided a lengthy essay explaining his convictions. He was granted a religious exemption both years. However, in 2014, the hospital changed its policy and Fallon was asked to provide a letter from his clergy supporting his exemption request. Instead, Fallon submitted a lengthy essay explaining his moral belief system but clarifying that he didn’t belong to an organized religion. In his 22-page essay, Fallon contended that the flu vaccine is ineffective, its benefits grossly exaggerated, its dangers downplayed, and is a fraud perpetrated upon the federal government. The hospital denied Fallon’s request, and he was ultimately terminated. Fallon eventually filed suit, asserting a claim for religious discrimination under Title VII, along with other claims. Ultimately, the trial court granted the hospital’s motion to dismiss the case, finding that Fallon’s mindset seemed to be more personal and social than spiritual. Fallon’s essay disputed the effectiveness of the flu vaccine and the motives of the pharmaceutical industry and at best constituted a lengthy editorial on contentious social issues—i.e. the effectiveness and propriety of vaccinations and the motivations of those who make and sell them. Moreover, the court noted that Fallon didn’t contend that others shared his anti-vaccination belief system. It should be noted that this decision appears to take a stricter view of what constitutes a sincerely held religious belief than the EEOC has taken in recent litigation.

EEOC Position Statements:

Effective January 1, 2016, the EEOC implemented nationwide procedures that permit the EEOC to provide position statements and non-confidential attachments to position statements to the charging party or his/her representative during the investigation of a charge of discrimination. Confidential information submitted as part of the position statement must be segregated and labeled confidential. Confidential information includes sensitive medical information (except for the charging party’s medical information), confidential commercial or financial information, trade secrets, non-relevant personally identifiable information of witnesses, comparators, or third parties (like social security numbers, dates of birth in non-age cases, home addresses, personal phone numbers, personal email addresses, etc.), and any reference to charges filed against the employer by other charging parties. This shift in procedures is significant. Employers shouldn’t submit position statements to the EEOC without first consulting legal counsel.

About the Author

Jennifer Craighead Carey chairs the Employment Law Group. She regularly counsels employers on issues related to discipline and discharge, ADA and FMLA compliance, workplace harassment, wage and hour compliance, policy and handbook development and review, and other issues related to human resources matters.

(717) 399-1523 l jcraighead@barley.com

USCIS Expands Optional Practical Training Program for Foreign Students with STEM Degrees

By: David J. Freedman

Related Practice Area: Employment Employee Benefits

Foreign nationals studying at colleges and universities under the F-1 visa are limited in their ability to work in the United States while completing their studies. But upon graduation these students are eligible to work in the United States for a limited period of time through a program called “optional practical training” or “OPT.” To be eligible, the student’s OPT work must relate to his or her field of study. The default OPT period is 12 months. Students, however, are eligible to extend that period if they have obtained at least a bachelor’s degree in a science, technology, engineering, or math field from a U.S. institution of higher learning. Previously, this STEM OPT extension allowed qualified students to extend their OPT period by an additional 17 months, giving STEM OPT students a maximum of 29 months of OPT following graduation.

On May 10, U.S. Citizenship and Immigration Services (USCIS) enacted new regulations expanding the STEM OPT program from 17 to 24 months. This means that students who are eligible for the STEM OPT extension can potentially work in the U.S. for up to 36 months following graduation.

The expanded STEM OPT period should assist employers trying to find eligible candidates for high-demand technology positions. Because there often aren’t enough qualified candidates in the U.S. to fill these positions, employers are sometimes forced to fill their personnel needs by recruiting foreign nationals. A common path for foreign students with STEM degrees is to work under OPT for an employer who then then files a petition for an H-1B specialty occupation visa on the foreign student’s behalf. The H-1B visa, if granted, allows the foreign national to work in the U.S. for up to six years and can lay the groundwork for the eventual attainment of permanent legal residency.

Obtaining an H-1B visa, though, is no easy task. The employer must pay for the entire H-1B process: the government filing fees, the attorney’s fees, and other expenses related to the visa application process. The employer cannot require the foreign national to contribute a portion of these costs or to reimburse the employer. Additionally, the employer must promise to pay the expenses associated with the foreign national’s return travel to his or her home country in the event that the employment relationship is terminated. So the STEM OPT program plays an important role by providing employers with an opportunity to evaluate a foreign student’s skills and abilities for an extended period of time before investing significant funds to obtain an H-1B visa.

