TABLE OF CONTENTS

Employment Law 2019 Year in Review

Our New Practice Group Leader!

Meet Our New Employment Attorney, Sarah Yerger

We’ve Got a Training Seminar for That

“How Much Did You Make in Your Last Job?”: Equal Pay Landmines in 2019

The Wait for Updated Overtime Regulations is Over . . . .

Will Pennsylvania Enact its Own Overtime Salary Threshold?

Blockbuster SCOTUS Term to Tackle LGBTQ Discrimination, Immigration Issues

Third Circuit Reinforces Employer-Employee Interactive Process

NLRB Skews Pro- Employer in 2019

2019 Marks Big Year of NLRB Rulemaking

Maintenance of Membership Provisions Under Fire Post-Janus

2019 Pennsylvania Workers’ Compensation Case Law Update

Is Litigation the Answer for Your Business Immigration Needs?

Ongoing ERISA Litigation Highlights Need for Enhanced Fiduciary Awareness

2019 Employment Litigation Victories

Employment Law 2019 Year in Review

Related Practice Area: Employment Employee Benefits, Employment Litigation, Immigration and Labor Law

Click here to view a PDF of our “2019 Employment Law Year in Review”.

Our New Practice Group Leader!

By: Jill Sebest Welch

Related Practice Area: Employment Employee Benefits, Employment Litigation, Immigration and Labor Law

Meet Our New Employment Attorney, Sarah Yerger

By: Sarah C. Yerger

Related Practice Area: Employment Employee Benefits, Employment Litigation, Immigration and Labor Law

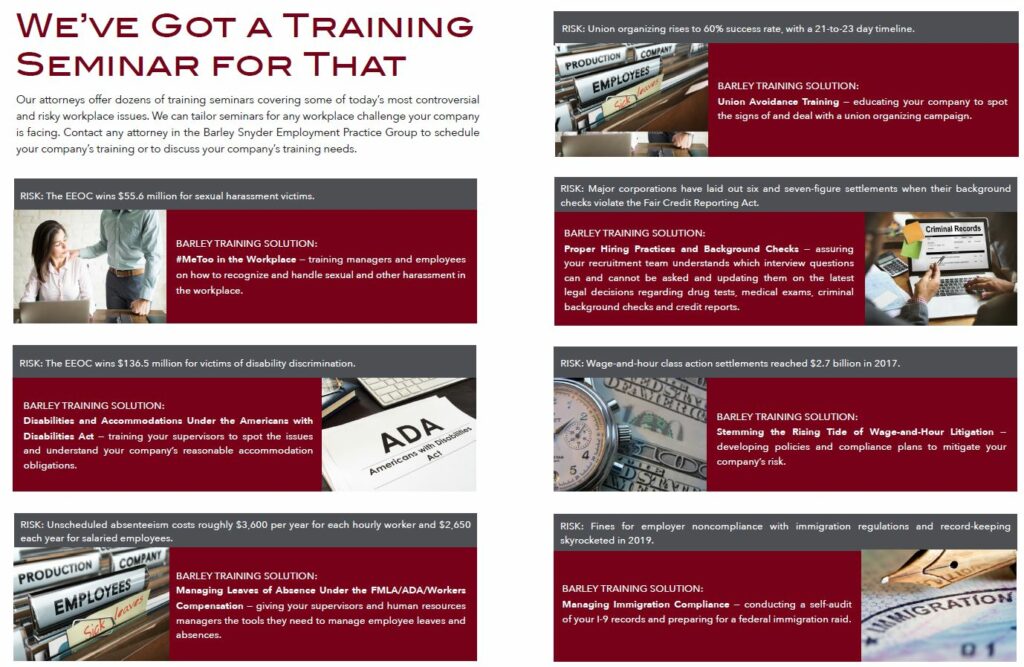

We’ve Got a Training Seminar for That

By: Jennifer Craighead Carey, David J. Freedman, Joshua J. Knapp, Keith Mooney, Silas M. Ruiz-Steele, Joshua L. Schwartz, Mark A. Smith, Jill Sebest Welch, Becky W. Munscher, Anne D. Dellosso, David M. Walker, Michael J. Crocenzi, Drake D. Nicholas, Robert J. Tribeck, Lori McElroy, Kareemah Mayer and Sarah C. Yerger

Related Practice Area: Employment Employee Benefits, Employment Litigation, Immigration and Labor Law

“How Much Did You Make in Your Last Job?”: Equal Pay Landmines in 2019

By: Jennifer Craighead Carey

Related Practice Area: Employment Employment Litigation

For years it was a standard question on employment applications and in job interviews:

“How much did you make in your last job?”

Many employers continue to ask this question. State and local lawmakers, as well as some courts, however, believe this question, while neutral on its face, serves to perpetuate the gender pay gap since women historically have earned less than men.

Some even believe the question fuels an unconscious bias to pay women less than men. Approximately 17 states and local jurisdictions have passed some form of a ban on the use of salary history information in the hiring process. New Jersey’s ban took effect January 1, and New York’s ban took effect January 6. Delaware’s ban has been in effect since 2017. In Pennsylvania, Gov. Tom Wolf signed an executive order in 2018 prohibiting state agencies from soliciting salary history information from prospective employees. Philadelphia City passed a similar salary history ban that has been enjoined, pending a legal challenge.

Even in the absence of a state or local ban on asking about salary history information, employers may be at risk for legal challenges. The federal Equal Pay Act prohibits pay disparity among members of the opposite sex performing similar work without regard to whether the employer intentionally discriminated.

To establish such a claim, an employee must show:

- The employer pays different wages to employees of different sex at the same establishment

- The employee performs substantially equivalent work

- The employee performs that work under substantially equal working conditions

The burden then shifts to the employer to prove the discrepancy is related to gender-neutral factors such as seniority, merit, quantity or quality of production or a differential based on any factor other than sex.

Many employers will raise the defense that salary history falls within the “any factor other than sex” defense. However, the federal circuit courts have disagreed on whether such a defense is valid. In 2018, the Ninth Circuit Court of Appeals ruled in Rizo v. Yovino that prior salary cannot be used to justify a wage difference between men and women under the Equal Pay Act and that it is “impermissible to rely on prior salary to set initial wages.” The Rizo case was vacated by the U.S. Supreme Court for procedural reasons but it nonetheless provides a roadmap for how the issue will be decided in future cases in the Ninth Circuit. Other circuit courts have permitted prior salary history to be used with some limitations, cautioning that salary history alone cannot justify a disparity in compensation between members of the opposite sex.

