TABLE OF CONTENTS

Employment Law 2018 Year in Review

Meet our New Employment Attorney, Kareemah Mayer

How Can We Help You?

The Third Circuit and the #MeToo Movement: The Court Makes It Easier for Women to Present Their Claims to a Jury

Pennsylvania Takes a Stab at Overtime Regulation Overhaul

Workplace Harassment a Priority for EEOC in Fiscal Year 2018

Medical Marijuana: Can a Business Still Fire Employees for Taking Drugs

The OFCCP under Trump: A New Era for Government Contractors

In-Person Interviews for Applicants of Employment-based Green Cards: Prepare or Risk the Consequences

2018 Pennsylvania Workers’ Compensation Update: The Triumphant(?) Return of the Impairment Rating Evaluation

New Opportunities and Uncertainties Ahead for Employee Benefit Plan Sponsors

Employment Litigation Successes

Employment Law 2018 Year in Review

Related Practice Area: Employment Employee Benefits, Employment Litigation and Workers’ Compensation

Click here to view a PDF of our “Employment Law 2018 Year in Review”.

Meet our New Employment Attorney, Kareemah Mayer

By: Kareemah Mayer

Related Practice Area: Employment

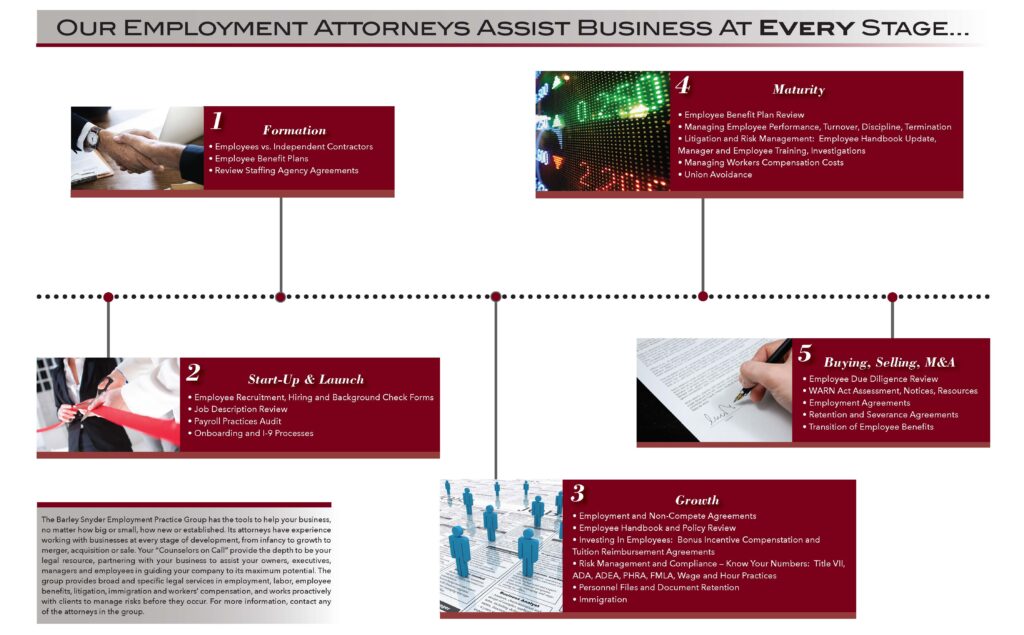

How Can We Help You?

The Third Circuit and the #MeToo Movement: The Court Makes It Easier for Women to Present Their Claims to a Jury

By: Michael J. Crocenzi

Related Practice Area: Employment Employment Litigation

An appeals court made a watershed decision in 2018 when it allowed a jury to hear a sexual harassment case even though the plaintiff waited years to report the incidents and the defendant had previous case law on its side.

In Minarsky v. Susquehanna County and Yadlosky, the court had to decide whether the plaintiff’s claims of a hostile work environment should be presented to a jury. The plaintiff worked as a part-time secretary for the Susquehanna County Department of Veterans Affairs in northeastern Pennsylvania. For over three-and-a-half years, her supervisor, defendant Thomas Yadlosky, kissed her on the lips, touched and embraced her without her consent, sent explicit emails and monitored her whereabouts. Even though the county had an anti-harassment policy, the plaintiff never reported the harassment to the county because she feared retaliation or that the county would not do anything about it.

The plaintiff eventually reported Yadlosky’s conduct after her physician strongly recommended that she do so. After an investigation, the county terminated Yadlosky. The plaintiff sued the county and Yadlosky for a hostile work environment.

The Case History

The county convinced the lower court that the plaintiff’s lawsuit should be dismissed citing two previous cases.

Those cases held:

- If the harassed employee suffers no tangible employment action, the employer can avoid liability by showing that it exercised reasonable care to prevent and promptly correct any sexually harassing behavior.

- The employee unreasonably failed to take advantage of any preventive or corrective opportunities provided by the employer.

