TABLE OF CONTENTS

Employment Law 2021 Year in Review

Message from our Employment Practice Group Chair

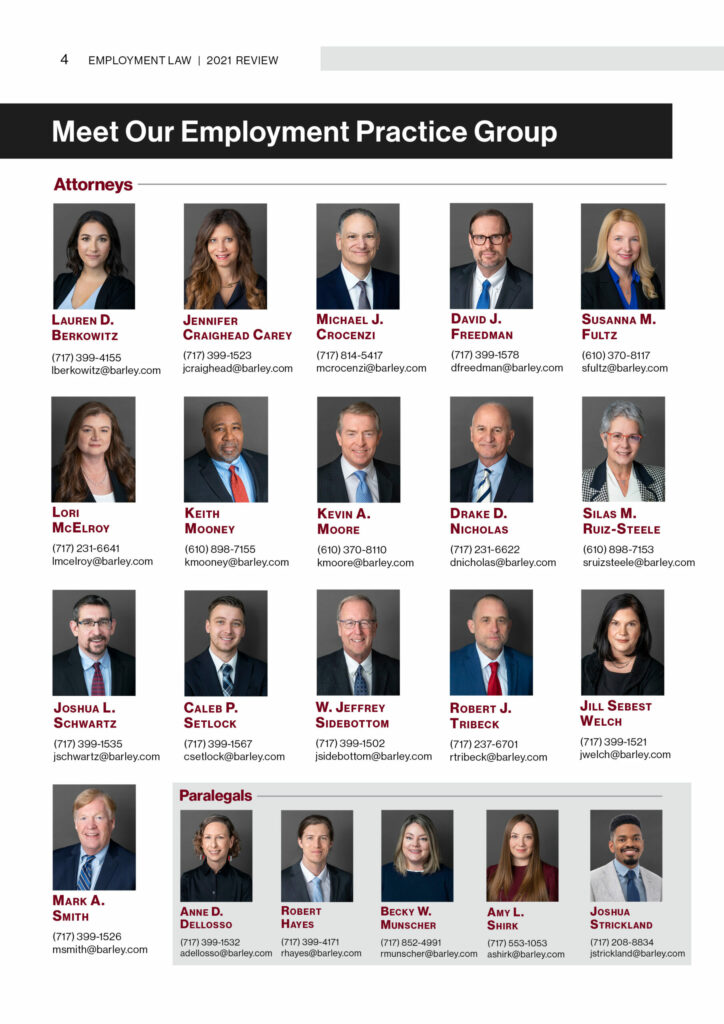

Meet Our Employment Practice Group

Federal Vaccine Mandates: Legal or Illegal?

Legal Implications of the “Great Resignation”

U.S. Department of Labor Wage and Hour Initiatives Now Favoring Employees

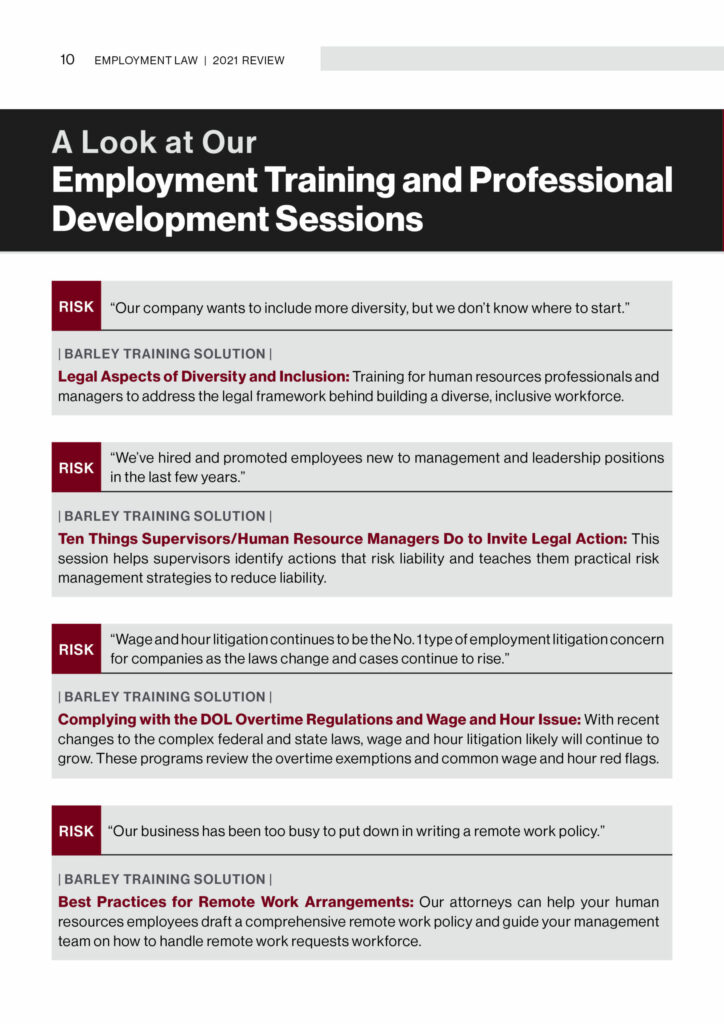

A Look at Our Employment Training and Professional Development Sessions

Pennsylvania’s Wage and Hour Regulations and More Changes from 2021

NLRB in 2021: Employee-Friendly Once Again

U.S. Immigration: 2021 Year in Review

Have You Updated Your Health and Welfare Benefit Plans?