The Third Circuit Court of Appeals, which has Pennsylvania in its jurisdiction, has yet to rule on the issue.

Given the legal risks surrounding this issue, what should employers do? First, employers need to check state and local laws to determine whether they are in a jurisdiction that bans the use of salary history in setting initial compensation. If an employer is not is such a jurisdiction, the employer needs to determine what weight, if any, they wish to put on salary history in setting compensation and how much legal risk they wish to take.

They should also be on watch to see if their jurisdiction does pass such a law. As a best practice, an employer may want to disregard salary history in favor of a well-defined compensation structure that sets salary bans or ranges with clearly defined criteria based upon seniority, experience, relevant education, special skills and other objective factors.

The Wait for Updated Overtime Regulations is Over . . . .

By: Jill Sebest Welch

Related Practice Area: Employment Employment Litigation

The U.S. Department of Labor in September finally settled on the salary thresholds regarding overtime pay under the Fair Labor Standards Act:

- $35,568 ($684 per week): The annual standard salary threshold for executive, administrative, and professional employees to be exempt from the overtime pay requirements under the FLSA, up from the currently enforced standard annual salary of $23,360 ($455 per week).

- $107,432: The total annual compensation level to be considered a “highly compensated employee” (HCE) exempt from the FLSA’s overtime requirement. The figure is up slightly from the currently enforced level of $100,000, but much less than the annual HCE salary level of $147,414 in the department’s original, proposed final rule in March. However, note that Pennsylvania does not recognize this specific HCE exemption under its overtime regulations, meaning that employees must meet the salary and duties test for one of the other exempt categories of employees to be overtime exempt.

The changes took effect January 1. The former federal overtime standards have been in place since 2004.

The department estimates that about 1.2 million additional U.S. workers will now be entitled to overtime pay because of the raise in the standard salary level. A little more than 100,000 additional workers will be entitled to overtime pay because of the hike in the highly compensated employee compensation level.

The final rule also allows for employers to use “nondiscretionary bonuses and incentive payments (including commissions) that are paid at least annually to satisfy up to 10% of the standard salary level.” The condition is a recognition of evolving pay practices, according to a department news release issued when the changes in salary thresholds were announced.

The final rule comes out of the department’s Wage and Hour Division, which enforces overtime pay. At the time of the announcement, division officials said now that the standards are enacted, it will look to help employers comply with them.

While the new annual standard salary threshold represents more than a 52% jump from the current rate, it is still a far cry from what the Obama administration had originally proposed at $47,476 annually. The large jump in the standard salary threshold served as a contributing factor to a federal lawsuit that eventually struck down the final rule, sending the department back to the drawing board to construct a new proposal.

Will Pennsylvania Enact its Own Overtime Salary Threshold?

By: Jill Sebest Welch

Related Practice Area: Employment Employment Litigation

In Pennsylvania’s latest overtime proposal, the salary threshold that employees in executive, administrative and professional occupations must meet to be entitled to overtime would increase over three years to $875 per week ($45,500 annually) by 2022. Employees whose salary is less than that amount would be entitled to overtime pay. Every three years after 2022, the threshold will update automatically.

The state’s proposed pay threshold would be phased in with incremental hikes to the 2022 rate as follows:

Similar to the federal rule, Pennsylvania’s proposed rule would allow up to 10% of the salary threshold to be satisfied by nondiscretionary bonuses, incentives and commissions that are paid at least annually. However, the federal salary threshold would not be automatically adjusted. Instead, the U.S. Department of Labor periodically will review the salary threshold and update it only after a notice and comment period.

As December came to a close, however, Gov. Tom Wolf’s administration signaled a willingness to withdraw its proposed overtime salary threshold in exchange for agreement on Wolf’s other working-person agenda item – a rise in the state’s minimum wage.

No matter what the governor and Pennsylvania lawmakers decide in the coming months, one thing is certain: The effective overtime salary threshold in Pennsylvania is $35,568 annually ($684 per week) as of January 1.

Where it stands beyond 2020? That’s for Harrisburg lawmakers to decide. In early December, Wolf indicated that if the House doesn’t vote on the Senate-approved minimum wage hike – an incremental raise from the current $7.25 per hour to $9.50 per hour by 2022 – he’ll request the state’s Independent Regulatory Review Commission (IRRC) to vote on his proposed increase to the overtime salary threshold in January.

Whether analyzing the impact of the enacted federal or Pennsylvania’s proposed salary threshold, we remind employers to take the following steps:

- Check employee handbook compensation policies for references to the outdated salary threshold ($455 per week) and update them to reflect the new threshold of $684 per week.

- Have exempt employees whose salaries currently fall between $23,660 and $35,568 per year keep a record of their hours worked including off-hours time on electronic devices. Upgrade time keeping systems where needed.

- Review job descriptions and exempt vs. nonexempt duties.

- Analyze the impact of bumping pay levels for exempt employees to match the salary threshold, hiring more employees to spread out what would otherwise be overtime hours for newly nonexempt employees, and/or reassigning job duties to funnel exempt tasks up the ranks to exempt employees.

Blockbuster SCOTUS Term to Tackle LGBTQ Discrimination, Immigration Issues

By: David J. Freedman

Related Practice Area: Employment Employment Litigation and Immigration

The U.S. Supreme Court’s 2019-2020 term will feature two major sets of cases that will have significant consequences for employers.

One set of cases will decide whether federal anti-discrimination law prohibits employers from discriminating against employees based on sexual orientation or gender identity. The other will resolve whether President Donald Trump has the authority to end the Deferred Action for Childhood Arrivals, or DACA program, a major immigration controversy that has been simmering for years.

How Far Does Title VII Go?

Title VII of the Civil Rights Act is a federal law prohibiting companies of 15 or more employees from discriminating against those employees “because of . . . sex.” For decades after the law’s passage in 1964, courts uniformly refused to extend the law’s prohibition against sex discrimination to protect LGBTQ employees. That was not entirely surprising, since the U.S. Supreme Court in that era held that states could criminalize a broad range of homosexual activities, even between consenting adults. Over the past 20 years, however, the Court radically changed its stance regarding LGBTQ rights – first striking down anti-sodomy laws, then invalidating the Defense Against Marriage Act (which limited the definition of marriage to heterosexual couples for the purpose of federal benefits). The Court ultimately held that the U.S. Constitution prohibits states from refusing to recognize marriages involving same-sex couples.

