As noted in our previous alert, the Federal Reserve Board initially announced its Main Street Lending Programs (the MSLP) on April 9. The MSLP is a program designed to support the flow of credit to small- and medium-sized for-profit businesses that were in sound financial condition before the COVID-19 pandemic. The loans are available for businesses that have already received loans through the SBA’s Paycheck Protection Program (PPP), as well as for businesses that were unable to access the PPP or require additional support after receiving a PPP loan. However, borrowers may only participate in one of the three Main Street facilities:

- the Main Street New Loan Facility (MSNLF);

- the Main Street Expanded Loan Facility (MSELF); or

- the new Main Street Priority Loan Facility (MSPLF).

In response to over 2,200 letters received in response to the Federal Reserve’s initial announcement of the MSLP, the Federal Reserve announced on April 30 he expansion of the loan options available to businesses and an increase in the maximum size of businesses eligible for the program. The changes in the MSLP include:

- Creating a third loan option, the MSPLF, with increased risk sharing by lenders for borrowers with greater leverage;

- Lowering the minimum loan size for certain loans to $500,000; and

- Expanding the pool of businesses eligible to borrow.

Under the new MSPLF, Eligible Borrowers (as defined by the terms of the MSLP program) have the option to refinance existing debt under certain circumstances (generally when the existing debt is owed to a non-bank lender). Additionally, Eligible Lenders will retain a 15 percent share on MSPLF loans that, when added to existing debt, do not exceed six times a borrower’s EBITDA. Under the other MSLP options, lenders will retain a 5 percent share on loans.

For all three facilities, more businesses will be eligible under the revised terms of the MSLP. Businesses with up to 15,000 employees or up to $5 billion in annual revenue qualify, as compared to the initial thresholds of 10,000 employees or $2.5 billion in revenue.

Loans originated under all three programs will have many of the same features, including:

- maturity;

- interest rate;

- deferral of principal and interest for one year;

- ability of the borrower to prepay without penalty;

- availability of both secured and unsecured loans;

- full-recourse (no forgiveness); and

- all three programs allow Eligible Lenders to choose whether and when to pass origination fees on to Eligible Borrowers.

The Federal Reserve has provided updated term sheets for each of the Main Street programs, the key terms of which we have highlighted and made available on the Barley Snyder website. In addition, in connection with the release of the new MSLP terms, the Federal Reserve Board also issued a set of Frequently Asked Questions.

The term sheets contain minimum requirements for the MSLP, but Eligible Lenders are expected to conduct their own assessment of each potential borrower’s financial condition at the time of application, and will apply their own underwriting standards in evaluating the creditworthiness of an application. You can view term sheets in these links:

https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200430a1.pdf

https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200430a2.pdf

https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200430a3.pdf

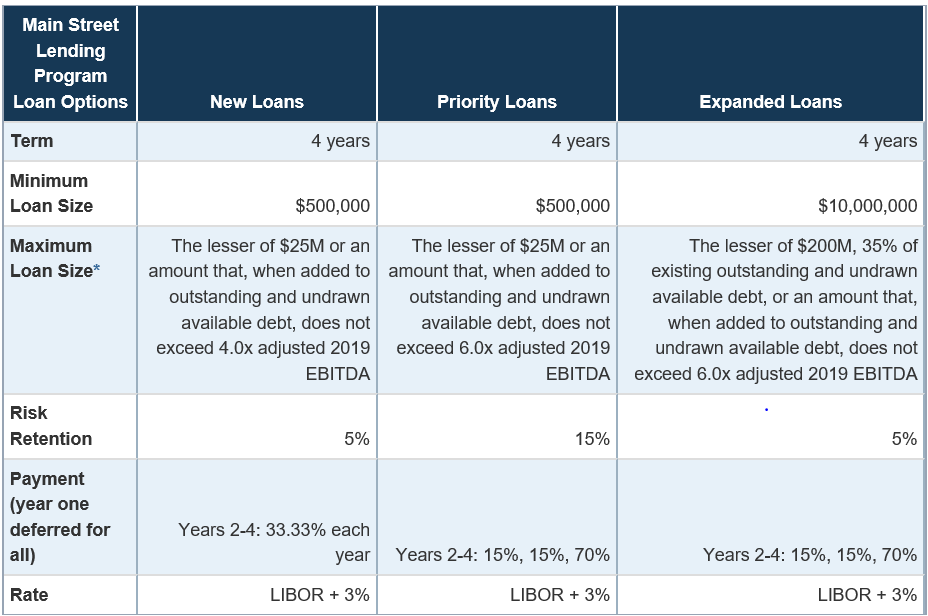

Other key features of each of the Main Street programs are summarized in the table below:

Key Terms for Eligible Borrowers

Under the new Priority Loan Facility, Eligible Borrowers may, at the time of origination of the loan, refinance existing debt to a lender that is not the Eligible Lender. This option is not available under the MSNLF or MSELF. With respect to refinancing, under any of the MSLP loans, an Eligible Borrower may be permitted to:

- Repay a line of credit (including a credit card) in accordance with the normal course of business usage for such line of credit;

- Take on and pay additional debt obligations required in the normal course of business and on standard terms, including inventory and equipment financing, provided that such debt is secured by newly acquired property and, apart from such security, is of equal or lower priority than the MSLP financing; or

- Refinance maturing debt.