Moreover, H-1B visas are in short supply. As a general rule, only 65,000 H-1B visas are available each year, unless the employer is one of a limited number of employers exempt from the H-1B visa cap. In 2015, employers filed approximately 172,000 H-1B visa petitions and normally only one petition per foreign national can be filed each year. The expansion of the STEM OPT period, therefore, will allow these highly skilled students to remain in the U.S. and file multiple H-1B visa applications over successive years should their initial applications not be picked for consideration.

The changes aren’t automatic for an employer looking to take advantage of the program. Like the previous STEM OPT program, an employer must be signed up with USCIS’s E-Verify program to participate in the new expanded 36-month STEM OPT program. But unlike the previous program, students and employers seeking to take advantage of the expanded STEM OPT program must now file a Form I-983. This form requires the student to obtain information from the designated school official (DSO) at the institution where the student graduated, much like students were required to do on the Form I-20 under the old program.

Although employers had very little responsibilities under the previous STEM OPT program, the new Form I-983 requires that the employer draft a training plan for each student seeking a STEM OPT extension. The plan must address a number of topics, like the knowledge or skills that the student will attain as a result of the training, how the employer intends to assist the student in meeting his or her goals, how the training directly relates to the student’s STEM degree, and how the organization will supervise the student. The employer’s portion of the Form I-983 must contain a description of the student’s compensation, which must be commensurate with salaries of similarly situated U.S. employees, and the employer must pledge that the student won’t replace a U.S. worker. The employer must update the plan if it changes and must conduct regular evaluations of the student’s work. These evaluations must be submitted to the DSO.

The Form I-983 is new; employers won’t be familiar with it. Additionally, the new STEM OPT regulations authorize the Department of Homeland Security to conduct on-site, email, or telephone reviews to confirm whether employers are complying with the STEM OPT requirements and training plan. Accordingly, employers wishing to take advantage of the expanded STEM OPT program would be wise to consult with experienced immigration counsel when completing the Form I-983, at least the first time through the process.

The attorneys and paralegals in Barley Snyder’s Immigration Group have extensive experience assisting employers and individuals with their immigration law needs. We would be glad to assist employers seeking to use to the expanded STEM OPT program.

About the Author

David Freedman is an experienced labor and employment litigator who represents public and private employers of all types and sizes in litigation before state and federal courts and administrative agencies. David also assists multinational corporations and individuals with their immigration needs.

(717) 399-1578 | dfreedman@barley.com

Form I-9 Fines and Other Immigration-Related Penalties Significantly Increased in 2016