In the wake of those decisions, the LGBTQ legal community has been aggressively seeking recognition that Title VII prohibits discrimination based on sexual orientation and gender identity. These efforts have yielded mixed – and somewhat bizarre – decisions. Some courts have continued to hold that Title VII does not prohibit LGBTQ discrimination because the term “sex” was not thought to include gender identity or homosexuality when Congress passed the law in 1964. Other courts have held that Title VII’s ban on discrimination because of “sex” protects both homosexual and transgender employees. Period, full stop. Yet other courts have held that while Title VII does not prohibit discrimination based on sexual orientation, it does prohibit discrimination on the basis of “gender stereotypes,” that is failure to comply with the stereotypical dress or behavior associated with an employee’s birth gender. The gender stereotype cases ended up providing discrimination protections for transgender employees and so-called “feminine” gay men and “masculine” lesbian women. But those decisions left bi-sexual employees without protection, and also did not address gay men and lesbians who comply with their respective gender stereotypes.

When different lower courts disagree about a matter of legal interpretation, the situation is ripe for the Supreme Court to weigh in. That happened on October 8, when the justices heard oral argument from lawyers on both sides in the cases of Zarda v. Altitude Express, Inc., a case examining whether Title VII protects gay employees, and EEOC v. R.G. & G.R. Harris Funeral Homes, Inc., a case to decide whether Title VII prohibits discrimination based on gender identity.

If the Supreme Court finds that Title VII covers either sexual orientation or gender identity discrimination, then that would likely open a floodgate of litigation claims. If instead the Court declines coverage to one or both groups, then LGBTQ civil rights could become a flashpoint cultural issue in the upcoming 2020 presidential election.

DACA in the Supreme Court

Immigration has been a hot topic in the national conversation ever since Donald Trump announced his presidential candidacy, and almost no topic has captured as much attention as DACA. Started by President Barack Obama, DACA has provided protection from deportation and employment authorization to more than 700,000 undocumented immigrants who were brought to the U.S. before they turned 15. DACA is not a visa program established through the Immigration and Nationality Act, although that law gives the president significant discretion in how to set priorities for enforcing immigration law. Studies show that approximately 11 million foreign nationals are present in the U.S. without legal authority, although the Department of Homeland Security and Department of Justice have capacity to deport only between 400,000 and 500,000 people each year. As a result, Obama issued an executive order establishing the DACA program as an exercise of his “prosecutorial discretion.”

In September 2017, former U.S. Attorney General Jeff Sessions announced that President Trump intended to end the DACA program. Immigrant rights groups sued to stop the administration, and those suits all around the country came to somewhat different results. The administration asked the Supreme Court to weigh in, and now the Court will have the final word. Oral argument in the case of Department of Homeland Security v. Regents of the University of California occurred on November 12.

Is DACA Illegal? Or Was Trump Wrong to Say it Was?

Again, President Obama implemented DACA through executive order. As a general principle, what one president does through executive order the next president may undo. The DACA case, however, has an unusual posture and actually hinges on application of the Administrative Procedure Act, a somewhat esoteric federal law that establishes the required procedure that agencies under the president’s purview must follow to change rules adopted by those agencies.

No one really disputes whether President Trump could have canceled DACA simply because he felt it was bad policy. But the administration did not frame its decision that way, at least not initially. Instead, the administration claimed that President Obama lacked the power to implement DACA in the first place.

By framing the issue that way, the administration may have unwittingly invited the Supreme Court to resolve the legal issue of whether President Obama had the power to implement DACA. That issue presents a far closer call than whether President Trump had the general authority to get rid of DACA because he thought it stands as poor immigration policy.

If the Supreme Court sides with the Trump administration, the case will have huge implications. The overwhelming majority of the more than 700,000 DACA recipients will lose their employment authorization. The Immigration and Nationality Act prohibits employers from knowingly employing unauthorized workers. So employers of DACA recipients may have to terminate employees if they do not have another form of work authorization.

That said, employers might commit a prohibited “unfair immigration-related employment practice” by preemptively terminating employees whom they know have DACA status. Employers should consult with their immigration counsel before taking actions regarding employees they know are employment-authorized through DACA.

The Court likely won’t hand down decisions in any of these cases until late June. Keep on the lookout for our employment law alerts regarding these significant decisions.

Third Circuit Reinforces Employer-Employee Interactive Process

By: Michael J. Crocenzi

Related Practice Area: Employment Employment Litigation

Pittsburgh Steelers’ coach Mike Tomlin is famous for saying that the “standard is the standard.” The catch-phrase reinforces his expectation that everyone must play at a high level regardless of their years of experience.

In a similar manner, some employers adopt and enforce stringent, inflexible policies with the implicit message that “the policy is the policy.” However, such an inflexibility concerning policies can cause significant legal problems for employers under the Americans with Disabilities Act.

In Matheis v. CSL Plasma Inc., a York County plasma center learned the hard way that an inflexible policy can cause legal problems. In the case, George Matheis, a retired police officer, was diagnosed with post-traumatic stress disorder. In an 11-month period, Matheis routinely and safely donated plasma at the plasma donation center. Matheis then received a service dog to help him manage his PTSD. The plasma donation center barred him from making any further donations when he brought his new service dog to the center because the center had a blanket policy that persons who use a service animal to manage anxiety are unsafe to donate plasma. Matheis sued and the case was ultimately decided by the U.S. Court of Appeals for the Third Circuit.

First, the court decided that the ADA applied to the plasma donation center because it is considered a public accommodation under Title III of the ADA. The plasma service center then had to prove that allowing the service dog would pose a direct threat to the health and safety of others or the animal was either out of control or not housebroken. Regarding the plasma center’s policy barring individuals from donating if they have a service animal, the Third Circuit held that “no medical justification or other scientific evidence undergirds [the plasma center’s] implicit conclusion that all these persons have ‘severe anxiety’ and will put staff, other donors, or themselves at risk when donating plasma.” The Third Circuit concluded that “[the plasma center] fails to explain why Matheis, who has managed his PTSD for nearly two decades and safely donated plasma roughly 90 times, should only be considered safe to donate when he renounces the new service animal that helps him better manage his PTSD.”

The Third Circuit continued its trend in 2019 of looking unfavorably upon inflexible policies and an employer’s refusal to engage in any interactive process under the ADA in Lewis v. University of Pennsylvania. In the case, an employee of the University of Pennsylvania’s police department suffered from a skin condition, pseudofolliculitis barbae (PFB). Because of his condition, it was painful for Lewis to shave. He asked Penn for an accommodation under the ADA not to shave his face or neck. The court held, “Penn was then on notice of Lewis’ claimed disability and the fact that he wanted accommodation, such that Penn had a duty to engage with Lewis in good faith. It is not clear that Penn did so. According to Lewis, Penn issued a flat denial without making any effort to communicate with him regarding his needs.”