Employment Law 2021 Year In Review

Click here to view “Employment Law 2021 Year in Review” e-reader

Message from our Employment Practice Group Chair

By: Jill Sebest Welch

Meet Our Employment Practice Group

Federal Vaccine Mandates: Legal or Illegal?

By: Jennifer Craighead Carey

As employers continued to ride the rollercoaster of the COVID-19 pandemic, many struggled with whether to mandate the vaccine. That decision seemed to be decided for most employers when President Joe Biden’s administration issued multiple federal vaccine mandates only to have those mandates face legal challenges, calling into question their enforceability moving forward.

At the start of 2022, the U.S. Supreme Court offered more clarity by allowing one vaccine mandate and ending another.

Here is how we got there:

Earlier in 2021, the U.S. Equal Employment Opportunity Commission (EEOC) provided key updates to its technical assistance manual addressing mandatory vaccination in the workplace. According to the EEOC, federal equal employment opportunity laws do not prevent employers from requiring all employees to be vaccinated for COVID-19 as long as the employer provides reasonable accommodations to its policy for individuals with disabilities and those with sincerely held religious beliefs. In addition, the EEOC gave the green light for employers to offer incentives to employees who voluntarily provided proof of vaccination for COVID-19 so long as those incentives were not so large as to be coercive. As a result of the EEOC guidance, some employers chose to voluntarily implement mandatory COVID-19 vaccination policies.

As the year unfolded and more contagious variants of the virus spread, the Biden administration announced in September an action plan titled, “Path Out of the Pandemic.” Three federal vaccination mandates arose from that plan.

On November 4, the Occupational Safety and Health Administration (OSHA) issued an Emergency Temporary Standard (ETS) calling for all private employers with 100 or more employees to have their employees vaccinated or go through weekly COVID-19 testing. Almost immediately after the announcement, the U.S. Court of Appeals for the Fifth Circuit, which covers Louisiana, Texas and Mississippi, issued a temporary stay of the ETS, ruling that OSHA had exceeded its statutory authority. The numerous challenges across the country were consolidated into one case in the Sixth Circuit which will determine its nationwide legality. While the Sixth Circuit ruled that the vaccine was legal, a fast path to the U.S. Supreme Court ended with the nation’s top court ruling that the government overstepped its bounds with the mandate, leaving it unenforceable. On January 25, OSHA officially announced it is pulling the ETS, making it null and void. We will monitor any OSHA action on this in the future.

Concurrent with OSHA’s efforts, the Centers for Medicare and Medicaid Services (CMS) issued a final rule which required workers in most health care settings in the Medicare and Medicaid programs to be fully vaccinated by January 4, 2022, with no option for testing. On November 30, 2021, a federal district court judge in Louisiana granted a nationwide preliminary injunction to prevent enforcement of the final rule. While the U.S. Supreme Court knocked down the OSHA ETS, it ruled that the CMS mandate was legal and enforceable.

To further promote vaccination in the workplace, Biden also signed an executive order in September requiring some employees of certain covered federal contractors to be vaccinated with no testing alternative. The order was followed by guidance issued on September 24 from the Safer Federal Workforce Task Force. Covered employees were originally required to be vaccinated by December 8 but the deadline was extended to January 4, 2022. But in December, a federal district court judge in Georgia issued a preliminary injunction that enjoins enforcements of the vaccine mandate for federal contractors nationwide, leaving the future of the executive order uncertain.

That leaves only the CMS mandate as currently legally enforceable. Nonetheless, even in the absence of a mandate, some employers are choosing to create policies mandating COVID-19 vaccination. In addition, many states and some localities are creating their own laws addressing mandatory vaccination, with some jurisdictions mandating vaccination while others attempt to restrict mandatory vaccinate requirements. Employers should be aware of any local mandates when crafting their own policies.

Legal Implications of the “Great Resignation”

By: Michael J. Crocenzi

Because of the confluence of multiple factors, employees are quitting their jobs or changing jobs at a rapid rate. This so-called “Great Resignation” started in 2021 and will most likely continue into 2022. According to some survey results, more than 40% of workers are considering quitting their job or changing their profession, making the competition for workers fierce. Some economists have indicated that the economy is short approximately 4 million workers since the COVID pandemic began in early 2020.

The very tight labor pool and other factors can create some legal issues for employers.

