TABLE OF CONTENTS

Message from our Employment Practice Group Chair

Crisis Management Service Team

A Look Back at Our 2020 Employment Practice Group Client Alerts

Multi-State Employers Need to Be Aware of State-Specific Laws

NLRB 2021 Predictions

SCOTUS Ends Blockbuster 2020 for Employment Law

More Updates on the DOL’s Joint Employer Rule

Employment Law 2020 Year in Review

Message from our Employment Practice Group Chair

By: Jill Sebest Welch

Related Practice Area: Employment Employee Benefits, Employment Litigation and Labor Law

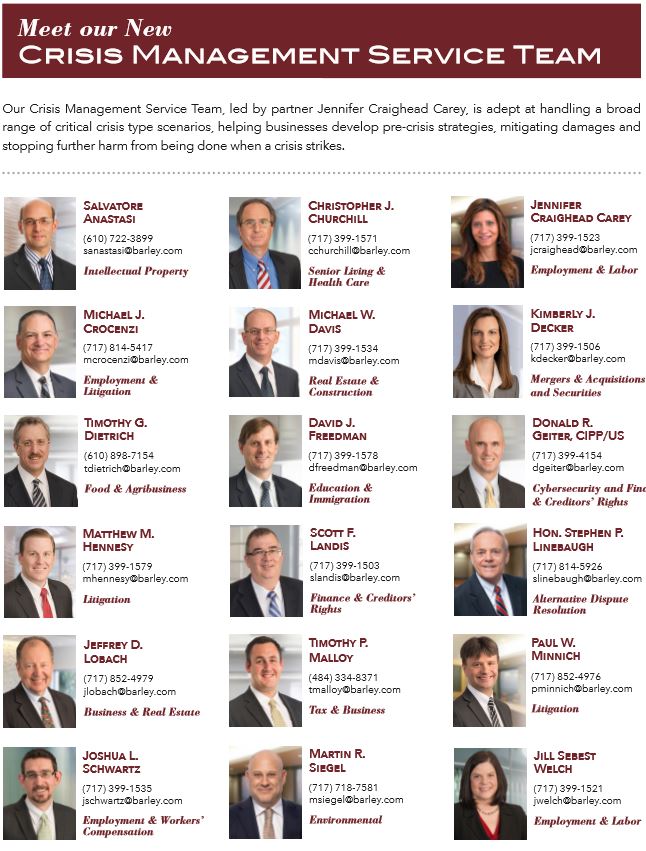

Crisis Management Service Team

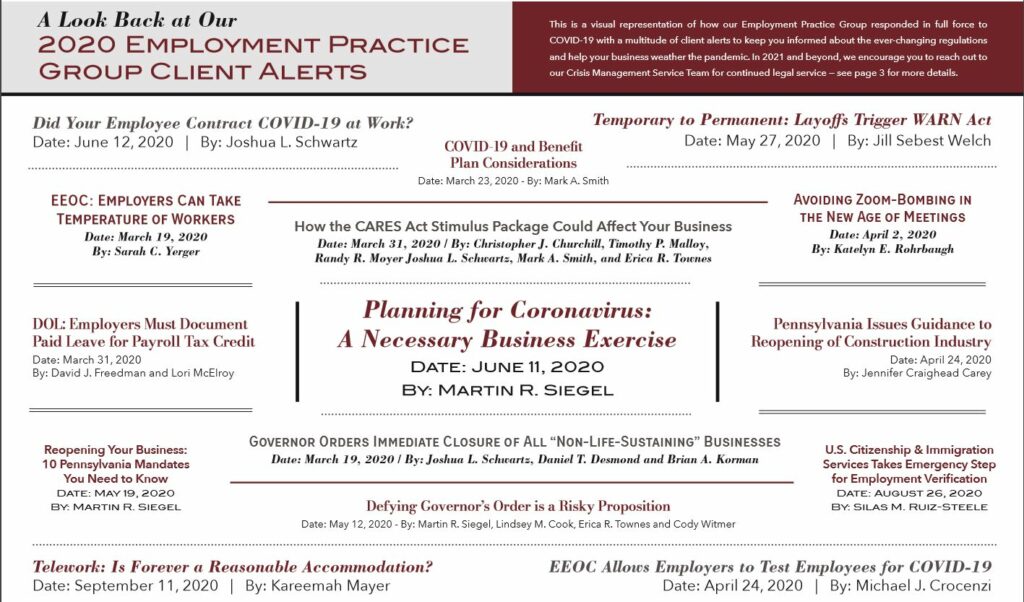

A Look Back at Our 2020 Employment Practice Group Client Alerts

Related Practice Area: Employment Employee Benefits, Employment Litigation and Labor Law