Since Congress passed the ADA Amendments Act in 2008, the courts, especially the Third Circuit, have continued to put the responsibility on employers to determine if an employee needs an accommodation. Even under the Family Medical Leave Act, the Third Circuit has consistently held that an employer needs to take the initiative to obtain additional information from an employee. In regard to the interactive process, the Third Circuit in the Lewis case explained, “If it appears that the employee may need an accommodation but doesn’t know how to ask for it, the employer should do what it can to help. In short, an employee has no obligation to unilaterally identify and propose a reasonable accommodation.”

In another 2019 Third Circuit decision, Villagomez v. Kaolin Mushroom Farms Inc., the court said even with the FMLA, “Where the employer does not have sufficient information about the reason for an employee’s use of leave, the employer should inquire further of the employee … to ascertain whether leave is potentially FMLA-qualifying. Consequently, the regulations clearly contemplate scenarios where an employee may satisfy his notice obligation without providing enough detailed information for the employer to know if the FMLA actually applies.”

The bottom line is that while the “standard is the standard” can work for a professional football team, a “the policy is the policy” standard may not work for an employer when faced with an employee who is seeking an accommodation under the ADA or leave under the FMLA. Once an employer has sufficient information that an employee has a qualifying disability or health condition and is seeking an accommodation or leave, the employer has the responsibility to meet with the employee to begin the interactive process and determine if there should be any exception to a policy.

NLRB Skews Pro- Employer in 2019

By: Sarah C. Yerger

Related Practice Area: Employment Employment Litigation and Labor Law

The National Labor Relations Board has issued a series of significant pro-employer decisions in 2019.

Here is a look back at some of the biggest cases and issues the NLRB took on in the past year.

Access to Employer Property

The board overturned precedent and announced new rules about how employees and union organizers may talk in the workplace about union issues. Historically, union organizers have been permitted to come to public areas of an employer’s property, such as a cafeteria, to talk with employees about unionization, thereby creating the “public space exception.” They have also been able to communicate on the employer’s property in areas where other groups of nonemployees, such as the Salvation Army, have been allowed to solicit. In UPMC Presbyterian Shadyside, the NLRB was confronted with the findings that an employer committed unfair labor practices when it tossed out two union representatives from a cafeteria that was open to the public. The board announced that it would reverse all cases supporting this exception, and stated,

“(T)o the extent that Board law created a ‘public space’ exception that requires employers to permit nonemployees to engage in promotional or organizational activity in public cafeterias or restaurants absent evidence of inaccessibility or activity-based discrimination, we overrule those decisions.”

The board concluded that employers do not have a duty to allow the use of their facility by nonemployees for promotional or organization activity. The fact that a cafeteria located on the employer’s private property is open to the public does not mean that an employer must allow any nonemployee access for any purpose. Absent discrimination between nonemployee union representatives and other nonemployees, the employer may decide what types of activities it will allow by nonemployees on its property.

The NLRB also ruled that off-duty employees do not have a right to engage in organizing activity in nonwork areas of their workplace if their employer is a contractor at the workplace as opposed to the owner or holder of the property. This case involved off-duty orchestra musicians leafleting outside a concert hall where they spend 80% of their working hours.

In another case (Kroger Limited), the President Donald Trump-appointed board curtailed the ability of union organizers to leaflet and solicit on an employer’s property even when the employer had allowed the Salvation Army and the Girl Scouts to solicit for their organizations on the employer’s property. It has long been the law that an employer cannot discriminate against the union message if it allows distribution and solicitation on its property by other groups. But the board redefined “discrimination” in the narrowest possible way: Discrimination, in its definition, means giving one group access to the employer’s property for actions similar in nature to the union’s activities while denying access to another group for similar actions.” Because the union was soliciting signatures on a petition and the Salvation Army was soliciting money, the activities were not, in the board’s view, “similar in nature,” even though both activities involved solicitation.

Dues Collection

As union membership continues to decline, the NLRB delivered another blow to organized labor, limiting the ways it can spend dues collections from certain members. The latest ruling stems from Communications Workers of America v. Beck, where the U.S. Supreme Court held that workers subject to a union security clause may decline union membership. However, according to the ruling, the union may still legally charge nonmember objectors – “Beck objectors” – for representational activities “reasonably employed to implement or effectuate the duties of the union.”

Thirty years after Beck, the board in 2019’s United Nurses & Allied Professional (Kent Hospital) considered whether unions’ use of nonmember dues and fees to pay for its lobbying and political work violates its duty of fair representation. The NLRB ruled that unions violate workers’ rights by forcing nonmembers who opt out of the union to fund union lobbying activities because lobbying falls outside the union’s “representational function.” The NLRB further required that unions must independently audit financial information and verify to Beck objectors that their dues money is being spent on representational functions – activities related to collective bargaining, contract administration and grievance adjustment – rather than union lobbying or political activities. The bottom line for the NLRB is that lobbying isn’t part of the unions’ collective bargaining duties, so Beck objectors can’t be forced to help fund political lobbying.

Micro Bargaining Units

The controversial – and often confusing – “micro-units” of unions have caused headaches for employers because of a lack of definition from the NLRB. But this year, an NLRB ruling will help employers understand a micro-unit classification, and has laid out a test for the NLRB to determine whether something is a micro-unit or not. In this new process, to conclude that a proposed unit is appropriate, the NLRB must:

- Consider whether the proposed unit shares an internal community of interest

- If the employees share an internal community of interest, the NLRB must then comparatively analyze and weigh the interest of those within the proposed unit and the shared and distinct interests of those excluded from the unit

- Consider its prior decisions on appropriate units in the particular industry involved.

Using this three-step test, the NLRB reversed a regional director’s decision to allow a micro-unit of a union at the Boeing Company. In the case, the International Association of Machinists Union filed a petition seeking an election for a bargaining unit of about 178 employees out of a total workforce of over 2,700 employees. The NLRB’s regional director held that this petitioned-for unit, composed of only two classifications, was appropriate under the National Labor Relations Act. Following an election – which the union won – Boeing successfully appealed, arguing that the two classifications were not an appropriate bargaining unit because they shared a community of interests with its larger workforce. With the new process, the NLRB concluded the proposed unit at Boeing did not share an internal community of interest, and that it inappropriately excluded other employees with shared interests as they were stationed on the same production line as the petitioned-for classifications.