On appeal, the U.S. Court of Appeals for the Third Circuit rejected this position. Even though the appeals court acknowledged the county had an anti-harassment policy, county officials knew that Yadlosky made inappropriate physical advances toward at least four other women. In its discussion, the court stated, “County officials were faced with indicators that Yadlosky’s behavior formed a pattern of conduct, as opposed to mere stray incidents, yet they seemingly turned a blind eye toward Yadlosky’s harassment.” The court held that a jury was in the best position to determine if the county exercised reasonable care to prevent and promptly correct any sexually harassing behavior.

The appeals court also held that a jury should determine if the plaintiff unreasonably failed to take advantage of any of the county’s preventive or corrective opportunities. While acknowledging that the passage of time with the failure to take advantage of the employer’s anti-harassment policy can be considered unreasonable, the “mere failure to report one’s harassment is not per se unreasonable,” according to the court. The passage of time is just one factor in the analysis.

Court Analysis

The court held that a plaintiff’s subjective belief of potential retaliation from reporting harassment could be considered objectively reasonable to a jury. The court distinguished this case from one where an employee’s fear of retaliation is generalized and unsupported by evidence. The plaintiff identified instances where asserting herself rendered her working conditions even more hostile and she was led to believe she could not protest her supervisor’s conduct. The plaintiff testified that she was concerned about Yadlosky retaliating against her. She needed her job to pay her daughter’s medical bills.

The court further stated that the county merely slapping Yadlosky on the wrist for prior incidents convinced the plaintiff that it was useless to complain. The court held, “A jury could find that [the plaintiff] reasonably believed that availing herself of the anti-harassment policy would be futile, if not detrimental.” Finally, the court held “A jury could consider the aggravating effect of prolonged, agonizing harassment as a way to credit [the plaintiff’s] fear of worsening her situation.”

Interestingly, in a lengthy footnote, the court commented on the #MeToo movement sweeping the country. The court stated in its ruling:

“This appeal comes to us in the midst of national news regarding a veritable firestorm of allegations of rampant sexual misconduct that has been closeted for years, not reported by the victims. It has come to light, years later, that people in positions of power and celebrity have exploited their authority to make unwanted sexual advances. In many such instances, the harasser wielded control over the harassed individual’s employment or work environment. In nearly all of the instances, the victims asserted a plausible fear of serious adverse consequences had they spoken up at the time that the conduct occurred.”

The court went on to cite an ABC News/Washington Post poll as well as a 2016 EEOC Select Task Force report which indicated that the majority of women who experienced harassment at work never reported it or filed a complaint.

What Should You Do?

In light of this court decision, employers will not be able to simply rely upon an anti-harassment policy and a victim’s significant delay in reporting the alleged harassment in asserting its affirmative defense. The lower courts especially will be looking at many factors to determine if the employer had an effective policy to prevent and correct sexual harassment and why a particular victim did not report the harassment.

You Should:

- Make sure your harassment policy clearly states to whom a person should report an allegation of harassment.

- Investigate any and all reports of harassment. Do not ignore it.

- If an investigation reveals there was harassing behavior, administer appropriate and effective discipline.

- If the discipline is less than terminating the harasser, follow up with the victim and the harasser to make sure there is no continuation of the harassment or retaliation.

- Conduct regular and effective training of your employees about harassment and how to report it.

There is no doubt that the #MeToo firestorm sweeping the country affected the appeals court’s analysis of the facts in the case and whether an alleged victim should have an opportunity to present her case to a jury.

If anyone has questions on this case and how it could affect them, please reach out to me or anyone in the Barley Snyder Employment Practice Group.

Pennsylvania Takes a Stab at Overtime Regulation Overhaul

By: Jill Sebest Welch

Related Practice Area: Employment

Pennsylvania Gov. Tom Wolf in 2018 introduced his proposal of an overhaul of the state’s overtime regulations – even though a somewhat similar measure to change overtime regulations failed at the federal level in 2016.

The proposed regulatory changes are intended to amend the white-collar exemptions from overtime under the Pennsylvania Minimum Wage Act of 1968, exemptions that have not been updated since 1977. The Pennsylvania Department of Labor and Industry’s proposed changes could affect more than a half-million salaried employees in Pennsylvania.

The regulatory changes proposed by the department contain two primary components: an updated salary level and changes to the duties test.

Updated Salary Threshold

Under the proposal, the minimum salary threshold for exempt executive, administrative and professional employees would increase:

- To $610 per week ($31,72 annually) effective on the date the final regulations are published in the Pennsylvania Bulletin

- To $766 per week ($39,832 annually) one year later

- To $921 per week ($47,892 annually) two years after final publication

Three years after final publication and January 1 of every three years going forward, the salary threshold will be automatically updated to the “30th percentile of weekly earnings of full-time, non-hourly workers in the Northeast Census regions in the second quarter of the prior year as published in the U.S. Department of Labor, Bureau of Labor Statistics.”