Non-Competition Agreements

Many employers are attempting to enforce existing non-compete agreements against employees who resign and go to work for a competitor who is offering more money and better benefits. Other employers are having new employees sign non-compete agreements to prevent these new employees from quickly jumping to a new employer. The courts typically do not favor non-compete agreements, but they can be enforceable if they are:

- Supported by adequate consideration

- Reasonable in time and geographic scope

- Necessary to protect an employer’s legitimate business interests

In the Rullex Co. v. Tel-Stream case, the Pennsylvania Supreme Court reminded employers that new employment can be considered adequate consideration, but a non-compete agreement must be signed on or before the employee’s first day of employment. Reasonable time and geographic scope are very fact-specific and depend on the circumstances of each case. The courts will typically adjust the time and geographic scope if the court believes they are unreasonable. Legitimate business interests include trade secrets/proprietary information, customer relationships and goodwill, specialized training and investment in product development.

Hybrid Work Model

Many employees who were forced to work from home in 2020 and even into 2021 have enjoyed the freedom and increased productivity from working from home. Employees are now demanding to either have a permanent remote work arrangement or have a hybrid situation where they might only have to come into an office one or two times per week. With a remote work arrangement, employers must remember that work hours must be tracked and employers must pay appropriate overtime wages, if required. Employers need to recognize that even when employees work from home, employees are still protected by workers’ compensation, the Fair Labor Standards Act regarding overtime, anti-discrimination laws and other employment related statutes and regulations.

Cybersecurity is also an important matter for employers to consider especially if they are permitting employees to use personal devices at home to perform work-related tasks. A best practice includes creating a policy covering a range of relevant considerations including time management practices, time reporting policies, designated work areas, equipment use and other important details that will help remote workers understand what is expected of them during work hours.

Remote Employees May Be Subject to Laws in a Different State From the Employer’s Corporate Headquarters

Because of the opportunities for working remotely, employers may now have employees working remote in a state different from their corporate headquarters or regular office location. Employees who work full-time from a remote location in a state different from the employer’s headquarters may be subject to the worker’s home state’s employment-related laws. This sometimes comes as a shock to employers who are used to managing their employees based on the law where the corporate headquarters is located. Now, human resource managers are faced with having to manage employees in multiple states and have to understand the laws in multiple states. Many states have been very aggressive in the last several years in enacting pro-employee laws and regulations pertaining to discrimination, sexual harassment training, non-compete agreements, pre-employment tests, background checks and other matters. These differences can often trip up employers and be costly.

Employee Versus Independent Contractor

With many employees resigning and starting their own business or gig work, there are more opportunities for employers to hire consultants, independent contractors or gig workers to fill gaps left from the “Great Resignation.” However, an independent contractor agreement simply is not enough to convince a government agency or a court there is a legal independent contractor relationship between the parties.

The essential test is the right of control the business has over the worker. For example, if the business is dictating a specific work schedule, provides training on how to perform the work, provides significant oversight on how the worker is performing the work, and pays the worker hourly, then the parties are in danger of having a government agency or the court deem the relationship to be an employer-employee relationship rather than an independent contractor relationship. The administration of President Joe Biden has indicated that it plans to crack down on sham independent contractor relationships.

As the labor force continues to shake out from the effects of the COVID-19 pandemic, employers need to be on their guard to make sure that they are complying with employment related laws and regulations.

U.S. Department of Labor Wage and Hour Initiatives Now Favoring Employees

By: Jill Sebest Welch and Caleb P. Setlock

Going into 2021, the prediction was a more employee-friendly stance from the U.S. Department of Labor under the new administration of President Joe Biden.

As the year closed, that prediction came true.

Two of the department’s big changes in 2021 – the definitions of joint employer and independent contractor under the Fair Labor Standards Act (FLSA) – returned to those of the former President Barack Obama-era, erasing President Donald Trump’s efforts to swing the rules to be more beneficial to employers. The department also made other changes favoring employees.

Joint Employer

In July 2021, the department announced a final rule rescinding its March 2020 rule. The 2020 rule, promulgated under the Trump administration, set forth a narrow, employer-friendly approach to determine joint employer status under the FLSA.

The DOL under the Biden administration criticized the March 2020 rule for being improperly narrow and conflicting with decades of regulations, interpretation and guidance. The department also noted a federal district court ruling vacating the Trump administration rule because it unlawfully limited the factors for judicial consideration by focusing only on control-based inquiries and ignoring economic dependence factors.

The current employee-friendly approach will ensure more workers receive wage protections. The department also affirmed its prior recognition of both the vertical and horizontal joint employment tests.

Independent Contractor

In January 2021, during the final days of the Trump administration, the DOL issued a proposed rule that would have narrowed the factors for courts to consider when determining FLSA coverage for independent contractors. The rule would have made it easier for businesses to classify workers as independent contractors rather than employees.