Misclassification

Misclassification of employees as independent contractors is a hot-button issue. In one case this year, the board reversed precedent to find that a group of 88 shuttle drivers at DFW International Airport in Texas are independent contractors not covered under the NLRA, giving them no federal right to form a union and bargain with their company over the terms and conditions of their work. The case led to a new test that concluded Uber drivers are independent contractors, not employees entitled to coverage under the NLRA.

Protected Concerted Activity

The NLRA protects concerted activity — one or more workers asserting a shared concern, on workplace issues, whether or not workers are engaged in the activity through a formal union. Workers are allowed to engage in advocacy around a workplace issue in a group or on behalf of a group, and an employer may not interfere with this activity or retaliate against workers engaged in this activity. The NLRB ruled in Alstate Maintenance, LLC that an airline skycap who protested about a lack of customer tips in front of co-workers and a supervisor was not engaged in protected concerted activity – meaning that it was legal for the company to fire the worker because of the protest activity.

Joint Employer

Two or more employers may “share or codetermine” workers’ pay, benefits or working conditions and be considered “joint employers,” meaning both employers have an obligation to bargain in good faith with the workers and can be held liable for violating workers’ rights. In Browning-Ferris, the NLRB updated its test for determining whether two employers are joint employers, and ruled that a recycling company was a joint employer with a staffing service that provided 80% of the line workers to the recycling company. The ruling meant that Browning-Ferris, which directly or indirectly controlled – or had the right to control – major aspects of the contract workers’ terms and conditions of employment, was required to engage in collective bargaining with the contract workers. The board attempted unsuccessfully to overrule Browning-Ferris and then decided to initiate proposed rulemaking on this issue (see 2019 Marks Big Year of NLRB Rulemaking).

2019 Marks Big Year of NLRB Rulemaking

By: Sarah C. Yerger

Related Practice Area: Employment Employment Litigation and Labor Law

While U.S. administrative agencies have often engaged in rulemaking procedures, the National Labor Relations Board has usually stayed on the sidelines.

But in 2019, the board was far more aggressive when it came to “notice and comment” rulemaking to implement policy and establish specific requirements under the laws it enforces. The board previously has stayed somewhat silent on rulemaking while other agencies, such as the U.S. Department of Labor, have issued numerous rules on employment matters.

In 2019, however, the NLRB found itself undertaking new rulemakings. Here are three highlights of their rulemaking year:

Joint-employer rulemaking

In 2018, the NLRB published a proposed rule to redefine the joint-employer standard under the National Labor Review Act. The NLRB, whose majority members were appointed by President Donald Trump, proposed a rule that would overturn a previous ruling and return the board to its earlier, narrower test for finding joint-employer status. This joint-employer rule proposes a clear and consistent four-part test – based on judicial precedent – to define the joint employment analysis on whether the potential joint employer actually exercises, whether directly or indirectly, the power to:

- Hire or fire the employee

- Supervise and control the employee’s work schedules or conditions of employment

- Determine the employee’s rate and method of payment

- Maintain the employee’s employment records

Election Rulemaking

The board has proposed three policy changes to its election procedure for union representation, which would give employees greater rights to choose union representation. The proposed rule, the “Election Protection Rule,” would amend regulations governing the filing and processing of petitions for secret ballot union elections, affecting three aspects of the rule:

- The effect of “blocking charges” filed by a union during a decertification election

- The election bar after an employer voluntarily recognizes a union

- The election bar after an employer in the building and construction industry voluntarily recognizes a union

President Trump-appointed NLRB Chairman John Ring said the board’s majority believes that the changes further the goal of protecting employees’ right to choose – or refrain from choosing – a labor organization to represent them. Changes in the proposed rule are not new, as they would adopt a pre-Obama era position on these issues.

Student Employees

The NLRB in September proposed a rule regarding students. Addressing a recurring question regarding the definition of “employee,” the proposed rule would view that students who perform services – including teaching and/or research – for compensation at a private college or university in connection with their studies are not “employees” under the NLRA. The basis for this proposed rule is that the relationship these students have with their school is predominately educational rather than economic. The NLRB is now seeking public comment on this proposal.

Maintenance of Membership Provisions Under Fire Post-Janus

By: David M. Walker

Related Practice Area: Employment Employment Litigation and Labor Law

Public sector employers and labor unions are still navigating the significance and fallout after the U.S. Supreme Court’s landmark 2018 decision in Janus v. AFSCME.

That decision forever changed union finances by confirming that non-union members cannot be forced to pay agency fees – the so-called “fair share” fees – for union representation. Such compelled fees, the Court held, violated the First Amendment rights of nonmembers of the union. The case has resulted in lower union membership rates, in turn reducing the dues those members would have paid and weakening unions around the country and in Pennsylvania.

As the post-Janus world entered 2019, its implementation began to struggle over a new target – maintenance of membership provisions. The classic maintenance of membership provision in a collective bargaining agreement is designed to compel union membership for a period of time other than a limited opt-out window. The rationale behind these provisions is the same as the rationale supporting fair share or agency fees in that people who receive the benefit of the union’s work should contribute, and that regular and stable union membership helps promote labor/ management peace.

Pennsylvania’s Public Employee Relations Act (Act 195), permits maintenance of membership provisions. Specifically, the act states that employees who have joined an employee organization, or who could join the organization in the future, must remain members through the term of the collective bargaining agreement and may only resign during a limited 15-day window prior to the expiration the agreement.

In application, this provision allows public sector unions to force individuals to continue their membership in the union – and to keep paying dues – until a very short, 15-day opt-out period at the end of the collective bargaining agreement.

As a natural outgrowth of Janus, union opponents are now asserting challenges to the permissibility and constitutionality of maintenance of membership provisions under Pennsylvania law. Most notably, such a challenge was filed in March in the U.S. District Court for the Middle District of Pennsylvania in Tammy C. Wessner v. AFSCME. In her complaint, Wessner specifically relied on Janus to argue that unions should not be able to force public employees to remain union members against their will, and that forcing a continued association with the union that required her continued financial support was illegal. Wessner essentially challenged the legality of maintenance of membership provisions under Act 195.

The legality of maintenance of membership provisions in Pennsylvania will not yet face judicial review as Wessner voluntarily dismissed her suit in September. It was noted that the case settled “to the mutual satisfaction” of the parties and that Wessner was no longer a member of AFSCME.

Act 195’s maintenance of membership provision was also the target of proposed legislative changes in 2019. Two bills proposed in the House – HB 506 and HB 624 of 2019 – suggested revisions to Act 195 that would either completely eliminate or severely limit the force of maintenance of membership provisions. Both bills remain pending in the House Labor and Industry Committee.