Similar to the failed federal proposal, up to 10 percent of the minimum salary amount may be paid as nondiscretionary bonuses, incentives or commissions provided they are paid, at a minimum, on a quarterly basis.

Changes to the Duties Tests

In addition to significant changes in the minimum salary threshold, the proposed regulations seek to align the duties tests for the executive, professional and administrative exemptions with the federal regulations. For example, the proposed state regulations eliminate the requirement that no more than 20 percent of an exempt employee’s duties be spent performing nonexempt work.

However, significant differences between Pennsylvania and federal law will continue to require employers to parse out the differences in the two laws for compliance purposes.For example, unlike the Fair Labor Standards Act and its regulations, the state’s proposal does not:

- Recognize a computer professional exemption

- Recognize a highly compensated employee exemption

- Recognize a specific exemption for administrative employees of educational establishments

- Make the requirements of the outside sales exemption the same under both laws

In addition, the proposed regulations would require exempt executive and administrative employees to “customarily and regularly” exercise their discretionary powers, a higher threshold than exists in the FLSA exemptions. The Department of Labor & Industry currently is mulling over the comments provided by the public and the Pennsylvania Independent Regulatory Review Commission to determine whether to issue final regulations and what the final regulations should be.

Please contact me or any member of our Employment Practice Group if you have any questions on how these proposed regulations could affect your business.

Workplace Harassment a Priority for EEOC in Fiscal Year 2018

By: Jennifer Craighead Carey

Related Practice Area: Employment

The Equal Employment Opportunity Commission engaged in the most enforcement litigation in its 2018 fiscal year than in any year in agency history, despite previous beliefs the department may scale back under the direction of President Donald Trump.

During that 12-month period that ended September 30, the EEOC filed 217 actions — 197 merit actions and 20 subpoena enforcement actions. Matters under Title VII — which prohibits discrimination on the basis of sex, race, color, national origin and religion — accounted for 55 percent of the cases, followed by cases arising under the Americans with Disabilities Act. During the week of August 9 alone, the EEOC filed seven harassment lawsuits against employers based on race, national origin and sex involving employees from a range of industries including country clubs, cleaners, sports bars, airlines, health care and grocery stores.

The EEOC also placed heightened focus on harassment cases, filing 66 during the fiscal year. Not surprising in the wake of the #MeToo movement, 41 of those lawsuits involved claims of sexual harassment, a 50 percent increase from the previous fiscal year. Victoria Lipnic, the EEOC’s acting director, has said she expects this trend to continue.

In early October of 2018, the EEOC reported on preliminary data on sexual harassment complaints for fiscal year 2018. The report stated that sexual harassment charges with the EEOC increased by more than 12 percent from the prior fiscal year. Reasonable cause findings against employers in sexual harassment cases increased by more than 23 percent, from 970 to close to 1,200. In addition, monetary awards recovered in sexual harassment cases increased by 22 percent to $70 million dollars.

Given the dramatic increase in filings and the EEOC’s continued focus on enforcement – particularly in the area of sex discrimination and sexual harassment – employers need to be vigilant in their EEOC compliance, including review and enforcement of anti-harassment policies. The issue of the effectiveness of the employer’s response to a workplace harassment complaint took center stage in some of the cases filed by the EEOC.

The Barley Snyder Employment Practice Group – “Your Counselors on Call” – regularly reviews anti-harassment policies, conducts sexual and other harassment training, provides counseling to employers on handling workplace harassment complaints and investigations and defends employers in EEOC charges of discrimination. Please contact me or any member of the Employment Practice Group for assistance.

Medical Marijuana: Can a Business Still Fire Employees for Taking Drugs

By: Jennifer Craighead Carey

Related Practice Area: Employment

The conflicting nature of Pennsylvania’s medical marijuana statute and existing, yet-unchanged federal regulations continue to confuse and confound employers who want to accommodate employees with legitimate medical issues, but don’t want to break the law doing it.

While it could be years before there is harmony between state and the federal governments, there are emerging guidelines for how employers can protect themselves.

Under Pennsylvania’s medical marijuana statute, employers cannot discharge, refuse to hire, threaten, discriminate or retaliate against an employee solely based on the employee’s status as an individual certified to use medical marijuana. Individuals with certain medical conditions as specified in the law may obtain an identification card from the Pennsylvania Department of Health which certifies them to use medical marijuana in certain forms such as pill form.

While employers may not discriminate against individuals who are certified medical marijuana users, the law makes it clear that employers do not have to allow medical marijuana on their property or premises. Furthermore, employers may discipline an employee for being under the influence of medical marijuana in the workplace or from working while under the influence of medical marijuana when the employee’s conduct falls below the standard normally accepted for the position. The act also prohibits employees from performing life-threatening tasks while under the influence of marijuana and makes it clear that an employer is not required to put itself in violation of federal law.