All three MSLP facilities impose additional requirements on Eligible Borrowers. An Eligible Borrower must make commercially reasonable efforts (in light of its capacities, the economy, available resources, and business need for labor) to maintain its payroll and retain its employees. Borrowers that have already laid-off or furloughed workers as a result of the disruptions from COVID-19 are eligible to apply for Main Street loans. Restrictions on compensation, stock repurchase, and capital distributions apply under each program, except that restrictions on dividends and other capital distributions will not apply to distributions made by an S corporation or other pass-through entity to the extent reasonably required to cover its owners’ tax obligations in respect of the entity’s earnings.

Once the MSLP is operational, borrowers can apply through an eligible lender, a list of which is available on the Federal Reserve’s website.

Key Terms for Eligible Lenders

A notable change across all three facilities is the interest rate change to an index based on LIBOR rather than SOFR. Although financial institutions are transitioning to SOFR, LIBOR remains the most common base rate used in business lending. However, the Federal Reserve has advised that loan agreements should include fallback language to be used should LIBOR become unavailable during the term of a loan.

Additionally, under all three facilities, an Eligible Lender must commit that it will not cancel or reduce any existing committed lines of credit outstanding to the Eligible Borrower, except in an event of default. This requirement does not prohibit the reduction or termination of uncommitted lines of credit, the expiration of existing lines of credit in accordance with their terms, or the reduction of availability under existing lines of credit in accordance with their terms due to changes in borrowing bases or reserves in asset-based or similar structures.

In its most recent guidance, the Federal Reserve has clarified that the MSELF allows Eligible Lenders to increase, or “upsize,” an existing extension of credit by adding a new tranche. If the loan underlying an upsized tranche is part of a multi-lender facility, the Eligible Lender must be one of the lenders that holds an interest in the underlying loan at the time of upsizing, but other members of the multi-lender facility are not required to be Eligible Lenders.

Additionally, for regulatory capital purposes, the interest in the portion of a Main Street loan that is retained by an Eligible Lender will be assigned the risk weight applicable to the counterparty for the loan—generally a 100 percent risk weight for a corporate exposure under the standardized approach.

Other Considerations

- The Federal Reserve has announced that it is evaluating a separate approach to meet the unique needs of nonprofit organizations.

- The Federal Reserve is evaluating the feasibility of adjusting the loan eligibility metrics for asset-based borrowers (since EBITDA is not usually the key metric in asset-based loans).

- We expect that the terms and conditions of the MSLP will make the attractiveness of the program somewhat limited. For example, many businesses will likely qualify for more favorable interest rates than are available under the MSLP without the compensation, dividend and stock repurchase restrictions. The inability to repay debt with the proceeds of MSLP facilities is another impediment to participation (although the MSPLF provides the option to repay debt to a lender that is not an Eligible Lender). However, it is possible that lenders may be able to provide certain customers, such as those that have a short-term liquidity need, credit that may not otherwise be available without the government participation.

- The Federal Reserve will be posting information regarding the loan documentation required to sell a loan participation to the special purpose vehicle (to be created by the Federal Reserve Bank of Boston) on the Federal Reserve’s website.

[i] However, an MSELF Upsized Tranche must be secured if the underlying loan is secured.

At the time of origination of a MSPLF or MSELF loan and at all times thereafter, the Eligible Loan must be senior or pari passu with, in terms of priority or security, the Eligible Borrower’s other loans or debt instruments, other than mortgage debt.

An MSNLF Loan, at the time of origination or at any time during its term, may not be contractually subordinated in terms of priority to the Eligible Borrowers’ other loan or debt instruments. This means that an MSNLF Loan may not be junior in priority in bankruptcy to the Eligible Borrower’s other unsecured loans or debt instruments. This provision does not prevent:

- the issuance of an MSNLF Loan that is a secured loan (including in a second lien or other capacity) to an Eligible Borrower, whether or not the Eligible Borrower has an outstanding secured loan of any lien position or maturity;

- the issuance of an MSNLF Loan that is an unsecured loan to an Eligible Borrower, regardless of the term or secured or unsecured status of the Eligible Borrower’s existing indebtedness; or

- the Eligible Borrower from taking on new secured or unsecured debt after receiving an MSNLF Loan, provided the new debt would not have higher contractual priority in bankruptcy than the MSNLF Loan.

[ii] The fees associated with the MSNLF, MSPLF, and MSELF are as follows:

- MSNLF and MSPLF: Eligible Lenders will pay the Main Street SPV a transaction fee of 100 basis points of the principal amount of the MSNLF and MSPLF Loan at the time of origination, and may pass on this fee to Eligible Borrowers. In addition, the Eligible Borrow will pay the Eligible Lender a fee of up to 100 basis points of the principal amount of the MSNLF or MSPLF Loan at the time of origination. Eligible Lenders have discretion over whether and when to charge Eligible Borrowers this fee.

- MSELF: Eligible Lenders will pay the Main Street SPV a transaction fee of 75 basis points of the principal amount of the MSELF Upsized Tranche at the time of upsizing, and may choose to pass on this fee to Eligible Borrowers. In addition, the Eligible Borrower will pay an Eligible Lender a fee of up to 75 basis points of the principal amount of the MSELF Upsized Tranche at the time of upsizing. Eligible Lenders have discretion over whether and when to charge Eligible Borrowers this fee.

The SPV will pay an Eligible Lender 25 basis points of the principal amount of its participation per annum for loan servicing.

[iii] If the Eligible Borrower had other loans outstanding with the Eligible Lender as of December 31, 2019, such loans must have had an internal risk rating equivalent to a “pass” in the Federal Financial Institutions Examination Council’s supervisory rating system on that date.