By: Silas M. Ruiz-Steele

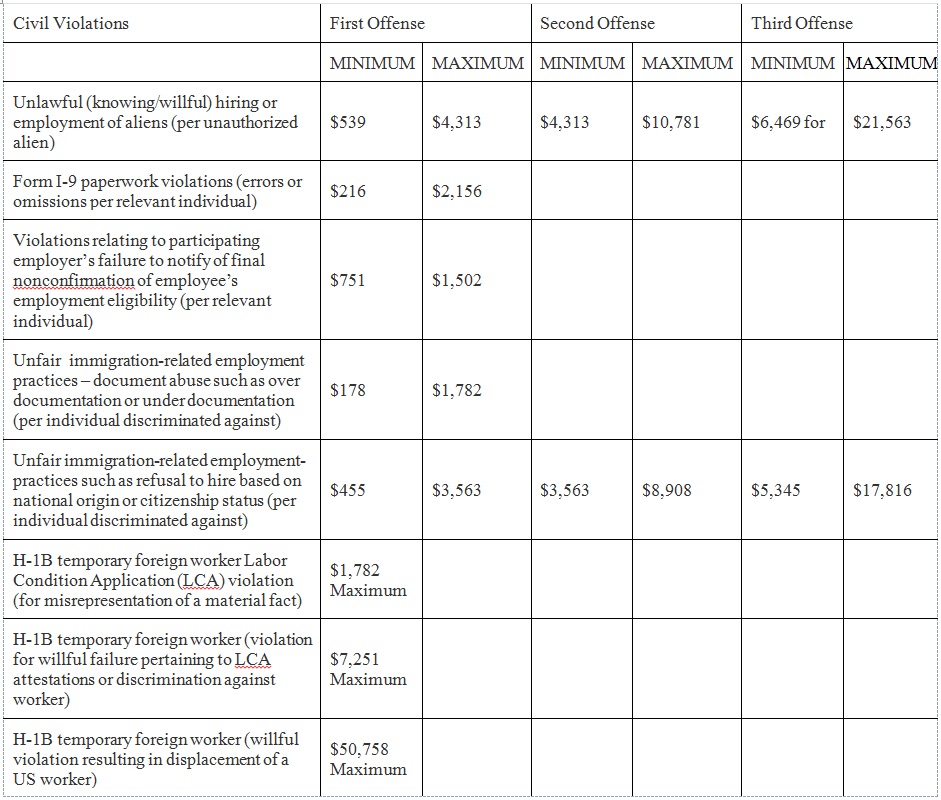

The U.S. Department of Homeland Security (DHS), the U.S. Department of Justice (DOJ), and the U.S. Department of Labor (DOL) each published separate rules in the Federal Register increasing penalties for various immigration-related violations, including Form I-9 paperwork violations, unfair immigration-related employment practices, and penalty schemes applying to certain temporary foreign worker visa programs such as H-1B Labor Condition Application (LCA) violations. The increased penalties were calculated pursuant to the Federal Civil Penalties Inflation Adjustment Act Improvements Act of 2015, requiring the agencies to make adjustments for inflation based on the Consumer Price Index. The new rules became effective August 1, 2016 and apply only to violations occurring after November 2, 2015.

The chart below provides a list of penalty increases for various immigration-related violations.

Employer Obligations Under The Immigration Reform And Control Act Of 1986

Form I-9 requirements come from the Immigration Reform and Control Act of 1986 (IRCA). IRCA prohibits employers from hiring and employing workers in the U.S. knowing that these workers aren’t authorized to work in the U.S. Employers also are prohibited from continuing to employ an individual knowing that he or she is unauthorized for employment. This law also prohibits employers from discriminating against individuals on the basis of national origin, citizenship, or immigration status. Under IRCA, all employers are required to verify the identity and employment authorization of each person hired in the U.S. after November 6, 1986 and to complete and retain a Form I-9 for each employee required to complete the form.

In light of the significant increase in penalties for immigration-related violations, including penalties for Form I-9 mistakes, employers should undertake a thorough review of their I-9 forms and implement (if not already in place) a robust immigration-related compliance program to minimize any possible exposure for IRCA violations.

About the Author

Silas Ruiz-Steele chairs Barley Snyder’s Immigration Group. She has focused her practice on immigration and nationality law for more than 20 years, regularly counseling and assisting employers and their employees as well as private individuals with their immigration needs.

(610) 898-7153 l sruizsteele@barley.com

Workers’ Compensation Update

By: Kylie L. Madsen

Protz Update

In September 2015, the Commonwealth Court of Pennsylvania held unconstitutional Section 306.2(a.2) of the Pennsylvania Worker’s Compensation Act, which authorizes physicians to use “the most recent version” of the AMA Guides to Evaluation of Permanent Impairment when evaluating permanent impairment ratings. In Protz v. WCAB (Derry Area School District), the physician evaluated the claimant’s permanent impairment rating using the 6th Edition of the AMA Guides, the latest version. But the Commonwealth Court held that Section 306.2(a.2) was an unconstitutional delegation of legislative authority and remanded the case for consideration under the previous 4th Edition of the AMA Guides. The claimant and employer both appealed, leaving employers, insurance carriers, and third party administrators wondering whether the Pennsylvania Supreme Court would immediately take up the issue or wait until the remand was decided.

On March 22, 2016, the Supreme Court granted the employer’s appeal and will now decide the constitutionality of Section 306.2(a.2). Until the Supreme Court definitively answers this question, it is recommended that an Impairment Rating Evaluation (IRE) determination be based upon both the 4th and 6th editions of the guide.

Relatedly, in Winchilla v. WCAB, the Commonwealth Court held that the right to question the constitutionality of the 6th Edition may be waived if the claimant does not properly raise and preserve the issue. The Pennsylvania Supreme Court denied the claimant’s appeal of the Commonwealth Court’s decision.