Multi-State Employers Need to Be Aware of State-Specific Laws

By: Michael J. Crocenzi

Related Practice Area: Employment Employment Litigation

With the accelerating trend of employees working fulltime from home because of the coronavirus pandemic, employers must be acutely aware that state-specific employment laws may apply to a small number of employees – or even one employee – that may work in another state.

In the absence of any significant employment initiatives from the federal government, many states and municipalities are passing state-specific laws that apply to employees working in that state. Several states have now passed paid sick leave statutes and sexual harassment/ training statutes, and many of these states even require employers to include disclaimers and other information in handbooks that would apply to employees working in that particular state.

Service-oriented employers especially are now hiring professionals in states other than the state of the company’s headquarters. An accounting firm may have its headquarters in Pennsylvania and most of its employees work at headquarters, but the firm may have accountants working from home full-time in other states, such as California, New Jersey, Florida, etc. In this situation, the accounting firm cannot automatically assume that Pennsylvania law will apply to the employees working full-time from home in other states. California’s Healthy Workplaces/Healthy Families Act of 2014, as an example, applies to all employees who have worked in California for 30 or more days. It does not matter that the employer’s headquarters or main office is located in another state. According to that law, paid sick leave accrues at the rate of one hour per every 30 hours of work at the employee’s regular wage rate. Employees can carry over a certain number of hours or days to the next year. An employee may use accrued paid sick days beginning on the 90th day of employment.

Several states have recently passed laws banning or severely restricting non-compete agreements. The non-compete agreements usually contain a “choice of law” provision indicating that a particular state’s law will be used to interpret the agreement. However, some courts have applied a choice of law analysis to determine what state law applies. In California, most non-compete agreements are banned. Some employers who have an employee working in California have tried to avoid California’s law by stating in the agreement that another state’s law should control – a state that does not ban or restrict non-compete agreements. In applying a choice of law analysis, some courts have determined that California has the most contacts with the employee working in California and refused to enforce the non-compete.

Even municipalities, such as Philadelphia, Pittsburgh, New York City and Minneapolis, now have paid sick leave ordinances that apply to employees working in those cities.

Employers must be diligent in reviewing state laws and even local municipality laws to determine if the laws apply to their employees working in that particular state. Employers should avoid being caught off-guard by failing to comply with out-of-state employment related laws, which can create a compliance nightmare and catch unsuspecting employers in a legal quagmire.

If you need any additional information about your obligation as a multi-state employer, please contact me.

NLRB 2021 Predictions

By: Sarah C. Yerger

Related Practice Area: Employment Labor Law

The last four years at the National Labor Relations Board proved employer-friendly, but a Democrat in the White House could change all of that.

Under Former President Donald Trump’s presidency, much of the Obama-era NLRB employee and union protections were dialed back significantly, not just by NLRB decisions but through memos from Trump’s appointed NLRB General Counsel Peter Robb and with the rulemaking process.

The Biden campaign ran on a platform of strengthening worker organizing and worker rights, particularly through the collective bargaining process. The president-elect can appoint key positions at the NLRB, including board members and the general counsel, and can affect policy change through these positions.

Here are some 2021 predictions for the NLRB:

Biden Will Appoint a Majority on the Board and Start to Reverse Trump Board Decisions

By the end of 2021, Biden will be able to appoint a majority of NLRB members, likely resulting in the overruling of many of the precedents issued during the past few years. Board members are appointed, with Senate consent, by the president to five-year terms. One member term expires each year. Currently, there are only four board members – three Republicans, and one Democrat – with one vacant position. Biden will likely appoint a Democrat to the vacant position and then in August of 2021 when Republican William Emmanuel’s terms expires, he will be able to appoint a third member and regain majority control. Once there is a Democratic majority, we will begin to see policy reversals, most likely sometime in 2022.