However, in May, the department effectively withdrew the Trump administration’s proposed rule. Consequently, the DOL returned to the prior existing “economic reality test,” which focuses on a multi-factor balancing test under the FLSA. The factors include:

- The nature and degree of employer control

- The permanency of the relationship

- The provider of equipment and facilities

- The requisite skill, initiative, judgment or foresight needed

- The profit or loss sharing

- The degree of integration of services into the business

- Although the DOL has said it does not plan to issue a new rule, Biden has vocally supported the “ABC” test. Under the ABC test, which California, Illinois, Massachusetts and New Jersey use, three elements must be met for a worker to be classified as an independent contractor:

- The worker is free from control and direction from the business

- The workers perform work outside the business’s usual course of business

- The worker is engaged in an independently run business that performs the same work for others

The department has targeted worker misclassification – including independent contractor misclassification – as an enforcement priority in 2022.

FLSA Tip Credit Rule

The DOL in 2021 issued its long-awaited final tip credit rule under the FLSA, estimated to affect over 470,800 establishments in the casino, hotel, bar, restaurant, snack bar and nail salon industries.

Under the final tip credit rule, an employer can take a tip credit only when the tipped employee is performing tip-producing work, or when the tipped employee is performing work that directly supports tip-producing work, if the directly supporting work does not exceed 20% of the hours worked during the workweek or is not performed during a continuous period of time that exceeds 30 minutes.

- On the other hand, an employer cannot take a tip credit, and must pay a tipped employee at least minimum wage, when tipped employees perform work that is not part of a tipped occupation. Examples of such work include:

- A server preparing food, salads and cleaning the kitchen or bathrooms

- A busser cleaning the kitchen or bathrooms

- A bartender cleaning the dining room or bathroom

- A nail technician ordering supplies for the salon

- A hotel housekeeper cleaning non-residential areas of the hotel such as an exercise room, restaurant or meeting rooms

- A bellhop retrieving room service trays from guest rooms

Increase in Federal Contractor Minimum Wage to $15/hour

The DOL issued a final rule in November that increases the minimum wage for employees who work on or in connection with federal contracts to $15 per hour. The rule also increases the minimum wage for such employees who regularly receive tips to $10.50 per hour and will eliminate the ability of contractors to take a tip credit effective January 30, 2024. This rule took effect on January 30, 2022, and is expected to provide a wage increase for over 300,000 workers.

The new rule does not apply to federal contracts entered into prior to January 30, 2022, but must be included in contract renewals or extensions. The definition of contracts includes subcontracts and overall is very broad, extending to procurements, service agreements and lease agreements.

A Look at Our Employment Training and Professional Development Sessions

Pennsylvania’s Wage and Hour Regulations and More Changes from 2021

By: Jill Sebest Welch

Like at the federal level, Pennsylvania saw some sweeping changes in employment-related legislation, including a political battle that resulted in the elimination of a long-time goal for Gov. Tom Wolf.

Pennsylvania’s Overtime Exemption Regulations Repealed by Legislature

To get the 2021-2022 budget passed, Wolf agreed to repeal the new overtime regulations published in October 2020 that would have increased the minimum salary requirements for the executive, administrative and professional (EAP) exemptions. The salary threshold was set to increase to $40,560 per year ($780 per week) on October 3, 2021. It seemed the upshot of this compromise would be that Pennsylvania’s new overtime salary threshold would not go into in effect, and Pennsylvania’s prior overtime salary thresholds would be restored.

However, in implementing this compromise, the Pennsylvania legislature actually went much farther than just rolling back Pennsylvania’s new overtime salary threshold, as Act 70 repealed the entire regulatory framework for defining the EAP exemptions under the Pennsylvania Minimum Wage Act. Currently, Pennsylvania is without any regulatory definition of what it means to be an exempt EAP employee. Thus, the current exempt salary threshold in Pennsylvania is $35,568 annually, consistent with the federal salary threshold.

Pennsylvania Supreme Court Requires Pay for Time Spent In Security Checks, Rejects De Minimis Doctrine

The Pennsylvania Supreme Court ruled that time spent by Amazon employees in mandatory security checks at the end of their shifts was compensable under the Pennsylvania Minimum Wage Act.

In reaching this conclusion, the court noted that the regulations implementing the act define four categories of compensable “hours worked,” and the security checks fell under the first category:

- Time during which an employee is required by the employer to be on the premises of the employer

- Time during which an employee is required by the employer to be on duty or to be at the prescribed workplace

- Time spent in traveling as part of the duties of the employee during normal working hours

- Time during which an employee is employed or permitted to work

The Pennsylvania regulations provide two exclusions from this definition of “hours worked”: time allowed for meals, unless the employee is required or permitted to work during that time; and time spent on the premises of the employer for the convenience of the employee – neither of which applied to the security checks.