The statute poses a genuine dilemma for employers. For federal law purposes, marijuana is still an illegal Schedule 1 controlled substance and nothing in the act protects against federal enforcement since federal law trumps state law. Given the safety-sensitive role of health care workers in caring for individuals, how far must employers go to accommodate medical marijuana users?

Medical Marijuana and Driving

There is some confusion about how drug testing results will be communicated for entities conducting pre-employment or other drug testing. Many follow the U.S. Department of Transportation Federal Motor Carrier Regulations for CDL drivers – even if the employer has no relation to the department. Since marijuana is considered a Schedule I controlled substance and illegal in the eyes of the department, employers subject to its regulations cannot permit CDL drivers to use medical marijuana.

For transportation department testing purposes, a test for marijuana is reported as positive even if the individual produces a Pennsylvania Department of Health certification approving the use of medical marijuana. The question is whether drug testing entities will report a test as negative if the person produces a valid certificate from the state for non-transportation department employees. Without an instruction from the employer, many medical review officers will follow transportation department regulations and report the test as positive. Employers should understand how their testing entities handle pre-employment and drug screenings for medical marijuana purposes.

Does the Drug Free-Workplace Act Apply to Us?

While employers can prohibit employees from being “under the influence” of marijuana if their performance is impaired or they are performing functions that could have life-threatening consequences, there is currently no scientifically valid method for measuring impairment as marijuana can stay in one’s system for 30 or more days. There is one section of the law which prohibits employees from performing public utility work or using dangerous chemicals if they have more than 10 nanograms of active THC in their systems, but this standard does not apply to the more generic prohibition on being under the influence. It appears employers would need to identify other objective factors beyond a positive drug test to show impairment, such as an unsafe act.

Another critical issue is whether employers are in violation of federal law if they accommodate certified medical marijuana users. The Federal Drug-Free Workplace Act (DFWA) requires any entity that receives a single federal contract of at least $100,000, or that receives any federal grant regardless of amount, to maintain a drug-free workplace. Failure to make good-faith efforts to do so disqualifies the entity from eligibility for federal funds. The DFWA requires that covered employers inform employees working on the grant or contract that the company prohibits the unlawful manufacture, distribution, dispensing, possession or use of a controlled substance on its premises and that action will be taken against employees who violate this proscription.

In addition, companies subject to the DFWA must:

- Establish a drug-free awareness program to make employees aware of the dangers of drug abuse in the workplace, the policy of maintaining a drug-free workplace any available drug counseling, rehabilitation and employee assistance programs and the penalties to be imposed for drug abuse violations.

- Notify employees that as a condition of employment on a federal contract or grant, the employee must notify the employer within five calendar days if the employee is convicted of a criminal drug violation in the workplace.

- Notify the contracting or granting agency within 10 days after receiving notice that a covered employee has been convicted of a criminal drug violation in the workplace.

- Impose a penalty or require participation in a rehab program to any employee who is convicted of a reportable workplace drug conviction.

- Make an ongoing good-faith effort to maintain a drug-free workplace by meeting the requirements of the DFWA.

It should be noted that nothing in the DFWA requires actual drug testing. However, the DFWA defines a controlled substance to include a Schedule 1 drug under the Controlled Substances Act and consequently, it appears that marijuana use would be prohibited for any employee working on a federal contract or grant, including medical marijuana.

Although no cases on the interplay between the DFWA and the state’s medical marijuana law have arisen in Pennsylvania yet, a federal district court in Connecticut has addressed the issue of the DFWA in connection with Connecticut’s medical marijuana statute which, like Pennsylvania, prohibits employers from discriminating against medical marijuana users. In the 2017 case, a nursing home rescinded a job offer following a positive drug test for marijuana. The potential employee was properly registered in Connecticut’s medical marijuana program through her doctor and filed a claim of discrimination under Connecticut’s medical marijuana statute. The nursing home defended the claim by arguing that it was covered by the DFWA but the district court rejected the nursing home’s argument. It ruled the DFWA did not specifically require drug testing nor specifically prohibit employers from employing individuals who use illegal drugs outside of the workplace. The nursing home’s decision to rescind its job offer amounted to discrimination under Connecticut law.

What Should We Do?

Given the confusion that exists between state and federal laws, we recommend, at a minimum, employers residing in a state such as Pennsylvania — where medical marijuana is legal — to take the following steps:

- Check with their testing vendor to determine how medical review officers are reporting test results for marijuana where the individual produces a proper certification for medical marijuana under Pennsylvania law. In such cases, does the medical review officer report the result as negative or does the medical review officer report the tests as positive or provide a notation that the person is a certified medical marijuana user? If the test is simply reported as positive for medical marijuana users, the employer may run afoul of state law in rescinding a job offer to the candidate.

- Determine whether there are mechanisms in the company’s substance abuse policy to report certification for medical marijuana for individuals in safety-sensitive roles so the company may properly monitor whether the employee is under the influence of marijuana at work.