Biden Will Support Worker-Friendly Legislation but Will Not Have Senate Support to Create Law

Biden has expressed strong support for the Protecting the Right to Organize Act, which would significantly change the union/ employer dynamic in favor of unions.

The act would:

- Ban employer-mandatory “captive audience” group meetings

- Require immediate collective bargaining shortly after a successful union election and if no agreement is reached, require binding interest arbitration of contract terms • Override states’ right-to-work laws

- Allow unfair labor practice claims to be brought as civil actions in court

- Add fines and liquidated damages as remedies for unfair labor practices

Biden also pledged to reinstate and codify into law the Obama administration’s “persuader rule” requiring employers to report not only information communicated to employees, but also the activities of third-party consultants who work behind the scenes to manage employers’ anti-union campaigns and the Obama era’s NLRB rules allowing for shortened timelines of union election campaigns. As a senator, Biden co-sponsored the original Employee Free Choice Act, which allowed workers to form a union if a majority signs authorization cards empowering a union to represent them.

Bottom line, it’s going to be an active and busy four years at the NLRB. If you have any questions on how this could affect your business, please contact me.

SCOTUS Ends Blockbuster 2020 for Employment Law

By: David J. Freedman

Related Practice Area: Employment Immigration

The U.S. Supreme Court issued major employment law decisions during its 2019-20 term on subjects ranging from LGBTQ discrimination to immigration to religious exemptions to federal antidiscrimination laws.

Sexual Discrimination

In a landmark ruling, the Court held, by a 6-3 vote, that Title VII of the Civil Rights Act prohibits discrimination against employees based on sexual orientation or gender identity. Title VII is the federal law that prohibits discrimination “because of sex.” Justice Neil Gorsuch, who was appointed to the Court by Former President Donald Trump, authored the majority opinion, which found that discrimination against LGBTQ employees constitutes discrimination “because of sex” prohibited by Title VII.

Although the decision finally puts to rest whether LGBTQ employees are entitled to federal anti-discrimination protections, other contentious issues remain unresolved, such as whether employers must allow transgender employees to use the restroom associated with their gender identities or whether employers are immune to Title VII liability if they harbor sincere religious objections to homosexuality. Those issues will have to be decided in future cases.

Ministerial Exemption

A separate ruling regarding the “ministerial exemption” suggests that a majority of the court’s current justices might be highly deferential to employers’ religious beliefs. The ministerial exemption, derived from the religious liberty protections found in the First Amendment to the U.S. Constitution, prohibits courts from deciding many employment disputes brought by employees of churches and other religious institutions. The doctrine obtained its name because most of the early cases involved challenges by terminated ministers against the churches that had once employed them.

In its most recent case involving this doctrine, Our Lady of Guadalupe v. Morrisey-Berru, the Court clarified that the ministerial exemption doesn’t just apply to ministers. Instead, the exemption prohibits federal courts from entertaining employment discrimination suits brought by many different employees of religious institutions. The decision arose from two separate cases in which schoolteachers at private Catholic schools in Los Angeles lost their jobs and sued their employers. One of the employees claimed that the school that employed her had discriminated against her based on her disability in violation of the Americans with Disabilities Act. The other employee sued claiming that her employer’s decision to fire her violated the Age Discrimination in Employment Act. The schools asked the federal courts to throw the cases out at their outset, arguing that the ministerial exemption prohibited the courts from hearing the cases. The employees, though, claimed that the exemption did not apply to them because they were not ministers; in fact, they mostly taught secular subjects.

The Supreme Court, however, in a 7-2 decision, adopted the schools’ arguments, finding that the ministerial exemption extends to any employee “who leads a religious organization, conducts worship services or important religious ceremonies or rituals, or serves as a messenger or teacher of its faith.” Moreover, the Supreme Court instructed lower courts evaluating whether the ministerial exemption applies that they must defer to religious employers’ explanation of the employees’ role in the religious tradition.

Although the employees mostly taught secular subjects, the Court held that could not override the schools’ views regarding the role these employees played in religious education, which included leading students in prayer. Writing for the Court’s majority, Justice Samuel Alito stated, “What matters, at bottom, is what an employee does. And . . . educating young people in their faith, inculcating its teaching, and training them to live their faith are responsibilities that lie at the very core of the mission of a private religious school.”