Subrogation And The MCARE

In a separate and subsequent Protz case, the Commonwealth Court considered the issue of subrogation as related to the Medical Care Availability and Reduction of Error Act (“MCARE”). The claimant in that case had an accepted work-related knee injury, which resulted in surgery. The surgery led to a medical malpractice claim, through which the claimant obtained an award for future medical expenses and lost wages. The employer and insurer sought to subrogate the claimant’s award due to the medical malpractice award. In response, the claimant argued that the MCARE prohibited recovery because the medical malpractice injury didn’t increase the employer and insurer’s workers’ compensation liability. The WCAB, and ultimately, the Commonwealth Court sided with the employer and insurer, holding that although “the MCARE Act disallows subrogation with respect to benefits paid up until the time of trial, it does nothing to alter the pre-existing law with regard to future benefits.”

Section 313 Notice Of Injury

In the case of Penske Logistics v. WCAB (Troxel), the Commonwealth Court considered whether reporting an injury to a co-worker discharges the claimant’s obligation to notify the employer of an injury covered by the Workers’ Compensation Act. In this case, the claimant alleged he slipped and fell at work, injuring his back and right arm/shoulder. The claimant reported the incident to a co-worker and filled out an injury report, which the claimant alleged he slipped under the office manager’s door. The office manager later testified that he never saw the report. The claimant didn’t initially seek treatment, and the report wasn’t formally filed with a supervisor until nine months later. Despite the late notice to the supervisor, the workers’ compensation judge awarded benefits, finding that the notice to the co-worker was sufficient.

The Commonwealth Court disagreed, holding that giving notice to another employee isn’t sufficient to satisfy the Workers’ Compensation Act’s injury notice requirements. According to the Commonwealth Court, notice must be given to an individual in a supervisory capacity, which is “a person whose position justifies the inference that authority has been delegated to him by the employer, as his representative, to receive a report or notice of such accidental injury.”

About the Author

Kylie Madsen is an associate in Barley Snyder’s Litigation and Employment practice groups who has also worked in general civil practice in the Lancaster area.

(717) 399-2160 l kmadsen@barley.com

National Labor Relations Board Update

Related Practice Area: Employment Employee Benefits

As many are painfully aware, the National Labor Relations Board has aggressively applied the National Labor Relations Act in the last several years. In particular, the Board has focused its efforts on striking employer policies, limiting an employer’s ability to discharge based on social media activity, and enacting labor-friendly regulations.

Enacted in the 1930s, the National Labor Relations Act (NLRA) created an administrative agency called the National Labor Relations Board (NLRB). The NLRB’s duties include overseeing elections, conducting investigations, and deciding unfair labor practice charges. The NLRB regulates the power between labor and management. But contrary to popular belief, the NLRA covers both union and nonunion employers.

In 2009 and 2010, labor interests aggressively pushed Congress to enact the Employee Free Choice Act (EFCA), which was designed primarily to increase labor representation through a card check or an expedited election process. Although this legislative goal failed, the NLRB enacted a series of aggressive regulations to implement the principles behind the failed EFCA.

Quickie Election Rule

The NLRB’s “quickie election rule” took effect in April 2015. Like EFCA, the purpose of this rule was to dramatically shorten the potential election timeline, and as a result, shorten the period of time an employer has to respond to and defend against a union election petition. Among other things, the quickie election rule:

- Permits electronic filing of election petitions

- Requires employers to file a statement of position outlining all pre-election hearing issues within seven days after the petition is filed or else risk waiving such issues

- Mandates that pre-election hearings commence within eight days of the filing of an election petition

- Requires employers to provide the union with voter information within two days of any direction of election

- Defers resolution of many voter eligibility issues until post-election, and

- Denies parties the opportunity to file a post-hearing brief as an automatic right.

The most recent data shows that the quickie election rule has achieved its goal. Elections are occurring more quickly. Before the rules, elections occurred on average 42 days after the filing of the petition. Under the new rules, that average has dropped to approximately 23 days. Plus, unions are winning a higher percentage of elections overall, which isn’t surprising. The less time between petition and election, the less the time an employer has to communicate with employees about the downsides of unionization.

Joint Employer Standard

The NLRB’s most dramatic impact on labor relations has been through recent decisions which have reversed long-standing precedent regarding the scope of the NLRA’s coverage. On August 27, in the Browning-Ferris Industries case, the NLRB “refined” its joint employer standard. Specifically, the Board found that two or more statutory employers are joint employers of the same statutory employees if they “share or codetermine those matters governing the essential terms and conditions of employment.”