- Review the company’s substance abuse policy to make it clear that medical marijuana users may not possess or use medical marijuana during work hours or perform work under the influence of marijuana.

- Assess the company’s tolerance for risks to determine the approach it will take with respect to medical marijuana users. While the federal district court in Connecticut disagreed with the nursing home’s position to not hire medical marijuana users, it is unclear how courts in Pennsylvania may credit this defense.

Our employment lawyers routinely review substance abuse policies and advise employers on drug testing issues in the workplace. Please contact me or any member of the Barley Snyder Employment Practice Group for assistance.

The OFCCP under Trump: A New Era for Government Contractors

By: Jennifer Craighead Carey

Related Practice Area: Employment

Federal contractors have something to be optimistic about with a 2018 shift in leadership and priorities at the Office of Federal Contractor Compliance Programs (OFCCP).

At the start of the year, President Donald Trump appointed Ondray T. Harris as OFCCP director and Craig Leen as senior adviser to the OFCCP. Both men come from managementside private practices. Harris pledged a more transparent and collaborative OFCCP, and worked at that until he resigned in July. Leen took over as acting director and deputy director.

To further that goal, the OFCCP issued nine directives in 2018:

Directive 2018-01 (February 27), Use of Predetermination Notices (PDNs): Requires OFCCP to issue predetermination notices before a notice of violation is issued and to provide the contractor with 15 days to respond.

Directive 2018-02 (May 18), TRICARE Subcontractor Enforcement Activities: Extends the current moratorium on TRICARE subcontractor audits for health care institutions. However, the directive does not change the requirement to have a written affirmative action program.

Directive 2018-03 (August 10), Executive Order 11246 §204(c), religious exemption: Aims to remind compliance officers of their duty to protect religious freedom, citing to recent Supreme Court cases as well as executive orders issued by Trump. It should be noted that Executive Order 11246 prohibits discrimination on the basis of religion, but also prohibits discrimination on the basis of sexual orientation and gender identity. However, the directive underscores certain guiding principles in relation to the rights of people and institutions to practice their religion without fear of infringement by the federal government, suggesting a balance tipped in favor of religious freedom.

Directive 2018-04 (August 10), Focused Reviews of EO 11246, §503 and VEVRAA (Vietnam Era Veterans Readjustment Assistance Act): Provides for on-site reviews focused on one of three issues, Executive Order 11246, Section 503 or VEVRAA.

Directive 2018-05 (August 24), Analysis of Contractor Compensation Practices During a Compliance Evaluation: Revamps guidance on compensation investigations and enforcement and is accompanied by an FAQ on the new directive. This is the third time in the last 10 years OFCCP has revised its compensation guidance. The directive reiterates that OFCCP will continue to rely upon statistical analyses of compensation differences, considering a twostandard deviation or greater as significant, but noted that it will also rely upon anecdotal evidence of discrimination. The OFCCP will be less likely to pursue a case where the statistical data is not supported by non-statistical evidence of discrimination.

Directive 2018-06 (August 24), Contractor Recognition Program: Recognizes contractors with highquality and high-performing compliance programs and initiatives.

Directive 2018-07 (August 24) Affirmative Action Program Verification Initiative: Requires contractors to certify their affirmative action program compliance to ensure contractors are completing the annual plans and target for audit those who are not in compliance. This guidance underscores the importance of having a written affirmative action plan.

Directive 2018-08 (September 19), Transparency in OFCCP Compliance Activities: Outlines expectations for audits and investigations to include an instruction to compliance officers to close audits at the desk audit stage within 45 days where there is no indication of violations. Significantly, the directive provides that during conciliation, the OFCCP is required to provide contractors with source data, factors used to calculate back pay and a summary of anecdotal evidence and non-statistical findings.

Directive 2018-09 (September 19), OFCCP Ombud Service: Provides an ombud service in the national office to facilitate the fair and equitable resolution of specific types of concerns raised by OFCCP external stakeholders such as contractors and subcontractors, contractor representatives, industry groups, law firms, complainants, worker rights organizations, and current and potential employees of federal contractors and subcontractors.

The OFCCP in 2018 also began mailing corporate scheduling announcement letters (CSALs) to federal contractors and subcontractors for fiscal year 2018, with an initial 1,000 CSALs mailed in February and another 750 mailed in September. The letter serves as a courtesy notice to a contractor that one or more of its establishments may be reviewed.

The OFCCP also issued guidance in September of 2018 on requesting extensions. Under the new guidance, OFCCP will provide a 30-day extension for supporting data related to the EO 11246, VEVRAA and Section 503 AAPs, but will not allow extensions to submit affirmative action plans. In addition, the request for an extension must be made prior to the initial 30-day due date to submit the affirmative action plans. The extension is contingent upon whether the contractor submitted the affirmative action plan within 30 days of receiving the scheduling letter.