The Pennsylvania Supreme Court also rejected Amazon’s second argument, that the time spent in security screenings was so small as to be “de minimis,” or too trivial to matter, and exempt from payment. The court held that neither the state’s minimum wage act nor its implementing regulations contain such an exception.

In the wake of this Amazon decision, Pennsylvania employers should consider examining the time that hourly, nonexempt employees are required to be on the premises, including time for COVID-19 related activities.

Pennsylvania Proposes Its Own Updated Tip Credit Rules

In November, the Pennsylvania Department of Labor & Industry proposed regulations to update the rules about how the state’s employers pay tipped workers. The proposal covers five primary areas for tipped workers, including:

- An updated definition of “tipped employee,” adjusted for inflation since 1977, that increases the amount in tips an employee must receive monthly from $30 to $135 before an employer can reduce an employee’s hourly pay from $7.25 per hour to as low as $2.83 per hour.

- Incorporation of the recent federal regulatory tip credit update to allow employers to take a tip credit under certain conditions, including that the employee spends at least 80% of their time on duties that directly generate tips, commonly known as the 80/20 rule.

- An update to allow for tip pooling among tipped employees under certain circumstances.

- A prohibition on employers deducting credit card transaction charges from an employee’s tip left on a credit card.

- A requirement for employers to educate patrons on the employer’s use of service charges, clarifying that service charges are not gratuities for tipped employees.

Look for updates on Pennsylvania’s tip credit proposal in Barley Snyder’s 2022 client alerts.

Wolf Passes Executive Order Raising Minimum Wage and Requiring Paid Leave for Certain State Contractors

The governor is directing the Department of Community and Economic Development to verify a business receiving an offer of assistance provides its workers paid sick leave and pays no less than the minimum wage for state employees before making a financial incentive offer.

The $13.50 minimum wage for state employees and contractors will reach $15 on July 1, 2024. The executive order also includes a requirement for paid employee sick leave in DCED’s criteria for offers of assistance, including offers of assistance involving the Redevelopment Assistance Capital Program.

The governor also encourages all agencies under his jurisdiction that provide funding to for-profit businesses to review existing programs and program guidelines and consider implementing a requirement of a minimum wage and paid sick leave consistent with the DCED’s new directive.

The governor also announced that Pennsylvania Department of Labor & Industry will make publicly available a list of offending companies that violate labor laws, misclassify their workers, owe unemployment compensation, back taxes or fail to carry requisite workers’ compensation insurance.

NLRB in 2021: Employee-Friendly Once Again

By: Joshua L. Schwartz

Like other agencies appointed by the executive branch, the National Labor Relations Board swings with the administration. After the labor-friendly environment of the President Barack Obama era, President Donald Trump’s presidency saw a significant rollback of rights for organized labor. Board decisions and general counsel opinions under Trump’s administration limited unions’ ability to lobby, made employer-friendly changes to union election procedures and approved broad employer policies that would not have been passed muster under the prior administration.

At the beginning of 2021, we predicted that President Joe Biden’s NLRB would reverse many of these Trump-era decisions, and his bold promises of the Pro Act – an early legislative agenda item for the Democratic majority in U.S. Congress – suggested that this could be the dawn of a new era in unionization and worker rights. The Pro Act itself has not materialized, and those calling for immediate, bold action to expand the role of organized labor were likely disappointed. However, the year did see the pendulum start to swing back in a labor-friendly direction, with several developments likely to have long-lasting impact.

Personnel Changes

Within the first days of his administration, Biden removed John Ring as NLRB chairperson and appointed Lauren McFerran, then the only Democratic member of the board. Biden also terminated Peter Robb, the NLRB’s general counsel, and ultimately appointed Jennifer Abruzzo, former acting general counsel for the NLRB and most recently special counsel for strategic initiatives for Communications Workers of America (CWA), the largest communications and media labor union in the U.S.

The year also saw the expiration of the term of Trump-appointee William Emanual and the appointment of two new board members, Gwynne Wilcox (whose term expires in 2023) and David Prouty (who term expires in 2026). Wilcox and Prouty both most recently served as labor counsel to large unions in the private sector. The appointments fill out the five-person board with a 3-2 Democratic majority. The next expiring term is that of Republican (and former chair) John Ring in December 2022.

An Aggressive General Counsel Agenda

The NLRB Office of the General Counsel has issued several memoranda that should serve as a warning to employers looking to actively discourage unionization. Here are several highlights:

An expanded definition of “mutual aid and protection”: Section 7 of the National Labor Relations Act grants employees the right to engage in “concerted” activities for the purpose of “mutual aid or protection.” In a memo issued in March, then-acting general counsel Peter Sung Ohr noted that traditionally, this definition has extended “only [to] certain vital categories of workplace life,” including wages, work schedules and job security. Ohr promised that, going forward, discussions regarding “workplace health and safety” and “racial discrimination” would also constitute protected, concerted activity. In this era of pandemic and a new reckoning with race relations, this expanded definition is certain to have significant impact.