Now, if a common law employment relationship exists, the question then is whether the potential joint employer possesses sufficient control over employees’ essential terms and conditions of employment to permit meaningful collective bargaining. However, the NLRB is no longer concerned whether “actual” control is exercised by an employer, but rather is focused on the indirect or potential right to control, which may occur when a business uses or contracts out to a third party services that it may need.

This ruling affects both franchisor-franchisee relationships and the relationships between staffing agencies and employers. Employers can no longer insulate themselves from NLRA coverage through staffing agency contracts that designate the staffing agency as the “employer” for purposes of employee benefits and wages. In light of this ruling (and other similar cases), employers need to examine carefully the relationships they have with outside entities.

Social Media Policies

Based on recent NLRB decisions, employers are finding it nearly impossible to draft NLRA-compliant social media policies. The NLRB’s approach has been to deconstruct every single word and sentence in employers’ social media policies in an attempt to limit employers’ ability to govern their workplaces.

A recent case involving Chipotle provides a perfect example. In that case, the issues involved provisions in Chipotle’s employee handbook regarding confidentiality, non-disparagement, and the use of Chipotle’s corporate logo.

Most employers maintain confidentiality provisions in their employee handbooks. Chipotle’s social media policy provided that, “If you aren’t careful and don’t use your head, your online activity can … spread incomplete, confidential, or inaccurate information” and prohibited employees from making “disparaging, false, misleading, harassing or discriminatory statements about or relating to Chipotle, our employees, suppliers, customers, competition, or investors.”

An administrative law judge (ALJ) ruled that Chipotle’s policies prohibiting employees from posting “incomplete, confidential, or inaccurate information” and preventing employees from making “disparaging, false, [or] misleading” statements were unlawful. The ALJ also found the prohibition on disparaging and false statements to be overbroad because false statements are protected unless they are maliciously false, i.e., knowingly or recklessly false.

Like in many employers’ handbooks, a provision in Chipotle’s “Confidential Information” policy prohibited “the improper use of” the company’s “name, trademarks, or other intellectual property. . . .” The Board contended that this policy violated employees’ protected rights because it would be understood to prohibit employees from using Chipotle’s logo when engaging in protected concerted activity.

Regarding the disclosure of “confidential” information, the ALJ found the term “confidential” overbroad because it wasn’t defined. Accordingly, employees reasonably could believe the handbook provision prohibited protected, concerted activity under the NLRA, such as discussions regarding employees’ wages and terms and conditions of employment.

Persuader Rule Status

In 2016, the U.S. Department of Labor (DOL) published its final “persuader rule,” which modified the “advice exemption” in the Labor-Management Reporting Disclosure Act of 1959 (LMRDA). Even though the NLRB didn’t promulgate this, the rule nevertheless could have a significant impact on labor relations. But whether the rule will be implemented is in serious doubt.

Under the controversial final rule, an employer-consultant agreement must be reported to DOL if the consultant engages in “persuader activities,” which are defined as any “actions, conduct or communications that are undertaken with an object, explicitly or implicitly, directly or indirectly, to affect an employee’s decisions regarding his or her representation or collective bargaining rights.” Under a typical reportable agreement or arrangement, a consultant agrees to manage a campaign or program to avoid or counter union organizing or a collective bargaining effort, either jointly with the employer or separately. Under the DOL’s prior interpretation of the law, the employer and consultant would be required to file a report only if the consultant communicated directly to the workers. The final persuader rule, though, would have required the reporting of both direct and indirect activities.

The persuader rule also requires the reporting of any materials provided to an employer for distribution to employees or any employer-consultant communications about such materials. A consultant’s revision of employer-created materials—including edits, additions, and translations—wouldn’t trigger reporting if intended to ensure legality. However, the reporting obligation would be triggered if the revisions were intended to increase the materials’ persuasiveness.

Activities that trigger reporting include direct contact with employees with an object to persuade them, as well as these categories of indirect consultant activities undertaken with an object to persuade employees:

- Planning, directing, or coordinating activities undertaken by supervisors or other employer representatives, including meetings and interactions with employees

- Providing material or communications for dissemination to employees

- Conducting a union avoidance seminar for supervisors or other employer representatives

- Developing or implementing personnel policies, practices, or actions for the employer

Ultimately, the DOL has sought to expand significantly the scope of reportable persuader activities well in excess of any prior interpretations. The rule’s vague language, which is open to DOL “interpretation,” could potentially impact something as seemingly innocuous as handbook provisions, if those provisions are designed to persuade employees to forgo joining a union.