2019 Pennsylvania Workers’ Compensation Case Law Update

By: Joshua L. Schwartz

Related Practice Area: Employment Employment Litigation and Workers’ Compensation

Both 2017 and 2018 were a bit of a roller coaster for Pennsylvania workers’ compensation attorneys and their clients.

In 2017, the Pennsylvania Supreme Court declared the 20-year-old Impairment Rating Evaluation (IRE) system unconstitutional, and in 2018, the legislature passed Act 111, a revised IRE statute that attempted to address those constitutional concerns.

By comparison, 2019 was a quiet interlude. Act 111 has been implemented but no regulations have been passed, so its contours remain uncertain. Its constitutionality has also been challenged, but the cases continue to make their way through the courts, and the Pennsylvania Supreme Court has not yet spoken definitively. In fact, the state’s highest court made no major pronouncements in the workers’ compensation arena in 2019. While we expect significant developments in 2020 and 2021, this year saw relatively little movement.

Nonetheless, 2019 was not without its important workers’ compensation decisions on items such as employer’s payment obligations, the employment relationship and the course and scope of employment:

Erie Insurance Co. v. Workers’ Compensation Appeal Board (WCAB)

In February, the Pennsylvania Commonwealth Court held that an employer or carrier’s improper, unilateral withholding of payment, followed by payment made only following a judge’s order, will prevent later reimbursement from the supersedeas fund even if the expenses are ultimately deemed non-compensable.

The case began when an employee was injured in a motor vehicle accident, and the claim was initially accepted through a Notice of Compensation Payable (NCP). However, the employer then learned that the employee may have been intoxicated at the time of the incident, and intoxication is a complete defense to liability under the Workers’ Compensation Act. The employer/carrier filed a petition to set aside the NCP and unilaterally stopped paying the injured workers’ medical expenses. Though the judge ultimately agreed to set aside the NCP, the judge further granted a penalty petition filed by the employee, noting that the employer violated the act by cutting off payment without a judicial decision. The employer therefore had to pay the medical expenses, and the court held that the employer could not obtain reimbursement from the state’s supersedeas fund under these circumstances. The case highlights the employer’s ongoing obligation to pay all medical and wage loss expenses pending the outcome of litigation, as the employer clearly would have been able to seek reimbursement from the supersedeas fund if it had not unilaterally stopped payment.

Burrell v. Streamlight

Applying “the borrowed servant” doctrine, the Pennsylvania Superior Court held that an injured worker was an employee not of the temporary services agency that hired him and paid wages but, instead, of the manufacturing company where he was assigned. The court reasoned that the manufacturing company supervised and had the “right to control” the day to day work the employee performed. Therefore, the company was immune from a personal injury lawsuit brought by the injured worker. Of particular importance was that the temp agency had no supervisors on site, so all tasks were assigned directly by the manufacturing company to the employees. The case arguably creates an incentive for companies using temp agencies to take a more active role in supervising those temporary employees, as those employees will be prevented from bringing negligence claims.

Peters v. WCAB (Cintas Corp.)

Decided in July, the case explored the limits of the “traveling employee” doctrine in the context of a social gathering with coworkers. The employee was a traveling sales representative who attended a celebration with coworkers at a bar after his work duties had been completed. On his way home, he was involved in a motor vehicle accident and sustained injuries. As a general matter, traveling employees are presumed to be “in the course and scope of [their] employment when traveling to and from work,” unless an employer can show “abandonment.” And in prior cases, courts have found injuries to be compensable where employees have finished their shift, engaged in a social activity, and then suffered injury on the commute home. However, in this case, the court held that the employee had abandoned his employment because the social gathering was not on his way home, but past his home. “Claimant clearly had the option of avoiding any hazards simply by choosing to take the exit home as opposed to bypassing his exit to attend happy hour,” the court explained. Since the bar was not part of his normal route home, the court held that his injuries later were not in the course and scope of his employment.

The attorneys at Barley Snyder regularly consult with employers to determine workers’ compensation management, return to work programs, retention of experts, settlement, and other strategies for limiting workers’ compensation exposure. If you have questions or concerns regarding your options under the workers’ compensation act, do not hesitate to call legal counsel.

Is Litigation the Answer for Your Business Immigration Needs?

By: David J. Freedman

Related Practice Area: Employment Employment Litigation and Immigration

You’ve watched the news. You’ve heard all about it: the Wall, family separations, the travel ban. Immigration is arguably the Trump administration’s most controversial area of federal regulatory policy. These disputes tend to focus on the human rights of the displaced and indigent. What’s getting less press is what is happening to American businesses that are trying to hire talented foreign nationals to augment their workforces in the midst of what is one of the tightest labor markets in recent memory. How are these businesses faring in their efforts to hire more engineers, physicians, nurses, computer programmers and highly skilled workers?

Not well.

U.S. Citizenship and Immigration Services (USCIS), a sub-agency of the federal Department of Homeland Security, has implemented ad hoc legal standards and heightened evidentiary requirements for H-1B visa applications. The H-1B visa is a temporary visa issued to workers in occupations that require a bachelor degree or higher. Congress created this visa class principally to create a path to U.S. employment for foreign students who graduate from U.S. institutions of higher learning in the fields of science, technology, engineering, and math. USCIS, however, is now of the opinion that entry-level employees are not eligible for H-1B visas.

The L-1 visa is a useful tool for multinational corporations to shift managers, executives, and employees with highly specialized knowledge to U.S. branches and affiliates for five-to-seven years. USCIS, though, has been enforcing restrictive definitions and issuing onerous requests for additional evidence, making it take longer and cost more money to obtain these visas.

Other across-the-board changes in the employment-based immigration system are causing headaches for high-tech start-ups and multinational corporations. In years past, Homeland Security quickly approved visa renewal applications by deferring to the original approval decision if the foreign employee was renewing in the same visa classification. But a 2017 change in the process means renewal applications are now treated exactly like the first-round visa application. That means employers must spend more time assembling evidence and must pay more money to immigration attorneys arguing on their behalf.

Moreover, most of these policy changes have not gone through the process normally required for executive agencies to change their rules.

If these policy changes weren’t enough, employers must also contend with absurd processing delays. Foreign nationals looking to change from employment-based temporary visas to legal permanent residency must go through a process called “adjustment of status.” In the past, that usually did not involve an in-person interview with an immigration officer. USCIS had determined that employment-based visa applicants pose very little danger of engaging in drug trafficking or terrorism. As a result, USCIS would only personally interview approximately 10% of all employment-based adjustment of status applicants. Two years ago, though, USCIS changed that policy and now requires in-person interviews of all such applicants. That has caused major application backlogs in all visa categories and for employees seeking employment authorization related to their visa status.