An explicit promise to push for reversal of Trump-era, employer-friendly decisions: In one of her first memos issued, Abruzzo directed that all cases touching on a series of recent board decisions be submitted to the Regional Advice Branch for review and reexamination. Areas of scrutiny include employer handbook rules, confidentiality provisions in separation agreements, circumstances triggering an employer’s duty to recognize and bargain with a union, union access to the workplace, the right to strike and “independent contractor” status.

A focus on remedies: The NLRA empowers the board, when faced with an employer violation, to order “reinstatement with or without back pay” and other remedies. In a memo issued September 8, Abruzzo encouraged regional offices to seek broad cease and desist orders and a variety of noneconomic remedies – such as training and extended monitoring periods.

Increased scrutiny of settlement agreements: In a memo issued September 15, Abruzzo reminded regional offices of the broad discretion they have in managing settlement of claims where NLRA violations are alleged. In addition to encouraging consideration of broad remedies, Abruzzo noted that clauses not admitting to violations should be the exception rather than the rule and suggested including a written letter of apology from an employer as one of the terms to accompany unconditional reinstatement.

A Board Looking to Expand its Jurisdiction and Establish New Rules for Workplace Interactions

The board did not have a Democratic majority until August, so the next 12 months are likely to be a much more significant period for decisions. Nonetheless, the board has already made its mark with several high-profile opinions:

Consideration of “consequential damages”: In the August case Vorhees Care & Rehabilitation Center, the board indicated an openness to considering damages for violations beyond the typical back pay and reinstatement. Employers may find themselves ordered to reimburse wrongfully terminated employees for bank and credit card fees, medical expenses and other costs stemming from an employee’s loss of work.

A “joke” social media post considered an unlawful threat: In a late 2020 decision, the board held that Ben Domenech, the publisher of the conservative only magazine The Federalist, had violated the NLRA by tweeting that if magazine employees unionized, he would send them “back to the salt mines.” The Federalist had argued that the tweet was clearly a joke, and in fact, the complaint to the board was filed a person who did not work at the magazine. The board was unconvinced and ordered removal of the tweet. The matter is up on appeal before the U.S. Court of Appeals for the Third Circuit, and the judges appeared skeptical of the board’s position. While this specific case may be reversed, it demonstrates the board is willing to scrutinize all management statements – including social media posts – and has a broad view of what constitutes an anti-union threat.

New union election ordered at Amazon: In April 2021, after a lengthy election process that garnered nationwide attention, workers at an Amazon warehouse in Alabama voted 1,798-738 against unionization. Despite such a clear defeat, the board has ordered a re-run election, primarily over concern that the drop box suggested to employees that Amazon was playing a role in collecting and counting ballets. The National Review, a conservative publication, has characterized the decision as a “twisting of federal law to overturn a democratic vote.”

Considering these developments and the likely deluge of labor-friendly decisions coming in the next few years, employers should tread carefully when managing what could be interpreted as collective activity.

U.S. Immigration: 2021 Year in Review

By: Lauren D. Berkowitz

As if the policy changes in federal immigration law that highlighted 2021 weren’t enough, businesses had to keep an eye on ever-changing travel restrictions that hindered their ability to hire noncitizens for on-site jobs in the United States.

As we enter 2022, here are some of the key developments in U.S. employment-based immigration over the last year.

Travel Restrictions and Vaccine Requirements

In the fall, U.S. businesses received good news when the government announced that fully vaccinated travelers from countries impacted by prior travel restrictions would be able to enter the U.S. starting on November 8.

However, the emergence of the Omicron variant led to the U.S. government imposing new travel restrictions, as well as a huge increase in canceled flights.

Currently, non-U.S. citizens must be fully vaccinated to travel to the U.S. by plane. As of January 4, 2022, you are considered fully vaccinated 14 days after your second dose of an accepted two-dose vaccine series, 14 days after your single dose of an accepted single-dose vaccine, or 14 days after receiving an accepted clinical trial vaccine or mix-and-match combination. These requirements are being strictly enforced at airports around the world, and international travelers to the U.S. are urged to carefully review the Centers for Disease Control and Prevention website prior to booking air travel to ensure compliance with the latest vaccination requirements.

In addition to being fully vaccinated, non-U.S. citizens coming to the U.S. by plane must present a negative COVID-19 test result or proof of recent recovery from COVID-19 on the day of travel. Masks are also required for all travelers.

On the flip side, the pandemic has introduced some benefits for U.S. businesses and their foreign employees. For example, U.S. Citizenship and Immigration Services (USCIS) has provided flexibilities for responding to certain agency requests, and these flexibilities have been extended through March 26, 2022.

USCIS also has provided flexible measures for I-9 document review and verification, which has expedited hiring processes and alleviated the need for cumbersome in-person document inspection processes. However, these flexibilities are temporary and only available to employers operating remotely. This has created confusion for employers who took advantage of the allowance for remote I-9 document review but who are now returning to in-person work. We encourage human resources professionals grappling with these issues to contact our office for further guidance regarding I-9 compliance.