However, immediately prior to the rule taking effect on December 1, the U.S. District Court for the Northern District of Texas issued a preliminary injunction enjoining the persuader rules across the nation. Among other things, the court found that the persuader rules would require attorneys to disclose confidential client information, the DOL lacked the statutory authority to adopt and enforce the new persuader rule, and the rule violated constitutionally protected rights of free speech and association.

Subsequently, the DOL issued a written directive stating that due to the nationwide preliminary injunction, the new reporting requirements for employers won’t apply until further notice. And in the wake of the national injunction, several business associations and states have filed their own lawsuits seeking to strike down the persuader rule. Accordingly, as of now, employers aren’t required to comply with the rule.

Election Effect

The recent election results could alter dramatically the field of labor relations. The Republican-controlled Congress and White House will likely curtail the NLRB’s aggressive stance on workplace standards and could even enact legislation to limit the NLRB’s ability to issue mandates like the quickie election rule. Further, it seems likely that future appointments to the NLRB will be less dismissive of employer’s interests than the current Board.

About the Author

Richard Hackman was the vice-chair of the firm’s Employment Law Group. He represents management and employers in all aspects of traditional labor and employment law issues.

(717) 852-4978 l rhackman@barley.com

U.S. Supreme Court Year in Review: Significant Employment Cases Decided in 2015-2016 Term

By: Jill Sebest Welch

The U.S. Supreme Court decided a dozen employment cases this past term, covering important issues under the Fair Labor Standards Act, Equal Employment Opportunity Commission procedures, public-sector employee rights, affirmative action in higher education, and immigration. The passing of Justice Antonin Scalia left the high court split 4-4 on two employment-related decisions: Freidrichs v. California Teachers Association and United States v. Texas. With no majority rulings from the Supreme Court, the lower court decisions in these cases stand until (and unless) the Court provides further direction.

Below are summaries of the major cases the Supreme Court decided this past term.

Supreme Court Approves “Trial By Formula” In Wage And Hour Class And Collective Actions Tyson Foods, Inc. V. Bouaphakeo

The Supreme Court removed the hurdle requiring each worker to prove with specificity his or her damages resulting from off-the-clock work. Instead, the Court approved a “trial by formula” method, which allows damages for a representative sample of workers to be extrapolated across an entire group of plaintiffs, despite potential differences among plaintiffs. The ruling came as a surprise, in light of two recent Supreme Court cases involving Wal-Mart and Comcast Corp. that had established employer-friendly class certification standards.

The workers claimed that Tyson violated the Fair Labor Standards Act (FLSA) by not paying them overtime compensation for time spent donning and doffing protective equipment. Although Tyson paid these employees for time spent at their workstations, Tyson didn’t record the actual time employees spent putting on taking off the protective equipment.

To prove their case, the workers’ expert recorded 744 employees and estimated that it took these employees between 18 to 21.25 minutes to put on and remove the required gear. Relying on the expert’s analysis, the workers claimed that an additional 18 to 21.25 minutes should be added to each employee’s time sheet to determine which employees were entitled to overtime compensation. Tyson argued that the varying amounts of time it took employees to don and doff different protective gear made reliance on the expert’s sample improper and that such a “trial by formula” would lead to recovery for workers who had not worked over 40 hours in a week. The jury disagreed and awarded the class $2.9 million in unpaid wages, later doubled to $5.8 million for liquidated damages.

Tyson appealed the case all the way to the Supreme Court, which rejected Tyson’s argument. According to the Court, in “many cases, a representative sample is ‘the only practicable means to collect and present relevant data’ establishing a defendant’s liability.” If the employer hasn’t kept accurate records of all hours worked, employees shouldn’t be punished because they can’t prove the exact amount of uncompensated time. Rather, the Court held “an employee has carried out his burden if he proves that he has in fact performed work for which he was improperly compensated and if he produces sufficient evidence to show the amount and extent of that work as a matter of just and reasonable inference.” The employer could then present evidence of the precise amount of work performed or evidence that the sample wasn’t representative or accurate, which Tyson didn’t do.