Obviously, these changes make the immigration process much more complicated, difficult, and expensive. Is there anything employers can do about it?

Yes, they can sue. Litigation is the only effective way to stop existing and anticipated new policies designed to restrict legal immigration. Litigation is the best, and in many cases only, way to overturn unjustified visa denials and fundamentally change the way USCIS adjudicates visa applications and petitions for immigration benefits.

Federal laws, such as the Administrative Procedure Act and the Mandamus Act, provide businesses with powerful tools to challenge unfair decisions and unreasonable delays. Moreover, another law – the Equal Access to Justice Act – sometimes requires the government to pay the attorneys’ fees that businesses spend successfully challenging unreasonable decisions and delays. Immigration litigation also usually implicates only matters of legal interpretation. The cases rarely involve disputes over facts. As a result, the cases are usually confined to the materials submitted to USCIS during the visa application process. On top of all that, immigration litigation takes place exclusively in federal courts, which impose fairly strict time constraints on litigating parties. All of these factors tend to make immigration litigation cases proceed at a quicker pace than other forms of litigation.

No business relishes taking on the costs associated with going to court. American businesses, however, have allies willing to assist in managing legal costs. Both the American Immigration Lawyers Association and the American Immigration Council have recently launched initiatives seeking to litigate cases on behalf of businesses harmed by USCIS’s policy changes. These organizations are well positioned to help, perhaps even on a “low bono” basis.

Businesses that rely upon high-skill workers from other countries should understand that litigation could be a viable option for cutting through delays and fighting unjustified visa denials. The process is significantly less expensive and more streamlined than other forms of litigation. Although litigating immigration cases is a less-than-perfect option, it may be employers’ best option right now.

Is a litigation challenge the right option for your business? The attorneys in Barley Snyder’s Immigration Group are experienced and have been successful in both pursuing employment-based immigration benefits from USCIS and federal court litigation. We can help you determine whether litigating an immigration case is a viable option. If your business is considering litigating an immigration case, feel free to contact me at dfreedman@barley.com.

Ongoing ERISA Litigation Highlights Need for Enhanced Fiduciary Awareness

By: Mark A. Smith

Related Practice Area: Employment Employee Benefits

In this era of ever-increasing IRS and U.S. Department of Labor scrutiny and private litigation involving employee benefit plans of all types, it is crucially important that employers, executives, managers, corporate directors and others with benefit plan responsibilities understand their roles and duties in relation to such plans.

If they don’t, they could face grave consequences not just for their business, but personally as well.

Not only are plan sponsors, including businesses and tax-exempt organizations, increasingly the targets of regulatory enforcement actions and lawsuits, but various individuals involved in the implementation and administration of benefit plans are, with growing frequency, also held personally liable for errors and omissions that adversely impact plan participants and beneficiaries.

Plaintiffs’ lawyers continue to look for opportunities to launch ERISA fiduciary class action suits and the pace of ERISA fiduciary litigation is likely to keep accelerating. Recent cases highlight the scope of potential damages related to ERISA fiduciary lawsuits. Just a few examples of the common situations that can lead to such liabilities include an insufficiently rigorous process for selecting and then monitoring investment choices offered under a participant-directed retirement plan, a failure to offer COBRA continuation coverage to a former employee’s dependent under a group health care plan, and the distribution of a pension account to a plan participant without the prior written consent of the participant’s spouse.

Plan administration errors such as these arise in innumerable contexts under benefit plans of every stripe. Whether an entity or individual may be held liable for the potential harm suffered by a plan participant or beneficiary when an error occurs will often hinge on the party’s status as a plan fiduciary with responsibility for the action involved. Liability may be imposed for violations of the laws and principles governing fiduciary conduct whether deliberately or inadvertently committed. Therefore, it is imperative to understand who the plan’s fiduciaries are, the scope of each fiduciary’s responsibilities with respect to the plan and the specific duties each fiduciary must observe and perform.

Are You a Fiduciary?

The provision by non-governmental employers of retirement benefits and most employee welfare benefits such as health care, disability coverage, and life insurance, is regulated under the federal Employee Retirement Income Security Act of 1974 (ERISA). Under ERISA, fiduciary status is based upon the functions a person performs with respect to an employee benefit plan. Fiduciary status usually begins with the person or entity identified in the plan’s governing documents as the plan administrator and, where a plan trust is established, the trustee.

But beyond the plan administrator and trustee, any number of additional plan fiduciaries may exist, including every person who exercises discretionary authority or control over management of the plan or of its assets, or who has any discretionary authority or responsibility in the plan’s administration. ERISA also specifically includes as a fiduciary any person who renders investment advice for a fee or other compensation, direct or indirect, with respect to the assets of a plan, or has any authority or responsibility to do so. This investment advisor fiduciary definition, which until now has been interpreted narrowly to include only providers of advice that is both regular and serves as the primary basis of investment decision-making, is currently being reworked by the Department of Labor. The revised regulatory standards are expected to significantly expand the class of investment advisors deemed to be ERISA fiduciaries by eliminating the “regular” and “primary” requirements. That potentially includes many brokers, insurance representatives and others not presently considered fiduciaries under ERISA.

The individual members of a committee that are assigned or that exercises fiduciary responsibilities relative to an employee benefit plan are themselves each fiduciaries to the plan. A retirement plan’s fiduciaries, for example, will include all members of any committee involved in deciding the plan’s investment policy. Officers and corporate directors may be plan fiduciaries, as will other parties acting under a delegation of discretionary authority from a plan fiduciary. In short, a person’s designation from the company in regards to the plan doesn’t matter. All that matters is if that person fits ERISA’s functional definition for “fiduciary.”

Regulation of Fiduciaries

With the passage of ERISA, Congress established various protections for employee benefit plan participants. These protections include standards of conduct that must be adhered to by plan fiduciaries, as well as specific fiduciary responsibilities for the detailed reporting and disclosure to plan participants and governmental agencies concerning plan provisions, administration and funding. The Department of Labor has recently finalized detailed participant disclosure regulations relating to investment fees, which have been applicable to defined contribution retirement plan fiduciaries since ERISA fiduciaries are subject to a strict duty of loyalty. That duty requires them to act solely in the interests of plan participants and beneficiaries for the exclusive purpose of providing benefits to them. It also includes defraying reasonable expenses of administering the plan. In addition, ERISA requires that a fiduciary must act “with the care, skill, prudence and diligence under the circumstances then prevailing that a prudent man acting in a like capacity and familiar with such matters would use in the conduct of an enterprise of like character and with like aims.” This standard of care to which ERISA fiduciaries are held is characterized by the courts as “the highest known to the law.”