The U.S. Department of State has also provided some flexibilities during the pandemic pertaining to visa processing, including authorizing consular officers to waive the in-person interview requirements for certain visa applicants. In late December 2021, the department announced it would extend these flexibilities through the end of 2022 and expand the interview waiver to additional visa applicants.

According to a December 23, 2021, announcement, consular officers are authorized through the end of 2022 to waive the in-person interview requirement for certain temporary employment-based visa applicants who have a petition approved by USCIS, including certain first-time visa applicants. This will benefit many visa applicants who would otherwise face lengthy delays waiting for an interview appointment.

It will be up to each U.S. embassy or consulate to implement this rule, so applicants are encouraged to check the website of their local consular office to confirm the level of services currently offered and to find guidelines for applying for a visa without an interview. Impacted clients with specific upcoming travel plans are also encouraged to contact our office for further guidance.

Federal Judge Sets Aside H-1B Lottery Rule

On January 8, 2021, the Trump administration proposed a regulation that would have significantly affected the H-1B high skilled visa program. The proposed regulation would have drastically changed the H-1B selection process from a random lottery to a selection process based on offered wages.

In September 2021, just months before the new H-1B rule was scheduled to take effect, a federal court set aside the regulation on the grounds that then-acting U.S. Department of Homeland Security Secretary Chad Wolf was not lawfully serving in his role at the time the agency issued the regulation.

Signing of Executive Orders

On his first day, President Biden signed six executive orders that focused on immigration.

One of those executive orders ended the prior administration’s travel restrictions that barred travelers from Muslim-majority countries from entering the U.S., including Iran, Iraq, Nigeria, Myanmar, Kyrgyzstan, Eritrea, Somalia, Sudan, Syria, Yemen and Libya.

Another one of the executive orders rescinded Trump-era enforcement policies and priorities, and called for a return to the former policy of prioritizing removal of immigrants convicted of serious crimes, those who threatened national security and recent arrivals.

The administration also reversed the highly contested Trump public-charge rule, which imposed new restrictive criteria upon green card applicants and those renewing temporary visas.

The early orders also strengthened the Deferred Action for Childhood Arrivals (DACA) program, expanded the U.S. refugee program Trump had attempted to weaken and halted construction of a wall between the U.S. and Mexico intended to keep undocumented immigrants out of the U.S.

Expansion of Work Authorization Eligibility for L-2, H-4 and E Dependents

At the end of 2021, spouses of work visa holders celebrated some good news following a settlement in November that directed USCIS to expand work authorization eligibility for L-2, H-4 and E dependents. The benefits depend on case-specific circumstances, and we encourage L-2, H-4 and E dependents to consult their attorneys to determine the availability of benefits under the new framework.

The latest change to work authorization followed an earlier action in January 2021 when the president rescinded a proposed regulation titled, “Removing H-4 Dependent Spouses from the Class of Aliens Eligible for Employment Authorization.” The proposed regulation, which was issued in 2019, was pending at the time that it was withdrawn by the Biden administration. The regulation would have reversed a final rule extending employment authorization eligibility for certain H-4 dependent spouses of nonimmigrant H-1B workers.

Immigration Reform

The year started with the potential of the first meaningful federal immigration reform in decades but ended with a thud of bureaucracy.

Proponents of immigration reform, buoyed by Biden’s assurances that it was high on his agenda once he took office, worked to get something done that would allow items like temporary work authorization and protection from deportation for some undocumented workers. But in December, a proposed bill in the U.S. House of Representatives was defeated and soon lost some of the Democratic support that had given it hope.

There hasn’t been much from Biden’s administration on a new immigration reform bill, which puts its future in jeopardy.

Looking Forward

2021 brought many new policies, many temporary and in response to the ongoing COVID-19 pandemic, others in reversal of the prior administration’s more restrictive policies, and a few in an attempt to create longer lasting systemic change for our immigration system. Heading into 2022, we hope to see improvements that will benefit U.S. employers, but we expect there to be more changes and some difficulties as well. Regular communication with immigration counsel will help employers navigate this constantly changing immigration landscape.

Have You Updated Your Health and Welfare Benefit Plans?

By: Mark A. Smith

Historically a great deal of attention has been given to the formal requirements associated with sponsoring a qualified retirement plan.

With the passage of the Employee Retirement Income Security Act of 1974 (ERISA) and the subsequent enactment of numerous changes in the retirement plan rules, employers have gained a heightened awareness of the need to facilitate compliance. In contrast, welfare benefit plan compliance tends to be an afterthought with employers displaying less vigilance. For example, some employers administer their health plans without the benefit of a formal plan document. Instead, they rely on insurance booklets and contracts. You only need to receive an information request in connection with a U.S. Department of Labor audit of your health plan to gain an immediate appreciation of the magnitude of the government’s view of your compliance obligations.