The Department Of Labor’s Interpretation Of The “Salesman” Exemption Not Entitled To Deference Encino Motor Cars V. Navarro

In this case, the Supreme Court addressed whether auto dealership service advisers are exempt from the FLSA’s overtime compensation requirements. The FLSA exempts from its overtime pay requirements “any salesman, partsman, or mechanic primarily engaged in selling or servicing automobiles.” Many automobile dealerships had classified service advisers as exempt because they primarily sell vehicle service work to customers. Several appellate court decisions and the Department of Labor (DOL) had supported this interpretation. Then in 2011 the DOL made a 180-degree change, issuing an interpretation finding service advisers aren’t entitled to the FLSA’s exemption and must be paid overtime.

The Supreme Court unfortunately didn’t issue the guidance the automobile dealership industry hoped for. Instead, the Court ruled that the DOL hadn’t provided the necessary reasonable explanation to support changing its older interpretation. Despite refusing to follow the DOL’s new interpretation, the Court sent the case back to the lower appellate court to decide whether service advisers are exempt from the FLSA’s overtime pay requirements.

Constructive Discharge Claims Begin When the Employee Actually Resigns Green v. Brennan

The Supreme Court ruled that the statute of limitations for pursuing a claim of constructive discharge with the EEOC begins to run on the date the employee actually resigns. A “constructive discharge” occurs when an employee establishes that discriminatory conduct makes the employee’s working conditions so intolerable that a reasonable person under the same circumstances would feel compelled to resign. In this case, the Court clarified that the statute of limitations period for such claims starts only when an employee officially resigns and gives “definite notice” of his or her decision to leave. As a consequence, employees are able to base constructive discharge claims on allegedly discriminatory acts that occurred well before the employee’s actual resignation.

A Prevailing Employer May Be Entitled To Attorneys’ Fees CRST Van Expedited V. EEOC

Title VII of the Civil Rights Act authorizes the award of attorneys’ fees to a party who “prevails” in a discrimination or retaliation claim. As a practical matter, though, courts have only awarded attorneys’ fees to employer-defendants in the rare cases when they find a plaintiff’s claim frivolous or unreasonable. In CRST Van Expedited, the Supreme Court narrowly opened the door by clarifying that an employer-defendant doesn’t necessarily need to “prevail on the merits” of a discrimination lawsuit to collect attorneys’ fees.

In CRST Van Expedited, the lead plaintiff, Ms. Starke, filed an EEOC charge alleging sexual harassment. The EEOC later filed suit on her behalf, alleging that over 250 female employees at the company had been subjected to sexual harassment. As the litigation proceeded, every single claim was dismissed, and the trial court awarded the company $4 million for the attorneys’ fees it spent defending the claims.

The EEOC appealed. Although the appellate court affirmed the dismissal of almost all of the claims, it reinstated Ms. Stark’s claim and that of another employee. The appellate court also vacated the attorneys’ fee award and sent the remaining two claims back to the trial court. After Ms. Starke settled her claims and the other employees’ claims were dismissed, the trial court re-instated the previous attorneys’ fees award to the company.

The EEOC appealed the case again, arguing that the attorneys’ fees award should be vacated since the company had prevailed only because of a procedural fault related to the EEOC’s investigation.

But in a unanimous opinion, the Supreme Court held that an employer-defendant doesn’t need to win a favorable ruling on the issue of whether it discriminated to be a “prevailing party.” The EEOC’s failure to investigate the case adequately or to resolve it before filing suit, although procedural in nature, might be sufficient to find that an employer is a “prevailing party” entitled to attorney’s fees. The Supreme Court, however, refused to decide whether the company qualified as a “prevailing party” entitled to attorneys’ fees. Instead, the Court remanded that issue back to the lower appellate court to decide (perhaps being inclined to issue narrow rulings in light of Scalia’s passing).

Public Sector Unions May Charge Non-Members “Fair Share” Fees Friedrichs V. California Teachers Association

Public sector unions scored a victory when the Supreme Court ruled that the First Amendment to the U.S. Constitution doesn’t prevent them from charging nonmembers “fair share” fees to cover expenses of negotiating and administering collective bargaining agreements. The ruling only covers states that allow such fees. The Pennsylvania Public Employee Relations Act permits such “fair share” fees.

In the past, the Supreme Court had been skeptical of “fair share” fees, and some predicted the Court would find such fees unconstitutional. But with the passing of Scalia, the Court split 4-4 and issued a one-sentence decision upholding California’s “fair share” fee law.