These generally stated standards of conduct for ERISA fiduciaries are supplemented by specific “prohibited transaction” rules, which dictate that a fiduciary may not cause the plan to engage in various dealings between the plan and any “party in interest” to the plan. Parties in interest could include:

- Plan fiduciaries

- Persons providing services to the plan

- An employer of covered employees

- A union whose members are plan participants

- Relatives of parties in interest

- Individuals or corporations having an ownership or employment relationship with a party in interest

Fiduciaries are subject to additional prohibitions against self-dealing and engaging in transactions involving potential conflicts of interest on the part of the fiduciary.

There are exemptions from the prohibited transaction rules. Service providers can administer changes necessary to the plan’s establishment or operation under a contract or arrangement that is “reasonable” and that appropriately limits the compensation the service provider receives. In the retirement plan context, fiduciary failures to assure the reasonableness of fees paid for investment management, brokerage and recordkeeping services have resulted in litigation, and sometimes judgments, against the responsible fiduciaries. Other prohibited transaction exemptions permit a plan fiduciary to concurrently participate in the plan on a basis consistent with the terms of the plan as applied to all other participants. Additional prohibited transaction exemptions are enumerated in ERISA and individual exemptions may be granted by the Department of Labor upon request. The requests are subject to certain conditions, including that the exemption is in the interests of the plan and of the plan’s participants and beneficiaries.

Principles for Minimizing Fiduciary Liability Risk

An ERISA fiduciary in violation of these duties may be held personally liable for compensating the plan and for restoring losses suffered by affected participants. Fiduciaries may also be assessed civil penalties and excise taxes in connection with prohibited transactions. To guard against such risks, fiduciaries must understand and fulfill their responsibilities and plan sponsors must proactively implement processes to ensure that plan fiduciaries comply with the duties the law imposes. Individual employees of plan sponsors who are serving in ERISA fiduciary roles should take the step to assure their employer will indemnify them in the event they are found liable for a fiduciary breach, and also assure themselves that the plan sponsor has fiduciary liability insurance is in place that covers them while serving in an ERISA fiduciary role. Also, qualified counsel should be consulted regarding a “fiduciary check-up” to help identify and avert potential problems.

Strict adherence to the following 10 principles will assist in avoiding ERISA-imposed liability for fiduciary misconduct:

1. Follow the terms of the plan documents.

2. Understand the distinction between corporate decisions and plan fiduciary decisions.

3. Be able to articulate a reasoned basis for plan decisions. Don’t be arbitrary or inconsistent.

4. Where there is discretion to be exercised, or a “gray” area to be decided, be consistent from case to case.

5. Be aware of, and adhere to, a schedule for reviewing plan investments.

6. Hold regular meetings and maintain complete and accurate minutes.

7. Be clear, complete and timely in communicating with participants and beneficiaries, and in meeting governmental filing requirements.

8. Be fully aware of the plan’s investment policy and scrupulously adhere to the investment guidelines.

9. Where plan administrative and fiduciary roles have been delegated to others, monitor their performance on an ongoing basis to assure that they are meeting the responsibilities they have assumed.

10. Manage fiduciary liability risk with appropriate indemnification and liability insurance protections.

2019 Employment Litigation Victories

By: David J. Freedman, Joshua J. Knapp, Jill Sebest Welch, David M. Walker, Michael J. Crocenzi, Sarah C. Yerger and Erica R. Townes

Related Practice Area: Employment Employment Litigation and Labor Law

Michael Crocenzi successfully defended a regional architectural and engineering company in federal court. A former employee of the company sued claiming violations of the Americans with Disabilities Act, the Family and Medical Leave Act, the Genetic Information Nondiscrimination Act, the Pennsylvania Human Relations Act and Title VII (sex discrimination). Mike successfully convinced the federal judge that there was no basis for these multiple claims and the judge dismissed the case before trial.

Michael Crocenzi won an appeal with the Superior Court affirming a hard-won trial verdict for a regional technology company. In 2018, Mike successfully defended the company after a five-day trial in which two former executives were seeking almost $11 million in damages related to their termination. After losing at trial, the two appealed the verdict to the Pennsylvania Superior Court. Mike once again successfully defended the company on appeal and convinced the Superior Court to reject the former employees’ arguments, thus preserving the jury’s verdict in favor of the company.

After a two-day hearing, an arbitrator agreed with Michael Crocenzi’s argument that a former CEO of a technology company and subsidiary of a central Pennsylvania bank must pay back his ownership stake in the company after he departed. Officials from the technology company predicted that the opposite decision from the arbitrator would have been disastrous to the company.

Joshua Knapp successfully represented a full-service drilling contractor and several of its employees on appeal before the Superior Court of Pennsylvania in a non-competition and misappropriation of trade secrets case brought by the employees’ former employer. The Superior Court of Pennsylvania affirmed the trial court’s complete denial of preliminary injunctive relief, noting that the case presented a factually and procedurally complex history and concerned the interaction between contractual restrictive covenants and relevant provisions of the Pennsylvania Uniform Trade Secrets Act. At the trial court level, Joshua first obtained the denial of emergency injunctive relief, then the complete denial of preliminary injunctive relief after extensive discovery and evidentiary hearing.

Jill Welch successfully secured a preliminary injunction for a medical supply manufacturer seeking to enforce a non-compete, non-solicitation and confidentiality agreement in the York County Court of Common Pleas against a former national sales director working for a competitor.

Sarah Yerger successfully helped orchestrate a company’s anti-union campaign that led to a resounding 27-4 employee vote against organizing, with many employees not voting. The campaign started in October with regular informational meetings and mailings and ended with the vote in December.

David Freedman teamed with Erica Townes to convince the York County Court of Common Pleas to reject a former employee’s request for a preliminary injunction that would have permitted our client’s former employee, a neurosurgeon, to work for a competing health care system in violation of the neurosurgeon’s non-competition agreement with our client.

David Freedman also teamed with David Walker to convince the Adams County Court of Common Pleas to enter a permanent injunction preventing an endocrinologist formerly employed by our client from setting up a nearby competing practice. The endocrinologist appealed the decision to the Pennsylvania Superior Court, but the Superior Court dismissed the appeal.