The Court’s deferential stance toward religious institutions’ views of which employees play a religious role could significantly affect the viability of lawsuits against religiously affiliated employers, such as many colleges, universities, and healthcare institutions.

DACA Program

In another major ruling, the Supreme Court invalidated Former President Trump’s attempt to eliminate the Deferred Action for Childhood Arrivals, or DACA, program. The U.S. Department of Homeland Security, under former President Barack Obama, had implemented the DACA program, which provides protection from deportation and employment authorization to individuals who entered the U.S. without legal authorization before their 15th birthday, provided such individuals undergo biometric screening and satisfy other criteria, such as enrolling in school or enlisting in the U.S. military. After Trump’s inauguration in 2017, the Department of Homeland Security announced that the program would be shut down. Many legal challenges ensued, with the matter ending up before the U.S. Supreme Court this past year.

In a 5-4 decision, the Court held that the attempt to rescind DACA violated the Administrative Procedure Act, a federal law that lays out how the president and federal executive agencies may adopt legally binding regulations. The Trump administration justified rescinding DACA by arguing that the program violated restrictions in the Immigration and Nationality Act regarding the circumstances under which foreign nationals may be authorized to work legally in the U.S. The Court’s majority, however, found that the administration failed to consider adequately the effects that removing deportation protections would have on the almost 800,000 DACA recipients. In Chief Justice Roberts’ words, “DACA recipients have enrolled in degree programs, embarked on careers, started businesses, purchased homes, and even married and had children, all in reliance on the DACA program.” The administration, therefore, would have to start the process of rescinding DACA over again.

A lot has changed since the Court’s decision this past summer. Most notably, former Vice President Joe Biden defeated Trump in the presidential election. President Biden has vowed to keep DACA in place. So DACA appears safe for the time being. That said, DACA’s fate might end up before the Supreme Court again, this time addressing whether the Obama administration had the legal authority to adopt the program in the first place.

If you have any questions about these cases and how they might affect your business, please contact me.

More Updates on the DOL’s Joint Employer Rule

By: Jill Sebest Welch

Related Practice Area: Employment Labor Law

In an example of how quickly laws and rules can change, we provided an update at our August Employment Law Seminar on the U.S. Department of Labor’s Final Joint Employer Rule, which took effect in April 2020. However, in September, a New York federal court vacated the four-factor vertical joint employer test implemented in April, declaring it impermissibly narrow, inconsistent with the DOL’s prior interpretive guidance and the significant body of federal case law interpreting the joint employer factors, and in contradiction with the Fair Labor Standards Act.

In November, the DOL appealed the decision to the U.S. Second Circuit Court of Appeals and businesses face uncertainty in this area once again.

In August, we explained that in vertical employment scenarios — such as franchisor-franchisee, as well as general contractor-subcontractor and employer-temporary staffing relationships — the DOL adopted an employer-friendly, four-factor test to determine whether two seemingly separate business entities would be joint employers, and both liable for employment claims.

In determining whether both companies directly or indirectly control the employees, the DOL rule looks to whether the company:

- Hires or fires the employee

- Supervises and controls the employee’s work schedule or conditions of employment to a substantial degree

- Determines the employee’s rate and method of payment

- Maintains the employee’s employment records

In its final rule, the DOL intended to provide clarity to the joint employer factors amidst varying appellate court interpretations. But then the New York district court upended this clarity by vacating the four-pronged test, and the Biden Administration may not defend the rule on appeal.

Now, in joint employer cases, courts will apply not only the four-factor test, but also other relevant factors of direct and indirect control, to determine whether a business is the joint employer of its contractor’s employees.

Thus, employers should once again carefully review their contracts with third parties, as well as the actual working conditions of the workers performing under these contracts, to determine the potential risk of a being bound in a joint employer relationship. If so, companies should ensure the wage and hour practices of these third parties comply with the FLSA and state wage and hour laws. Companies should also consider including safeguards in their contracts, such as representations and warranties with respect to wage and hour law compliance, and indemnification provisions, to mitigate risk associated with joint employer liability.

If you have any questions on how this could affect your business, please contact me.

Employment Law 2020 Year in Review

Click here to view “Employment Law 2020 Year in Review” e-reader