The importance of ERISA-required plan documents also has been highlighted as employers have to scramble to deal with the unprecedented impact of COVID-19 and the related employee welfare benefit plan considerations. For example, any change in an employee’s job status such as a furlough or layoff raises issues with your health plan coverage. A change in an employee’s job status ranging from a reduction in hours to a termination of employment may trigger COBRA continuation rights. However, the impact on an individual’s health plan coverage will depend on the specific facts and circumstances as well as the health plan language. You also need to consider whether any such employment change gives rise to an employee’s ability to make midyear changes to their existing benefit plan elections – all of which should be addressed in your plan documents.

As employers dealt with the unprecedented impact of COVID-19, the DOL and the Internal Revenue Service announced some relief in the form of a general extension of time for meeting many of the deadlines pertaining to health and welfare plans. This extension of time was retroactive to March 1, 2020. Essentially, the DOL took the position that during the COVID-19 emergency, plan sponsors will not be treated as having violated ERISA’s reporting and disclosure rules if they make a reasonable effort to do so “as soon as administratively practicable.” For plan sponsors, this means that a delay in providing documents such as summary plan descriptions, summary of material modifications, summaries of benefit coverages, and benefit claims and appeals notices will not be actionable if the plan sponsor meets the requirements for the extension of time.

The IRS also announced relief from certain timelines and carryover restrictions for flexible benefit plans. Plan participants also were provided with additional time to meet certain deadlines, including the election of COBRA continuation coverage and payment of the required premium, pursing a claim for benefits and filing appeals of denied claims.

Also, plan participants will have additional time to pursue their special enrollment rights. Under HIPAA, group health plans are required to offer special enrollment rights to employees and their dependents in certain situations, including the loss of eligibility for health coverage or the addition of a new dependent. Normally, a participant would be required to elect the special enrollment within 30 days from the occurrence of the qualifying event. Participants will now have until 30 days after the end of the COVID-19 emergency.

Some of these relief provisions trigger required plan amendments. As employers have faced various COVID-19-related administrative challenges, they have discovered that they either do not have the required welfare benefit plan documentation in place or that the existing documents lack sufficient detail.

As a starting point, a plan sponsor must determine the extent to which ERISA applies to its various welfare and fringe benefit plans. The scope of ERISA’s definitions and coverage sections is very broad and covers essentially the full range of employee benefit plans. Plans sponsored by a church or governmental entity are specifically exempt from ERISA. Although the actual determination will be very fact-specific, generally welfare benefit plans are those plans which provide benefits such as medical, dental, vision, accidental death and dismemberment, disability, life insurance, severance pay, etc. There are some important exceptions including “payroll practices,” such as the payment of wages, overtime pay and sick pay. This exception is only applicable if these payments are made from the employer’s general assets. Any advanced funding or setting aside of funds will cause a program to fall outside of the payroll practice exception.

ERISA requires that a welfare benefit plan be “established and maintained pursuant to a written instrument.” The plan document requirement is applicable to each plan an employer maintains. The DOL grants the plan sponsor a great deal of discretion in determining the number of plans it maintains. In return, the DOL will demand that your documents and participant communications consistently reflect this determination with respect to the number of plans. Although plan participants may bring suit to compel the preparation of a formal plan document, there is no specific ERISA penalties for failure to maintain a written plan document.

Aside from satisfying ERISA’s documentation requirements, there a number of reasons an employer may wish to maintain formal documents for its welfare plans. A formal plan document is often referred to in the summary plan description (SPD). The formal plan document also is useful in establishing the standard of review to be applied, as well as determining whether the plan has a subrogation right against amounts recovered by the employee from third parties. It may also prevent employees from successfully enforcing informal practices or unwritten plans. Finally, a formal plan document will identify who has the authority to amend the plan and the procedures for amendment.

Even though ERISA does not impose specific format requirements for welfare benefit plan documents, in the case of a fully insured plan, the insurance contract and/or booklet will not necessarily satisfy ERISA documentation requirements. Sponsors of self-insured plans often elect to use a single document combining both the formal plan document and SPD. If you incorporate the necessary language, this approach should satisfy ERISA’s documentation requirements. It is common for employers to establish a “wrap around” document for a single bundled plan through which all welfare benefits are provided.

A “wrap” or “umbrella” document is used to supplement existing documentation, supplying the necessary ERISA language by wrapping itself around the insurance contract or other third-party documents. By incorporating the terms of the insurance contract or SPD it is unnecessary to duplicate many of the plan’s most important terms and conditions. This approach also permits a plan sponsor to incorporate all of its welfare plans under a single plan document thereby avoiding the need to file multiple Forms 5500.

Given the experience dealing with COVID-19, this is a great time for employers to do an inventory of their governing documentation for their health and welfare benefit plans to determine whether they are ERISA compliant and whether they need any updates.