The OFCCP appears more focused on efficiency and transparency. However, contractors should not be asleep at the wheel. The Trump OFCCP has made it clear that it expects government contractors and subcontractors to meet their obligations under EO 11246, VEVRAA and Section 503 to have written affirmative action plans. It is also clear that contractors will not be given an extension to submit them in the event of an audit. Contractors must ensure that they are meeting all of their other obligations under EO 11245, VEVRAA and Section 503.

Our Employment Practice Group works with federal contractors and subcontractors on the development of affirmative action programs and OFCCP audits. Please contact me or any member of our group for assistance.

In-Person Interviews for Applicants of Employment-based Green Cards: Prepare or Risk the Consequences

By: Silas M. Ruiz-Steele

Related Practice Area: Employment Immigration

As the federal government continues its in-person interviews with green card hopefuls, both employers and the applicants need to keep all documentation on hand and up-to-date.

Without those documents – and a thorough preparation for the interview – the result could be a green card denial.

The U.S. Citizenship and Immigration Services (USCIS) started the new policy requiring all adjustment of status applicants seeking employment-based green cards to appear for an interview at a USCIS field office in 2017. The interviews are for all Form I-485 adjustment of status applications filed on or after March 6, 2017, where the underlying immigrant petition is an employment-based Form I-140 in the EB-1, EB-2, and EB-3 preference categories. USCIS stated that the change “complies with Executive Order 13780 Protecting the Nation from Foreign Terrorist Entry into the United States,” and “is part of the agency’s comprehensive strategy to further improve the detection and prevention of fraud and further enhance the integrity of the immigration system.”

Because this change affects employers and their sponsored foreign workers for permanent residence, it’s imperative employers prepare their applicants in advance for a thorough questioning by the field officer at the in-person interview. As a best practice, the applicant should review the Form I-140, the underlying Program Electronic Review Management (PERM) application (if applicable), and the Form I-485 – including all supporting documents – to become familiar with the information that was provided, as well as the specific requirements of the employment category forming the basis of the Form I-140. During the interview, the applicant can expect the interviewing field officer to ask about the applicant’s job, qualifications, and employer.

Typically, the following areas are probed:

- The applicant’s eligibility

- The applicant’s educational background and/or prior experience that may have been used to qualify for the sponsored position

- The applicant’s immigration history and proper maintenance of all nonimmigrant status

- The applicant’s admissibility, such as any arrests or misrepresentations made to an immigration officer

- The applicant’s salary, job and job duties as defined in the I-140 petition

- Anything asked and/or listed on the Form I-485

Dependents, such as a spouse or a child of the principal applicant, are also expected to be called for an in-person interview with the field officer before their green cards can be approved. Every applicant scheduled for an interview can expect to receive their own separate interview notice from the USCIS that will include a list of required documents. During the interview, dependents can expect the interviewing field officer to ask questions related to the legality of the relationship to the principal applicant, as well as the principal applicant’s employment experience and sponsored role.

If the field officer conducting the interview is not satisfied with an applicant’s answers and believes an applicant is not eligible for adjustment, the Form I-485 could be denied. In light of the importance of these inperson interviews – the final stage in the green card process – we remind employers and their employmentbased green card applicants to keep immigration counsel informed of any material changes to an applicant’s employment, including:

- Transfer to a new employer

- Change in job location

- Change in job title, duties or responsibilities

- Promotion or demotion

- Corporate mergers, acquisitions, name change, federal employer identification number change, or other similar restructuring

- Significant change in salary

- Termination of employment

In light of the risks, applicants should dedicate some time for consultation and preparation with immigration counsel for the in-person interview process.

If you have any questions on the in-person interview process for I-485 green card applicants, please reach out to me or anyone in the Barley Snyder Immigration Practice Group.

2018 Pennsylvania Workers’ Compensation Update: The Triumphant(?) Return of the Impairment Rating Evaluation

By: Joshua L. Schwartz

Related Practice Area: Employment Workers’ Compensation

We witnessed the judicial demise of the Impairment Rating Evaluation (IRE) as a means of limiting wage loss exposure in Pennsylvania in 2017.But in 2018, the state brought it back – with some changes.

Gov. Tom Wolf in October signed Act 111, which immediately reinstates the IRE process. For approximately 20 years, the IRE had permitted insurance companies to deem certain permanently restricted individuals only “partially disabled” – and, therefore, limited to 500 additional weeks of wage loss benefits, also called “disability benefits” – once an independent physician had determined that they were less than 50 percent impaired by their work injury. The impairment rating determination was made using the “most recent edition” of the American Medical Association’s guides, and this referral to the AMA was the IRE’s downfall. In Protz v. WCAB (Derry Area School District), decided in June 2017, the Pennsylvania Supreme Court struck down the IRE section of the Workers’ Compensation Act, holding that deferring to the AMA’s updates constituted an improperly delegation of legislative authority.