First Amendment Protects Public Employees From Retaliation Based On Mistaken Perceptions Regarding Political Activity Heffernan V. City Of Paterson

Under well-established precedent, the First Amendment prohibits a public employer from discharging or demoting an employee for supporting a particular political candidate (subject to limited exceptions). But what about when a public employer takes action against an employee based on the mistaken belief that the employee had supported a political opponent?

In Heffernan v. City of Paterson, Heffernan, a police detective in Paterson, N.J., was demoted the day after he had been seen holding a sign supporting the mayor’s opponent in the upcoming election and speaking with the opponent’s supporters. Apparently, the detective’s supervisors—both appointed by the mayor—believed that Heffernan was supporting the mayor’s opponent in the election. In fact, Heffernan wasn’t involved in the opposition’s campaign at all. He had picked up the sign in response to a request from his bedridden mother.

The city argued that it hadn’t violated Heffernan’s First Amendment right to engage in political activity because Heffernan hadn’t actually engaged in protected political activity. But the Supreme Court held that Heffernan could pursue his claim because the motive for and effect of the city’s demotion were the same despite its mistaken belief.

Universities May Continue To Consider Race As An Admission Factor Under Certain Circumstances Fisher V. University Of Texas At Austin

In a 4-3 decision, the Supreme Court held that the University of Texas at Austin’s consideration of race as part of its admissions criteria didn’t violate the Equal Protection Clause of the Fourteenth Amendment. Abigail Fisher, a Caucasian Texas resident, sued the University after being denied admission to the university in 2008.

The Court reiterated the three important principles it uses to assess the constitutionality of a public university’s affirmative action program. First, a university may not consider race “unless the admissions process can withstand strict scrutiny.” In other words, the institution must show that its “purpose or interest is both constitutionally permissible and substantial, and that its use of [race] is necessary” to accomplish that purpose. Second, “the decision to pursue the educational benefits that flow from student body diversity is, in substantial measure, an academic judgment to which some, but not complete, judicial deference is proper.” Third, when determining whether the use of race is narrowly tailored to achieve the university’s permissible goals, the school bears the burden of demonstrating that “available” and “workable” race-neutral alternatives don’t suffice.

In this case, the University of Texas articulated what the Court deemed were concrete and precise goals—including ending stereotypes, promoting cross-racial understanding, preparing students for an increasingly diverse workforce and society, and cultivating leaders with “legitimacy in the eyes of the citizenry.” These goals mirrored goals the Court had approved as compelling interests in prior cases.

Importantly, the Supreme Court noted that the university has a continuing obligation to satisfy the strict scrutiny review by periodically reassessing its admission program’s constitutionality and efficacy in light of the school’s experience and the data it has gathered since adopting its admission plan. The Court also directed the school to tailor its approach to ensure that race plays no greater role than necessary in meeting its compelling interests. In the majority’s words, “The Court’s affirmance of the university’s admissions policy today does not necessarily mean the university may rely on that same policy without refinement.”

President Obama’s Immigration Programs On Hold United States V. Texas

A 4-4 tie at the Supreme Court leaves in place a lower court order prohibiting President Obama from implementing the Deferred Action for Parental Accountability (DAPA) and an expansion of the Deferred Action for Childhood Arrivals (DACA) programs. These programs would have allowed the Department of Homeland Security (DHS) to stay deportation proceedings and issue work permits to undocumented immigrants who are parents of U.S. citizens or lawful permanent residents and those who entered the U.S. as youths but who were over 31 years old when the original DACA program became effective on June 15, 2012. Note, this decision doesn’t affect the original 2012 DACA program, which remains in effect for the time being. The original DACA program is available for undocumented foreign nationals who entered the U.S. before their 16th birthday and satisfy a number of other criteria making them a low deportation priority for DHS.

About the Author

Jill S. Welch is a partner in Barley Snyder’s Employment Law Group. She counsels companies in handling workplace challenges and helps clients resolve disputes, claims, cases, and litigation in all aspects of labor and employment law. As an employment law counselor, Jill assists in developing employment policies, employee handbook provisions, non-compete and restrictive covenants and severance agreements, and has assisted companies through difficult layoffs and reductions in force. In her employment litigation practice, Jill defends employment law claims for employers across all industries: large and small, public, private, family-owned, emerging companies, entrepreneurs, and others.

(717) 399-1521 l jwelch@barley.com