In the new legislation, instead of the “most recent edition” of the AMA Guides, IRE physicians are instructed to use the sixth edition—a feature that may require future legislative action if the AMA enacts updates. In addition, in a concession to injured workers and their attorneys, Act 111 changes the threshold to retain total disability status from 50 percent to 35 percent and permits the injured worker to choose a health care provider if paid by the injured worker.

The Bureau of Workers’ Compensation has already resumed the authorization and designation of IRE physicians, and any injured worker who has reached maximum medical improvement and received 104 weeks of disability can be required to attend an IRE. Credit is provided for periods of total disability prior to passage of Act 111, so the effect will be immediate. Credit is also given for weeks of partial disability compensation paid prior to the effective date, though arguably this would not include weeks that were merely “deemed” partial from an unconstitutional IRE. A petition must be filed to obtain an IRE where more than 60 days have passed since the 104 week mark. Otherwise, the carrier can merely file a notice, and designation of the IRE will be automatic.

Because Protz increased premiums by eliminating one means of limiting long-term exposure, Act 111 also instructs the Pennsylvania Compensation Rating Bureau to recalibrate rates in light of the IRE’s return. Self-insured programs will remain unaffected.

Some attorneys have suggested they will challenge the new IRE legislation on the basis that it still delegates standards of impairment to the AMA. However, supporters of the legislation argue that incorporating language from a specific edition of the AMA Guide is quite different from giving the AMA the right to change the impairment standards with each new edition. Some observers also have expressed concern over the retroactivity provisions, and I expect the courts to weigh in several times over the next few years.

Act 111 also makes two changes unrelated to the IRE process, both involving fatal claims:

- Burial expenses have been increased from $3,000 to $7,000

- Calculation of survivor benefits has increased in certain cases, with wages of the deceased set at not less than 50 percent of the statewide average weekly wage.

Even upon its return, the IRE remains an option of last resort for employers and carriers. Ideally, employees will recover from their injuries and return to preinjury employment. Short of full recovery, employers may bring employees back to work in other capacities or engage an expert to perform a labor market survey and try to find alternative employment opportunities for disabled workers. Settlement may be an attractive option for employees wishing to move on and employers eager to close out claims. The loss of the IRE raised settlement values in difficult cases, and its return may bring valuations back to pre-Protz levels.

The attorneys at Barley Snyder regularly consult with employers to discuss IREs, return to work programs, retention of experts, settlement and other strategies for limiting workers’ compensation exposure. If you have questions or concerns regarding your options under the workers’ compensation act, please reach out to me or anyone in the Barley Snyder Workers’ Compensation Practice Group.

New Opportunities and Uncertainties Ahead for Employee Benefit Plan Sponsors

By: David J. Ledermann

Related Practice Area: Employment Employee Benefits

Legislative and regulatory changes made in 2018 to federal rules governing employee benefit plans present some welcome opportunities for plan sponsors and would-be plan sponsors.

Employers will generally favor changes made relaxing the rules governing hardship withdrawals under tax-qualified retirement plans and easing restrictions on association health plans and multiple employer retirement plans. However, some questions remain unanswered and await resolution through additional regulatory guidance, legislative action and even judicial decision.

Hardship Withdrawal Rules Relaxed Beginning 2019

Retirement plan sponsors have been able to revise their plans since January 1 to take advantage of provisions under the Bipartisan Budget Act of 2018. These provisions offer plan sponsors the opportunity to make the hardship withdrawal process more user-friendly to participants and plan administrators alike.

For 401(k) plans – but not yet 403(b) plans – the new rules permit distributions for hardship to be made from qualified non-elective contributions, qualified matching contributions and from earnings on these contributions, as well as from post-1988 earnings on elective deferral contributions. These sources specifically include non-discrimination safe harbor matching contributions. All of these were prohibited sources for hardship distributions under prior law.

Both 401(k) and 403(b) plans can be revised to remove the requirement for a six-month suspension of a participant’s elective deferrals after receiving a hardship withdrawal. Regulations proposed by the IRS in November 2018 indicate that elimination of the six-month deferral suspension will be mandatory for hardship withdrawals made on or after January 1, 2020. Retirement plans also no longer must require participants to first access any available plan loans before obtaining a hardship distribution.

Retirement plan sponsors making optional changes to their hardship withdrawal procedures in 2019 should adopt plan amendments on or before December 31, 2019. Other plans providing for hardship withdrawals will have to be amended at a later date yet to be determined.

Expanded group health plan access for small employers and sole proprietors

The U.S. Department of Labor issued regulations in June relaxing the rules governing association health plans, making it easier for small employers, and even self-employed business owners having no common law employees, to obtain group health plan coverage under a single large group health plan. These smaller organizations could benefit from the ability to more easily band together to purchase insurance. In addition, the coverage would not be subject to certain Affordable Care Act mandates applicable to small group and individual insurance policies, and so may offer greater flexibility in terms of policy provisions and potentially lower premiums.

In addition to redefining “employer” and “employee” under the Employee Retirement Income Security Act of 1974 (ERISA) to include a sole proprietor with no common law employees as both employer and employee for purposes of qualifying for group health insurance, the new regulations will permit employers in the same trade, industry, line of business or profession to form association health plans across state boundaries. Also, employers having their principal place of business in the same state, or within a single metropolitan area that includes parts of multiple states, can form an association health plan even absent any trade or line of business that they share in common. Unlike previously, an association may have as its primary purpose the provision of employee benefits for the employees of association members, so long as it has a substantial business purpose unrelated to the provision of benefits.

Aspects of the new regulations are opposed by some state insurance regulators, including Pennsylvania’s insurance commissioner. Because states retain a degree of regulatory authority over association health plans, they may be able to substantially undercut the new federal regulations. A number of state insurance departments have announced that small employers and sole proprietors joining association health plans in their states will remain subject to the small group and individual insurance market regulations that would apply to them absent their participation in an association health plan. Uncertainty remains concerning whether the states’ regulatory authority extends to this degree. In addition, a lawsuit by the District of Columbia and 11 states, including Pennsylvania, challenging the new regulations as violating the intent of Congress in enacting the Affordable Care Act, is pending in federal court.

Expanded retirement plan options for small employers and sole proprietors

In addition to expanding access to association health plans, the U.S. Department of Labor in October released proposed regulations intended to make it easier for small employers, including some sole proprietors with no common law employees, to offer the benefits of a tax-qualified retirement plan through a multiple employer plan (MEP).

By aggregating assets and participant populations from numerous employers, a properly constituted MEP – deemed a single-employer plan for purposes of ERISA – can provide advantages to employers and their employees, such as affordable professional management and administrative services. Employers participating in the MEP can avoid the necessity of filing an annual Form 5500, obtaining an ERISA fiduciary bond, maintaining a plan document and complying with various notice and disclosure requirements under ERISA. Instead, the MEP sponsor would undertake those functions.

Like the association health plan regulations, the proposed MEP rules would expand the availability of MEPs to associations of unrelated employers in a state or locality, and to associations operating in any number of states if their members are in a related trade or line of business. The association must have some substantial business purpose other than the provision of benefits and the plan must be controlled by its members. The proposed regulations also provide certainty to qualifying professional employer organizations – generally, companies that assume certain of the employer functions of their employer clients, such as payroll – that their MEPs will be treated as a single-employer retirement plan under ERISA. While the proposed regulations do not go so far as approving as a single ERISA plan an “open MEP” – a retirement plan offered to multiple employers by a service provider, such as a bank, insurance company or third party administrator – they do request public comments regarding the possibility for future proposals concerning open MEPs.

Unaddressed by the proposed regulations is a troublesome tax rule within the purview of the Treasury Department, commonly referred to as the “one bad apple” rule. This rule can result in the entire MEP losing its tax-qualified status due to a compliance failure on the part of a single participating employer, such as a failure to cover a sufficient number of its non-highly compensated employees. It is anticipated that the IRS will provide guidance modifying or clarifying, if not eliminating, the one bad apple rule to give employers some assurance that their mere participation in a MEP will not result in adverse tax consequences based on the actions of another participating employer.

If you have questions about any of these new regulations, please contact me or anyone in the Barley Snyder Employee Benefits Practice Group.

Employment Litigation Successes

By: Joshua L. Schwartz and Michael J. Crocenzi

Related Practice Area: Employment, Employment Litigation

- After a 2017 decision Michael Crocenzi won for a radiology group being sued for breach of contract and defamation, he revisited the case in 2018 on appeal to the Pennsylvania Superior Court. With the plaintiff seeking $330,000 in compensation, costs of litigation and attorneys’ fees, Crocenzi scored a second victory in the case. The state Superior Court agreed with the lower court ruling after reviewing the briefs and listening to oral arguments in the spring.

- Two top executives sued their former financial institution for more than $10 million, but Michael Crocenzi made sure the company didn’t have to pay. The two executives said their former employer violated their state whistleblower law for firing them after they complained the company didn’t follow the directives of federal regulators – a charge refuted by the company. Crocenzi convinced a county jury the financial institution did not violate the whistleblower law and the jury rendered a verdict in favor of the financial institution.

- Joshua Schwartz obtained summary judgment for a large corporate client in a pregnancy discrimination case in U.S. District Court for the Southern District of Indiana. The plaintiff contended not only that she was fired inappropriately, but also that she was kept in a room and prevented from using the bathroom, resulting in labor complications. Following the plaintiff’s deposition, the judge adopted our argument that no reasonable juror could find discrimination under the circumstances.

- The Commonwealth Court agreed with Joshua Schwartz’s interpretation of the law in a breach of contract action brought against a municipality. The Commonwealth Court overturned an earlier decision from the lower court on Joshua’s argument that the original trial judge had incorrectly applied the law, finding in favor of Barley’s municipal client.